Credit/Shutterstock

Credit/Shutterstock

Both credit unions and banks lost share of credit cards and consumer loans from January to February, according to a Fed report released Friday.

The Federal Reserve's G-19 Consumer Credit Report showed total consumer credit fell by 0.2% from January to February for all lenders, while falling 0.5% at credit unions and banks.

Recommended For You

The change over 12 months also showed credit unions falling behind the rest of the market, rising 2.4%, compared with 3.5% at banks and 2.6% overall.

Credit unions held $657.2 billion in consumer debt on Feb. 29, or 13.1% of the total, compared with 13.2% in both January 2024 and February 2023.

Banks held $2.07 trillion in consumer debt on Feb. 29, or a 41.3% share in February, compared with 41.4% in January and 40.9% in February 2023.

Credit unions saw declines in both credit card balances and consumer term loans, which include auto loans and personal loans.

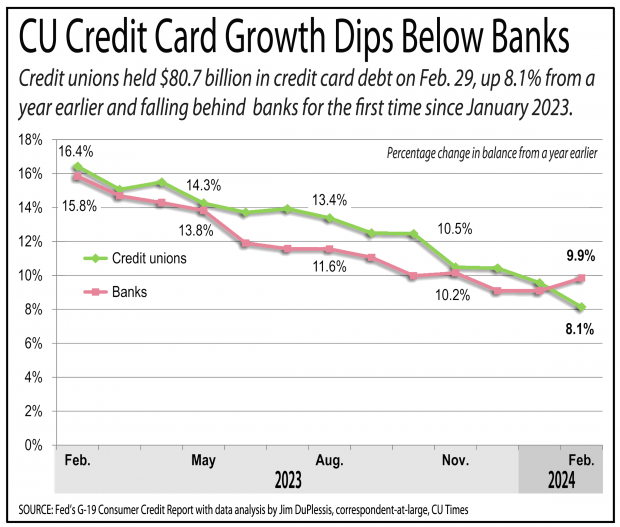

Credit unions held $80.7 billion in credit card debt Feb. 29, up 8.1% from a year earlier. The balance fell 1.5% from January to February, compared with a 10-year average February drop of 0.9%. Credit unions' share was 6.3% in February, unchanged from a year earlier and the previous month.

Banks held $1.2 trillion in credit card debt, up 9.9% from a year earlier. The balance fell 0.7% from January to February, compared with an average February drop of 1.7%. Banks' share was 90.6% in February, unchanged from January and up from 90.2% in February 2023.

Credit unions held $576.5 billion in non-revolving consumer loans in February, up 1.6% from a year earlier. The balance fell 0.3% from January to February, compared with an average February gain of 0.4%.

Credit unions' share of non-revolving loans was 15.5% in February, unchanged from January and up from 15.3% in February 2023.

Banks held $904 billion in consumer loans in February, down 3.6% from a year earlier. The balance fell 0.2% from January to February, compared with an average February gain of 0.1%.

Banks' share of non-revolving loans was 24.3% in February, unchanged from January and down from 25.3% in February 2023.

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.