Source: Callahan's Peer-to-Peer Analytics

Source: Callahan's Peer-to-Peer Analytics

Over the past two pandemic-affected years, credit unions faced a sudden surge of liquidity in the form of widespread Federal relief programs. Throughout 2022, however, that dynamic flipped more quickly than many anticipated. As price increases inflate the cost of living for many Americans, budgets have tightened, savings have declined and borrowing has surged. Now, some credit unions are focused on managing liquidity as they look ahead to 2023.

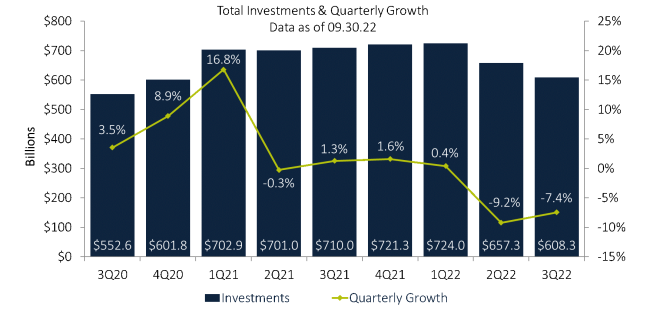

Total Credit Union Investments Fall 7.4% From June

Total investments – including cash balances – held by credit unions declined 7.4%, or $49.0 billion, over the past three months to $608.3 billion at the end of the quarter. This continued the industrywide contraction trend, following a 9.2% decrease in the second quarter. In total, $115.7 billion has left credit union investment portfolios over the past two quarters, the largest decline in a six-month period on record by nearly $50 billion. This outflow has reversed a sizable portion of the liquidity expansion realized during the pandemic, as total investments are now in line with industry totals at year-end 2020.

Recommended For You

Outstanding loan balances increased $75.4 billion on credit union balance sheets in the third quarter while deposit balances grew just $9.4 billion over the same period, causing net liquidity to decline $65.9 billion since June. Rising costs of living mean members are spending and borrowing more and depositing less. Even higher interest rates – which are intended to slow borrowing demand – have yet to make much of an impact on loan originations. The industry's loan-to-share ratio increased 3.6 percentage points quarter-over-quarter to 78.3% by the end of September. To fund lending, credit unions have dipped predominantly into cash balances, which were held at elevated levels throughout the pandemic when deposits accumulated in excess. As cash is repurposed, however, credit unions may need to look into alternative ways to source new funds, like certificate rate promotions or borrowings.

Cash Declines to Fund Lending Activity

Cash balances declined 16.9%, or $31.4 billion, since June – the primary driver of the investment portfolio's decline. Totaling $153.4 billion at quarter-end, cash and equivalents comprise 25.4% of investments, down from 28.3% a quarter ago, and 37.5% in September 2021. Despite the cash decline, cash balances on hand at credit unions increased 10.3% since June, the only investment category to expand over the quarter. Credit unions reduced cash held at the Fed by 23.8% quarter-over-quarter, a $28.6 billion reduction. After utilizing significant cash to fund loans over the past six months, cooperatives will have to consider how to best generate additional liquidity to fund further lending programs and help members achieve their financial goals.

Balances of non-cash investments decreased 3.7% quarter-over-quarter to $453.9 billion. U.S. government and federal agency securities is the largest investment asset category and suffered the largest quarterly decline in dollar terms, contracting $15.0 billion, or 4.2%. The relatively small percentage decline compared to cash balances meant this category became a larger portion of investment portfolios, increasing its composition by 2.2 percentage points to 56.8% at September-end. Other equity security balances, primarily mutual funds, declined 21.3% since June and comprise just under 1.0% of total portfolios.

Source: Callahan's Peer-to-Peer Analytics

Source: Callahan's Peer-to-Peer Analytics Industry Yield Reaches 1.38%

The industry-wide average yield on investments rose 26 basis points since June, reaching 1.38% by the end of September. This marks the highest level of portfolio return since December 2020 and is 56 bps above the recent bottom recorded in the first quarter of 2021. Credit union investment income continues to benefit from aggressive Fed rate hikes, as portfolios reprice to new rates and declining cash balances boost overall average returns for the portfolio. Despite a 7.4% decline in investment dollar balances since June, income from investments rose 36.9% from the second quarter to the third quarter. However, as interest rates rise, bond prices fall. Credit unions are affected by this dynamic through their available-for-sale securities portfolios, with unrealized losses now totaling $39.2 billion as of September. Looking ahead, expect investment yields to continue to rise as investment portfolios further reprice.

Source: Callahan's Peer-to-Peer Analytics

Source: Callahan's Peer-to-Peer Analytics

Jay Johnson

Jay Johnson Jay Johnson is President of Callahan Financial Services, Distributor of the Trust for Credit Unions, in Washington, D.C.

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.