Overall, credit unions had a great 2022, and their problems as the year ended were the kind that would seem to suggest a booming economy.

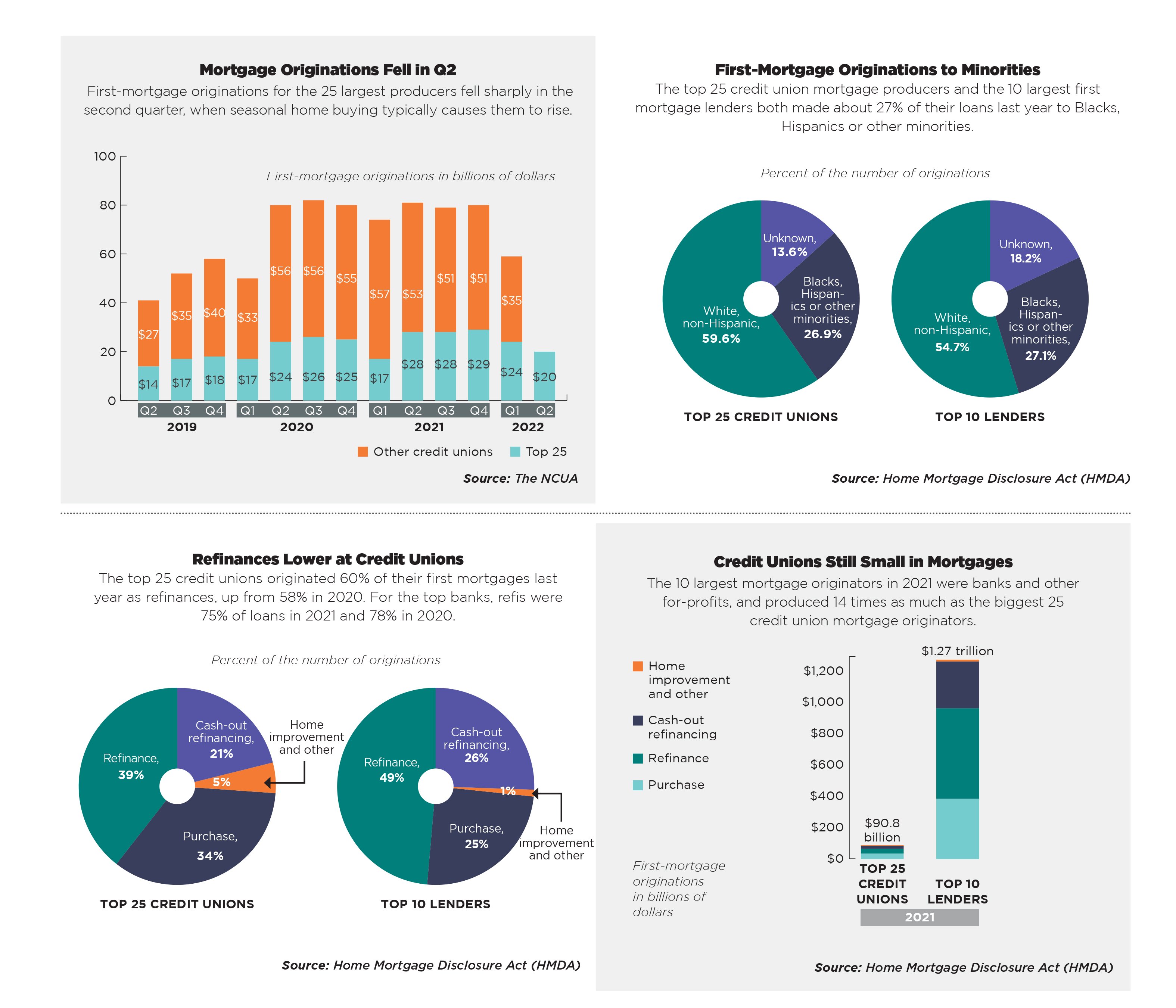

Yes, the Fed's aggressive interest rate hikes eroded loan production, but portfolios still grew at record rates and net interest income surged as credit unions raised loan rates at a faster rate than savings rates.

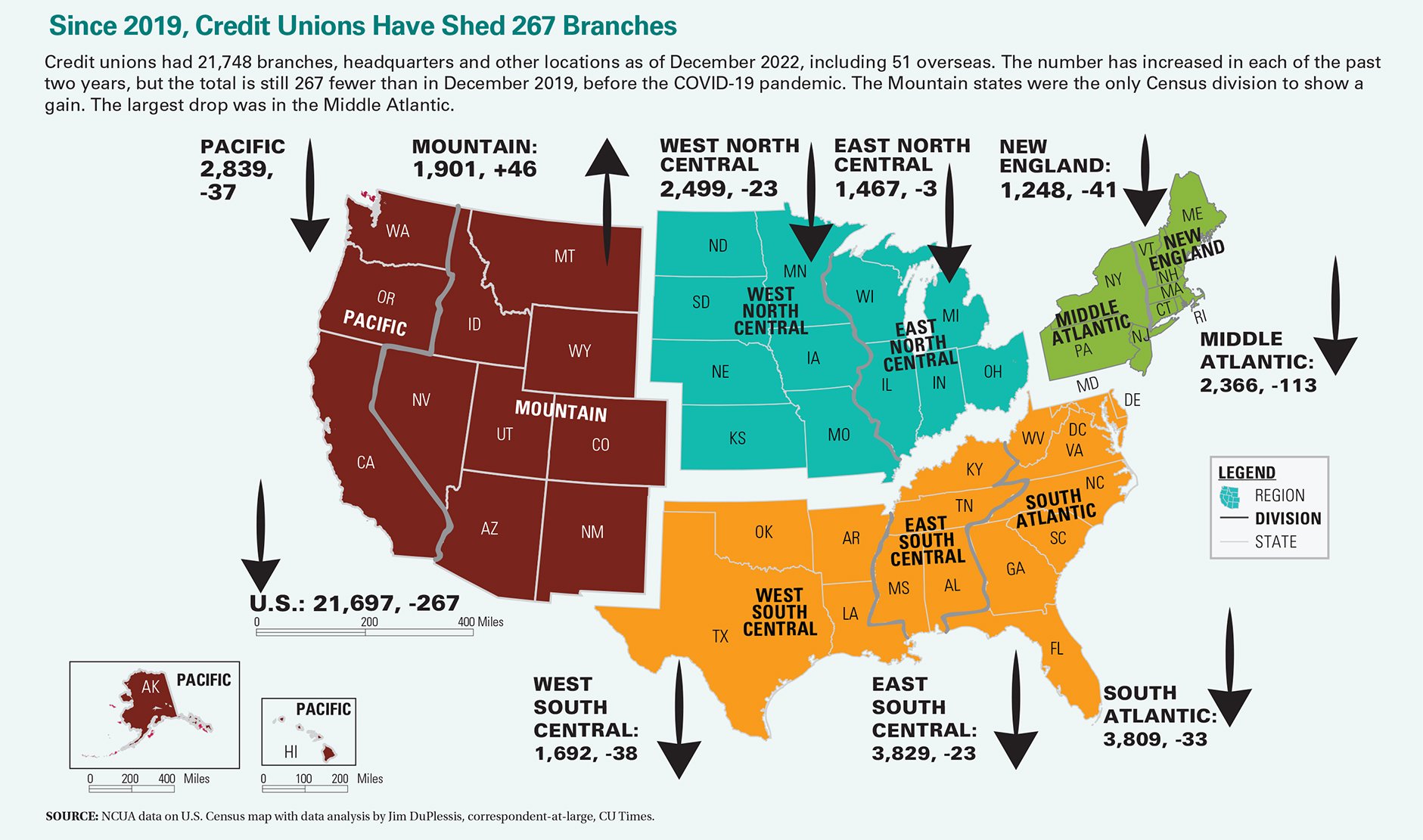

And the drop in originations – at least through 2022's fourth quarter – has only returned credit unions to where they were at the end of 2019, before the COVID-19 pandemic began.

Recommended For You

Loan quality certainly deteriorated, but that was from the peculiarly low delinquencies and charge-offs during the pandemic when households were flush with cash from government supports. NCUA Chair Todd Harper said March 8 that he's concerned especially by the rapid rise in delinquencies for credit cards and auto loans.

About 55% of auto loans in credit union portfolios were from indirect lending as of Dec. 31. That was up from 53% on March 31, and credit unions have struggled to keep those members.

As the year marches on, hopes are fading that the Fed will taper off interest rate hikes. CUNA and the Mortgage Bankers Association forecast last fall that a mild recession would begin early this year. As of March, it appears they might be wrong only on timing.

Click here to enlarge infographic.

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.