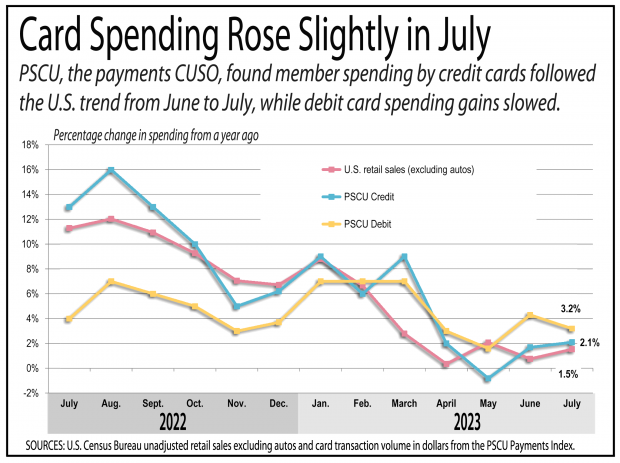

Credit union members' spending by credit and debit cards rose only about 2% to 3% from a year earlier, but the gains were made as inflation moderated and gasoline prices fell.

The PSCU Payments Index report showed spending in July rose 2.1% by credit cards and rose 3.2% by debit cards compared with the year earlier among credit union members using services of the St. Petersburg, Fla., CUSO. In June, payments rose 1.7% by credit cards and rose 4.3% by debit cards.

Recommended For You

The Fed's G-19 Consumer Credit Report released Aug. 7 showed credit unions held $77.3 billion in credit card debt on June 30, up 14.2% from a year earlier and accounting for 6.3% of the nation's total credit card balance. PSCU reported their total balances rose 13.1% in June and 12.6% in July.

Using unadjusted U.S. Census Bureau figures to compare with unadjusted data from PSCU, the U.S. Census Bureau reported that total U.S. retail sales excluding automobiles and parts rose 1.5% in July from a year earlier, after rising 0.9% in June.

Tom Bennett, manager of Advisors Plus Consulting at PSCU, said the steady purchase volumes in July showed consumers remained resilient.

Tom Bennett

Tom Bennett "Given the growth we saw in this month's performance, our credit unions have also been successful in having their cards in the wallets of their members," Bennett said.

The top sectors for year-over-year growth included transportation, restaurants and travel. Members made more transactions on gasoline, but spent much less as gasoline prices were much cheaper than in July 2022.

Here are some comparisons by segment between the Census and PSCU reports:

- Grocery store spending rose 1.3% in July from a year earlier, Census reported. At PSCU, spending rose 4% by credit and rose 4% by debit.

- Gasoline spending fell -21% in July from a year earlier, Census reported. At PSCU, spending fell -14% by credit and fell -12% by debit.

- Spending at restaurants and bars rose 10.6% in July from a year earlier, Census reported. At PSCU, spending rose 11% by credit and rose 9% by debit.

PSCU's average credit card account balance among active accounts increased to $2,996 in July, up 8% from a year earlier.

Delinquencies continued to worsen. The rate was 2.08% in July at PSCU, up from 1.61% a year earlier, 1.94% in June and 1.89% in July 2019.

Discretionary spending continued to outpace non-discretionary for both credit and debit. Discretionary spending rose 4.1% by credit and 9.8% by debit in July, while non-discretionary spending rose 1.4% by credit and 2.3% by debit.

The PSCU Payments Index was based on data from credit unions that have been processing payments with PSCU since January 2021. It encompassed 2.8 billion transactions valued at $139 billion of credit and debit card activity in the 12 months ending July 31.

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.