Both credit union and bank credit cards underperformed in December compared with past gains at the height of the holiday season.

The Federal Reserve's G-19 Consumer Credit Report showed credit unions held $82.6 billion in credit card debt on Dec. 31, up 1.8% from November to December. Their average November-to-December gain from 2016 through 2022 was 2.2%.

Recommended For You

Banks held $1.2 trillion in credit card debt, up 1.21% from November, compared with an average November-to-December gain of 2.6%.

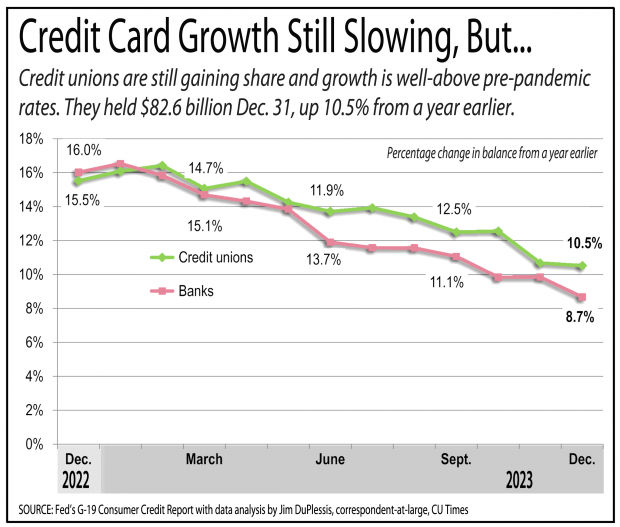

However, credit unions are still gaining share and growth is well above pre-pandemic rates.

Credit unions' share was 6.3% in December, up from 6.2% a year earlier and unchanged from November. Banks' share was 90.6% in December, up from 90.4% a year earlier and unchanged from November. Both took share from finance companies.

Credit union share had previously been reported as 6.4% for October and November, but the Fed revised credit union balances down 1.8% for November and down 0.1% to 0.4% for July through October. Bank and finance company balances were unchanged.

Compared to a year earlier, balances rose 10.5% at credit unions and 8.7% at banks, continuing a slowing trend that began in early 2023. The 12-month balance grow still exceeded the pre-pandemic gains of 7.5% in December 2018 and 6.7% in December 2019.

Fed and NCUA data showed the Top 10 credit unions have higher growth rates for total balances, and larger average balances than those for the nation's other credit unions.

As a result, the Top 10 has grown from holding 44% of the credit card debt held by credit unions in December 2021 to 47% as of Dec. 31, 2023.

The nation's other credit unions held $43.7 billion in credit cards Dec. 31, up 8.2% from a year earlier and up 4% from September.

That data point matched that of PSCU of St. Petersburg, Fla., the largest payments CUSO. It reported its members' credit card balances rose 8% in the 12 months ending in December. Their average balance reached a five-year high of $3,095 in December, surpassing the pre-pandemic 2019 average. The average also rose 3% from $3,001 in September.

The Top 10 held $34.3 billion in credit cards in December, up 13.3% from a year earlier. The average balance was $5,063 on Dec. 31, up from $4,672 a year earlier and $4,914 in September.

The Top 10, measured by the latest reported assets, are not necessarily the 10 largest credit card holders.

For example, Suncoast Credit Union of Tampa, Fla. ($17.4 billion in assets, 1.2 million members) is the nation's 11th-largest credit union by assets, but would be among the 10 largest credit card holders. It held $974.6 million in credit cards Dec. 31, up 18.4% from a year earlier. Its average balance was $4,245 on Dec. 31, up from $3,885 a year earlier.

But the Top 10 is CU Times' handy reference for early analysis of the latest three-month results available from NCUA Call Reports.

Here are some key credit card balance statistics for the Top 10 credit unions by assets:

1. Navy Federal Credit Union, Vienna, Va. ($170.8 billion in assets, 13.3 million members) held $26 billion in credit cards, up 12.7% from a year earlier. The average balance was $6,509 on Dec. 31, up from $6,270 a year earlier.

2. State Employees' Credit Union, Raleigh, N.C. ($54.6 billion in assets, 2.8 million members) held $1 billion in credit cards, up 11.5% from a year earlier. The average balance was $3,366 on Dec. 31, up from $3,107 a year earlier.

3. Pentagon Federal Credit Union, Tysons, Va. ($34.8 billion in assets, 2.9 million members) held $2.1 billion in credit cards, up 14.6% from a year earlier. The average balance was $2,718 on Dec. 31, up from $1,950 a year earlier.

4. BECU, Tukwila, Wash., near Seattle ($29.9 billion in assets, 1.5 million members) held $1.4 billion in credit cards, up 16.2% from a year earlier. The average balance was $4,466 on Dec. 31, up from $4,246 a year earlier.

5. SchoolsFirst Federal Credit Union, Santa Ana, Calif. ($29.2 billion in assets, 1.4 million members) held $1 billion in credit cards, up 20.9% from a year earlier. The average balance was $3,601 on Dec. 31, up from $3,319 a year earlier.

6. Golden 1 Credit Union, Sacramento, Calif. ($21.1 billion in assets, 1.1 million members) held $481.3 million in credit cards, up 16% from a year earlier. The average balance was $3,121 on Dec. 31, up from $2,864 a year earlier.

7. America First Federal Credit Union, Riverdale, Utah ($19.3 billion in assets, 1.4 million members) held $801.6 million in credit cards, up 13% from a year earlier. The average balance was $3,742 on Dec. 31, up from $3,429 a year earlier.

8. Alliant Credit Union, Chicago ($18.5 billion in assets, 839,296 members) held $230.8 million in credit cards, up 1.7% from a year earlier. The average balance was $2,002 on Dec. 31, down from $2,246 a year earlier.

9. Mountain America Federal Credit Union, Salt Lake City ($18.4 billion in assets, 1.2 million members) held $736.3 million in credit cards, up 24.4% from a year earlier. The average balance was $2,312 on Dec. 31, up from $2,122 a year earlier.

10. Randolph-Brooks Federal Credit Union, San Antonio ($18 billion in assets, 1.1 million members) held $501.3 million in credit cards, up 6.4% from a year earlier. The average balance was $1,768 on Dec. 31, up from $1,720 a year earlier.

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.