The nation's largest credit unions produced less loans in the third quarter than the previous quarter or a year earlier, as first mortgages fell and mortgage rates rose above 7%.

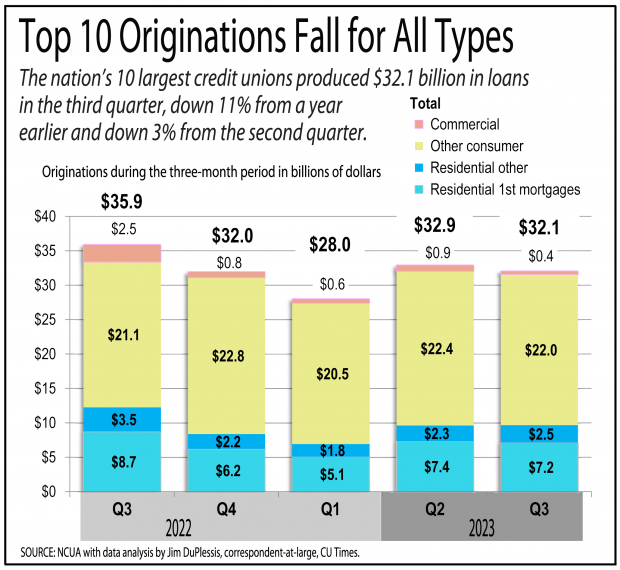

The Top 10 credit unions originated $32.1 billion in loans in the third quarter, down 11% from a year earlier and down 3% from the second quarter.

Recommended For You

Residential first mortgage originations were $7.2 billion, down 18% from a year earlier and down 3% from the second quarter.

The results were also bad for other lenders. The Mortgage Bankers Association's Oct. 15 forecast showed all lenders originated $444 billion in residential first mortgages in the third quarter, down 10% from a year earlier and down 4% from the second quarter.

The MBA reported Wednesday that mortgage applications for the week ending Oct. 27 fell for the third week in a row after seasonal adjustments.

Joel Kan, the MBA's deputy chief economist, said 30-year mortgage rates passed the 7% mark in early August and ended September around 7.6%. Rates were 7.86% on Oct. 27, which is close to a 23-year high.

"The impact of higher rates continued to be felt across both purchase and refinance markets. Purchase applications decreased to their lowest level since 1995 and refinance applications to the lowest level since January 2023," Kan said.

Following the Fed's decision Wednesday to leave the federal funds rate unchanged, MBA Chief Economist Mike Fratantoni said the Fed is likely to keep rates on pause until it starts to cut rates next spring.

"If the Fed does indeed move to cut rates next year and signals its intent to do so, mortgage rates should trend downward. Our forecast calls for this to happen, which would support a somewhat stronger spring housing market," Fratantoni said.

NCUA data for the Top 10 showed third-quarter originations in other sectors were:

- $2.5 billion for home equity lines of credit and other second liens, down 29% from a year earlier, but up 11% from the second quarter.

- $22 billion for consumer loans, which include autos, credit cards and personal loans, were up 4% from a year earlier, but down 2% from the second quarter.

- $445.7 million for commercial loans, which have been diminishing for the past year. They were down 82% from a year earlier and down 50% from the second quarter.

The third-quarter originations included an adjustment for BECU of Tukwila, Wash. ($29.2 billion, 1.4 million members).

Starting in the third quarter, the nation's fourth-largest credit union changed the way it counts credit card originations. The result was that its NCUA Call Reports showed essentially no change in the volume of originations from the first six months of 2023 to the first nine months of 2023. After backing out that change for CU Times' presentation, BECU's total third-quarter originations were about $2.7 billion, according to BECU.

The Top 10 credit unions encompassed 27.2 million members and $406.9 billion in assets as of Sept. 30. The group accounts for nearly 20% of all credit union assets and members.

Originations for the Top 10 credit unions in the third quarter were:

1. Navy Federal Credit Union of Vienna, Va. ($168.4 billion, 13.2 million members) originated $16.4 billion, up 4.5% from a year earlier and up 8% from the previous quarter.

2. State Employees' Credit Union of Raleigh, N.C. ($50.7 billion, 2.8 million members) originated $2.7 billion, down 16% from a year earlier and down 5.5% from the previous quarter.

3. Pentagon Federal Credit Union of Tysons, Va. ($35.4 billion, 2.9 million members) originated $1.7 billion, down 45% from a year earlier and down 29% from the previous quarter.

4. BECU of Tukwila, Wash. ($29.2 billion, 1.4 million members) originated $2.7 billion, up 38% from a year earlier and down 10% from the previous quarter.

5. SchoolsFirst Federal Credit Union of Santa Ana, Calif. ($28.8 billion, 1.3 million members) originated $1.8 billion, down 12% from a year earlier and up 4.7% from the previous quarter.

6. Golden 1 Credit Union of Sacramento, Calif. ($20.5 billion, 1.1 million members) originated $1.3 billion, down 36% from a year earlier and down 35% from the previous quarter.

7. America First Federal Credit Union of Riverdale, Utah ($19.1 billion, 1.4 million members) originated had ROA of 1.25% in the third quarter, compared with 1.04% a year earlier and 0.97% in the second quarter. Originations were $1.7 billion, down 31% from a year earlier and up 4.3% from the previous quarter.

8. Alliant Credit Union of Chicago ($18.9 billion, 831,626 members) originated $1.5 billion, down 21% from a year earlier and up 13% from the previous quarter.

9. Mountain America Federal Credit Union of Salt Lake City ($18 billion, 1.2 million members) originated $1.4 billion, down 34% from a year earlier and down 22% from the previous quarter.

10. Randolph-Brooks Federal Credit Union of San Antonio ($17.9 billion, 1.1 million members) originated $996.5 million, down 35% from a year earlier and down 11% from the previous quarter.

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.