Source: Callahan's Peer-to-Peer Analytics

Source: Callahan's Peer-to-Peer Analytics

Credit union balance sheets realized record share growth throughout the pandemic, mainly driven by government relief programs and increased saving rates during quarantines. Despite record mortgage loan originations, loan balance growth slowed through a combination of early repayments and credit unions selling low-interest loans to secondary market buyers.

In the first half of 2022 however, these trends have turned. After annual loan growth outpaced deposit growth in the first quarter of the year, all eyes were on whether this trend would continue. The mid-year numbers didn't disappoint, with credit union loan balances growing 16.2% on an annual basis, almost doubling the 8.2% rate for shares. Of course, this meant credit union assets flooded out of investments – mostly excess cash balances – and into loans.

Recommended For You

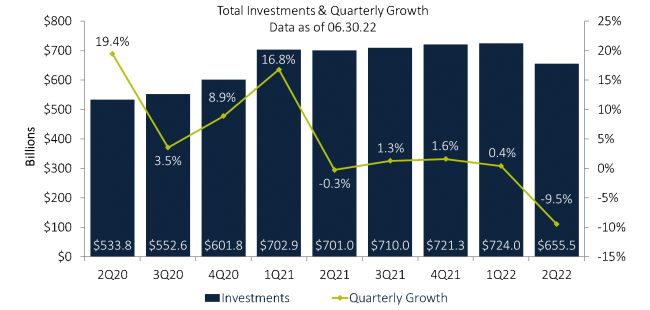

Total Credit Union Investments Fall 9.5%

Total investments held by credit unions, including cash balances, fell 9.5%, or $68.6 billion, over the past three months to total $655.4 billion outstanding at the end of the quarter. This is the most significant quarterly percentage decline in the last 20 years, but that superlative is misleading without looking at the bigger picture. Credit union investments boomed in the past two years, growing from $389.3 billion in December 2019 to a high of $724.0 billion in March 2022, mostly driven by excess deposits being held as cash. Even after this recent decline, total industry investments are well above where they stood at the start of the pandemic.

Loan balances increased $86.8 billion in the second quarter, causing net liquidity to decrease $82.3 billion. This was by far the industry's largest quarterly liquidity reduction on record and was three times greater than the most recent significant drop in the second quarter of 2018. After persistent share growth the past two years, liquidity was bound to reverse eventually. Higher costs of living reduced savings, while accelerating asset price growth pushed loan demand to record highs in dollar terms. These dynamics pushed the loan-to-share ratio up 4.5 percentage points from last quarter to 74.7%, a welcome sign for credit union interest margins. Only $7.5 billion in mortgages were sold to the secondary market in the quarter, a 73.8% decline from the same period last year. Credit unions are holding more mortgages on their balance sheets as higher rates make holding these loans more attractive. All told, less deposits and more held loans is going to equate to less assets held as investments. Low-yielding cash balances were the main casualty, as cash balances fell $65.9 billion during the quarter, 96.0% of the total decline in investment balances.

Credit Unions Favor the Front of the Curve

The yield curve flattened after the Fed raised rates 75 bps in both June and July. Short-term Treasuries, which are most sensitive to Fed action, priced in expectations for additional rate hikes. The two-year yield increased 40 basis points in June after some dramatic intra-month swings. It settled at 2.95% at month end after reaching as high as 3.45%. The market struggled to price in both recession risk and more Fed rate increases at the same time, as the two forces counteract each other. The 2-year/10-year spread finished the month at 6 basis points, threatening inversion.

Portfolio allocators took advantage of the increase in shorter-term yields and reinvested funds into securities of more near-term maturity. The one-to-three-year maturity category took in $4.2 billion from credit union investors since March, good for a 3.6% increase and enough to become the largest non-cash category. Investments in securities are spread relatively evenly across each of the maturity categories within the one-to-10-year range, understandable given recent changes to the yield curve. Cash comprises 28.3% of total investments, down from its all-time high of 42.9% in March 2021. Credit unions used these large cash balances to fund higher lending activity in 2022, and gradually increased their allocations to securities.

Source: Callahan's Peer-to-Peer Analytics

Source: Callahan's Peer-to-Peer Analytics

Industry Yield Up 21 Basis Points

The average yield on investments increased 21 basis points quarter-over-quarter, up to 1.12% through June. While this marked the fifth straight quarterly increase, it was the most significant change in yield since the first quarter of 2019. Declining cash balances and a rising interest rate environment driven by the Fed were the main reasons for the spike. This stands in marked contrast to trends from 2020 and early 2021, when the Fed reduced rates to spur demand and subsequently lowered yields, and deposits drove low-yielding cash to record portions of the portfolio. Of course, with rising yields come unrealized losses on available-for-sale securities, and these, perhaps temporary, losses now total $28.3 billion year-to-date throughout the industry. Looking forward, interest rates are projected to increase even further in the coming months with the Fed's commitment to bring down inflation.

Source: Callahan's Peer-to-Peer Analytics

Source: Callahan's Peer-to-Peer Analytics

Jay Johnson is President of Callahan Financial Services, Distributor of the Trust for Credit Unions, in Washington, D.C.

Jay Johnson

Jay Johnson © Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.