Internal Revenue Service, Washington D.C. (Source: Shutterstock)

Internal Revenue Service, Washington D.C. (Source: Shutterstock)

"It's not our fault," credit unions across the country are telling members who think their federal Economic Impact Payments have been deposited into their accounts.

After all, their accounts state the money, provided in the latest economic stimulus legislation passed by Congress, is there.

Recommended For You

Credit union members may have received messages over the weekend that their Economic Impact Payments have been deposited into their accounts, but also have discovered that the funds will not be available until Wednesday.

And while credit unions are having to field inquiries from members about the discrepancy, the blame belongs squarely on the shoulders of the IRS, credit union and banking trade groups said Tuesday.

The problem stems from an IRS decision not to send the payments using the same-day Automated Clearing House system for direct deposits. Instead, the IRS used the March 17 date.

"The confusion the IRS created could have been easily avoided if they used same-day ACH to deliver the funds on the day they wanted the funds made available," CUNA Chief Advocacy Officer Ryan Donovan said. "The IRS chose March 17th as the fund availability date and that is the date that credit unions are able to make funds available. If the administration wanted the funds available earlier, they could have set an earlier date – but they did not."

NAFCU's Executive Vice-President of Government Affairs and General Councel, Carrie Hunt said, "As the IRS sends additional batches of stimulus payments to millions of Americans in need of economic assistance, credit unions will work with members to ensure prompt availability of funds as soon as the IRS has allowed."

The statement from the trade groups, which include NAFCU, CUNA and banking groups states, "It is up to the sender, in this case the IRS, to decide when it wants the money to be made available and the IRS chose March 17."

As the IRS began processing the impact payments, Commissioner Chuck Rettig applauded the agency's efforts.

"Even though the tax season is in full swing, IRS employees again worked around the clock to quickly deliver help to millions of Americans struggling to cope with this historic pandemic," he said. "The payments will be delivered automatically to taxpayers even as the IRS continues delivering regular tax refunds."

But it has been up to credit unions to explain to members why their money is not immediately available.

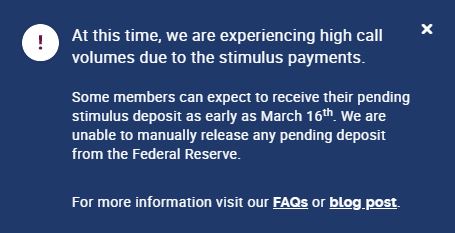

Message posted on the Neighborhood Credit Union's website.

Message posted on the Neighborhood Credit Union's website. For instance, the Neighborhood Credit Union in Dallas notes on its website that White House Press Secretary Jen Psaki said the payments would begin the weekend of March 12.

But the credit union added, "If you see that your direct deposit is pending, Neighborhood CU is unable to manually release funds from any direct deposits into your Neighborhood CU accounts."

And the LM Federal Credit Union noted, "Please note the IRS, not LMFCU, controls when an Economic Impact Payment (stimulus check) will be directly deposited into your account."

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.