Filter this View

NOT FOR REPRINT

Page Printed from: cutimes.com/search/?page=7926&search=TDECU

Search Results

Resources

Elan Credit Card

From Elan Credit Card

A credit union’s ability to deliver the right products and services that best meet members’ daily needs is the most important factor in creating a superior member experience.

Download Resource

CPI

From CPI

Discover five critical factors you should consider when choosing to deploy an instant issuance solution -- all of which can affect cost, efficiency and member experience.

Download Resource

Alkami

From Alkami

This comprehensive market study dives deep into the contrasting views between financial institutions and account holders, offering critical insights that can drive your credit union's strategic decisions.

Download Resource

CPI

From CPI

We worked with an independent researcher to conduct an online survey of over 2000 credit and debit card users to find out how people pay everyday. Download the results!

Download Resource

TransUnion

From TransUnion

What if you could get your offer to consumers before the competition?

Download Resource

Elan Credit Card

From Elan Credit Card

Unlock insights into the spending habits and motivations of new cardholders! Explore why so many chose general-purpose credit cards and what this trend means for industry leaders.

Download Resource

Alogent

From Alogent

Managing deposits effectively is more crucial than ever to keep pace with member expectation. Discover how a transaction level approach to deposit automation delivers unmatched speed, a lower risk for fraud, and reduced operating costs.

Download Resource

Alogent

From Alogent

Explore how cloud-based solutions revolutionize deposit management and transaction processing for credit unions. Download the white paper now!

Download Resource

Alogent

From Alogent

Enhance your credit union’s security with a comprehensive approach to check fraud mitigation. Discover how built-in capabilities safeguard both your organization and your members.

Download Resource

Alogent

From Alogent

Access this white paper to discover how modern technology is revolutionizing payment experiences while lowering operational costs.

Download Resource

Open Lending

From Open Lending

Millennials and Gen Z consumers represent a significant opportunity for credit union lenders. This report uncovers key trends and insights about their credit outlook and how to capture their long-term value.

Download Resource

Elan Credit Card

From Elan Credit Card

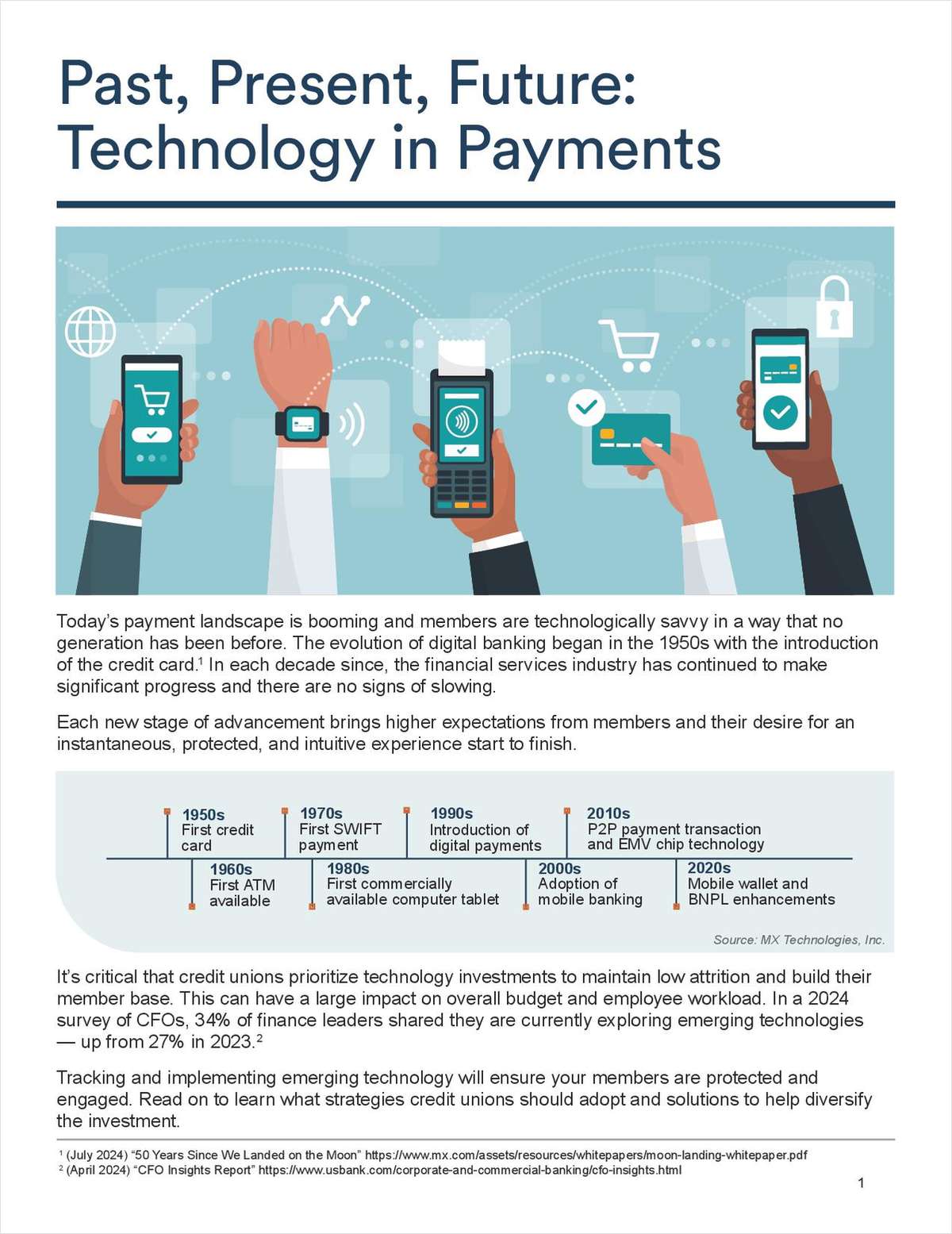

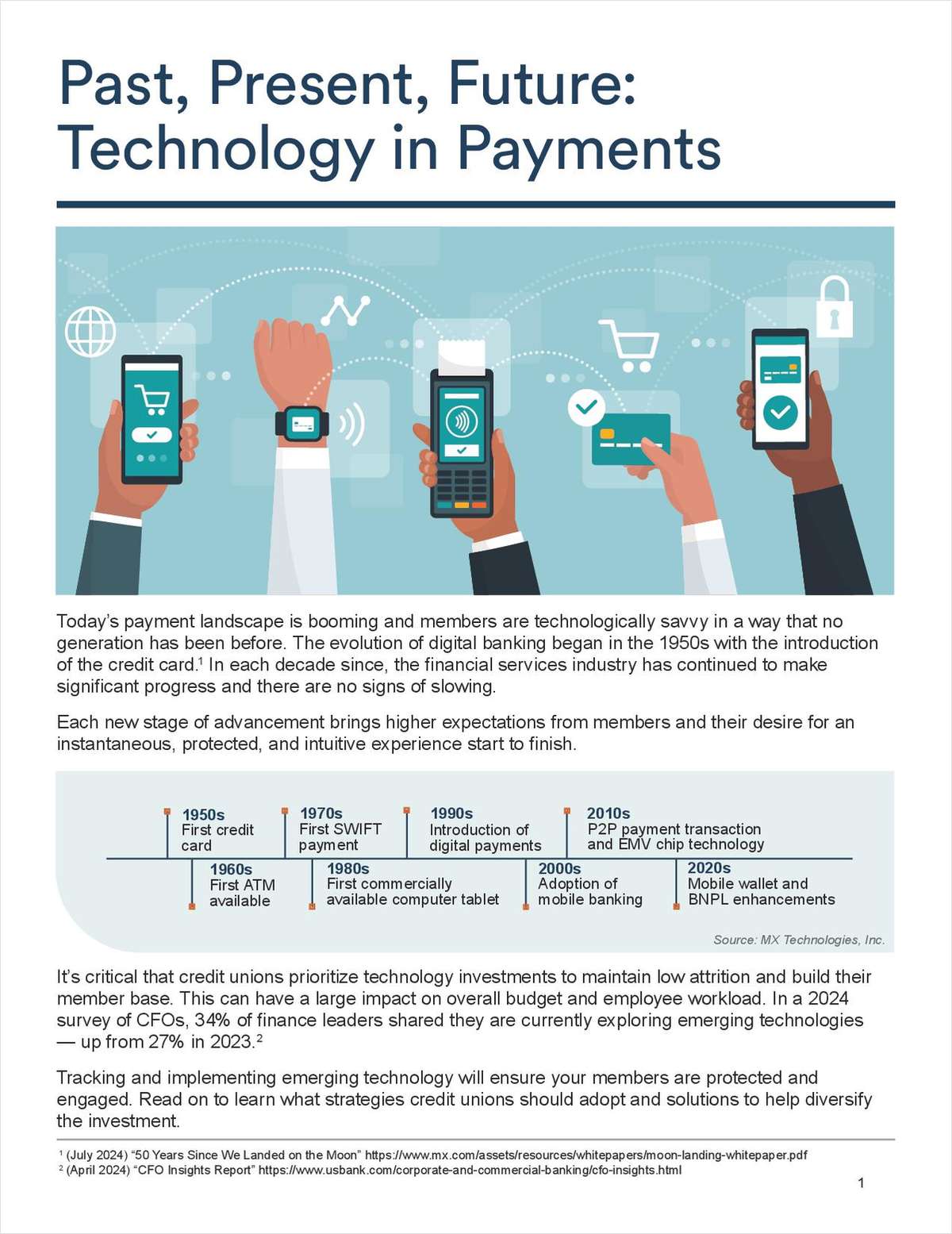

As quickly as technology advances, so do the expectations of your members. Learn what digital capabilities and solutions are trending, how much credit unions are investing, and what’s next in payments innovation.

Download Resource

Elan Credit Card

From Elan Credit Card

Struggling to keep your credit card program profitable? Discover why many leaders are turning to the agent issuing model.

Download Resource

Elan Credit Card

From Elan Credit Card

Consumers with general-use credit cards average 37% higher monthly spend than those with co-branded cards. Learn more preferences, habits, and trends in this new report from Elan Credit Card and PYMNTS Intelligence.

Download Resource

Elan Credit Card

From Elan Credit Card

Social media scams, phishing, and telephone-oriented attack delivery are a few of the increasingly sophisticated attack methods by cybercriminals. Learn more about these evolving techniques and how to protect your members.

Download Resource

Elan Credit Card

From Elan Credit Card

Does the value outweigh the risk? Review three key considerations when evaluating whether to invest in growing an internal credit card program or explore an outsourced solution.

Download Resource

Elan Credit Card

From Elan Credit Card

Learn where consumers are applying for credit cards, what type of spenders they are, what features are most persuasive, and what smaller financial institutions should focus on to continue expanding their market share.

Download Resource

Upstart

From Upstart

When Vantage West CU decided to prioritize a seamless digital experience and data-driven lending decisions, they knew the right partner was critical. Download this case study and discover how they diversified their loan portfolio, acquired 1400 new members in 6 months, and built in flexibility to withstand the economic cycles.

Download Resource

Elan Credit Card

From Elan Credit Card

Customer payment expectations are shifting. Explore the top five merchant payments trends we’re watching in 2023 and learn how a partnership may help meet the needs of your members.

Download Resource

Elan Credit Card

From Elan Credit Card

Nearly 33% of cardholders increased their credit card spending over the last six months, showing how critical credit cards are in today's economic environment.

Download Resource

Elan Credit Card

From Elan Credit Card

Young adults are the future of your credit union. From college to home-buying, learn why credit cards are key to winning the loyalty of Gen Z and millennials.

Download Resource

Elan Credit Card

From Elan Credit Card

With the current economic environment and rise in interest rates, credit unions may find the credit card market increasingly complex to operate internally. Learn why shifting from insourcing to outsourcing your credit card program can benefit your credit union.

Download Resource

Elan Credit Card

From Elan Credit Card

A credit union’s ability to deliver the right products and services that best meet members’ daily needs is the most important factor in creating a superior member experience.

Download Resource

CPI

From CPI

Discover five critical factors you should consider when choosing to deploy an instant issuance solution -- all of which can affect cost, efficiency and member experience.

Download Resource

Alkami

From Alkami

This comprehensive market study dives deep into the contrasting views between financial institutions and account holders, offering critical insights that can drive your credit union's strategic decisions.

Download Resource

CPI

From CPI

We worked with an independent researcher to conduct an online survey of over 2000 credit and debit card users to find out how people pay everyday. Download the results!

Download Resource

TransUnion

From TransUnion

What if you could get your offer to consumers before the competition?

Download Resource

Elan Credit Card

From Elan Credit Card

Unlock insights into the spending habits and motivations of new cardholders! Explore why so many chose general-purpose credit cards and what this trend means for industry leaders.

Download Resource

Alogent

From Alogent

Managing deposits effectively is more crucial than ever to keep pace with member expectation. Discover how a transaction level approach to deposit automation delivers unmatched speed, a lower risk for fraud, and reduced operating costs.

Download Resource

Alogent

From Alogent

Explore how cloud-based solutions revolutionize deposit management and transaction processing for credit unions. Download the white paper now!

Download Resource

Alogent

From Alogent

Enhance your credit union’s security with a comprehensive approach to check fraud mitigation. Discover how built-in capabilities safeguard both your organization and your members.

Download Resource

Alogent

From Alogent

Access this white paper to discover how modern technology is revolutionizing payment experiences while lowering operational costs.

Download Resource

Open Lending

From Open Lending

Millennials and Gen Z consumers represent a significant opportunity for credit union lenders. This report uncovers key trends and insights about their credit outlook and how to capture their long-term value.

Download Resource

Elan Credit Card

From Elan Credit Card

As quickly as technology advances, so do the expectations of your members. Learn what digital capabilities and solutions are trending, how much credit unions are investing, and what’s next in payments innovation.

Download Resource

Elan Credit Card

From Elan Credit Card

Struggling to keep your credit card program profitable? Discover why many leaders are turning to the agent issuing model.

Download Resource

Elan Credit Card

From Elan Credit Card

Consumers with general-use credit cards average 37% higher monthly spend than those with co-branded cards. Learn more preferences, habits, and trends in this new report from Elan Credit Card and PYMNTS Intelligence.

Download Resource

Elan Credit Card

From Elan Credit Card

Social media scams, phishing, and telephone-oriented attack delivery are a few of the increasingly sophisticated attack methods by cybercriminals. Learn more about these evolving techniques and how to protect your members.

Download Resource

Elan Credit Card

From Elan Credit Card

Does the value outweigh the risk? Review three key considerations when evaluating whether to invest in growing an internal credit card program or explore an outsourced solution.

Download Resource

Elan Credit Card

From Elan Credit Card

Learn where consumers are applying for credit cards, what type of spenders they are, what features are most persuasive, and what smaller financial institutions should focus on to continue expanding their market share.

Download Resource

Upstart

From Upstart

When Vantage West CU decided to prioritize a seamless digital experience and data-driven lending decisions, they knew the right partner was critical. Download this case study and discover how they diversified their loan portfolio, acquired 1400 new members in 6 months, and built in flexibility to withstand the economic cycles.

Download Resource

Elan Credit Card

From Elan Credit Card

Customer payment expectations are shifting. Explore the top five merchant payments trends we’re watching in 2023 and learn how a partnership may help meet the needs of your members.

Download Resource

Elan Credit Card

From Elan Credit Card

Nearly 33% of cardholders increased their credit card spending over the last six months, showing how critical credit cards are in today's economic environment.

Download Resource

Elan Credit Card

From Elan Credit Card

Young adults are the future of your credit union. From college to home-buying, learn why credit cards are key to winning the loyalty of Gen Z and millennials.

Download Resource

Elan Credit Card

From Elan Credit Card

With the current economic environment and rise in interest rates, credit unions may find the credit card market increasingly complex to operate internally. Learn why shifting from insourcing to outsourcing your credit card program can benefit your credit union.

Download Resource

Elan Credit Card

From Elan Credit Card

A credit union’s ability to deliver the right products and services that best meet members’ daily needs is the most important factor in creating a superior member experience.

Download ResourceCredit Union Times

Don’t miss crucial strategic and tactical information necessary to run your institution and better serve your members. Join Credit Union Times now!

- Free unlimited access to Credit Union Times' trusted and independent team of experts for extensive industry news, conference coverage, people features, statistical analysis, and regulation and technology updates.

- Exclusive discounts on ALM and Credit Union Times events.

- Access to other award-winning ALM websites including TreasuryandRisk.com and Law.com.

Already have an account? Sign In Now