(Photo: VP Brothers/Shutterstock)

(Photo: VP Brothers/Shutterstock)

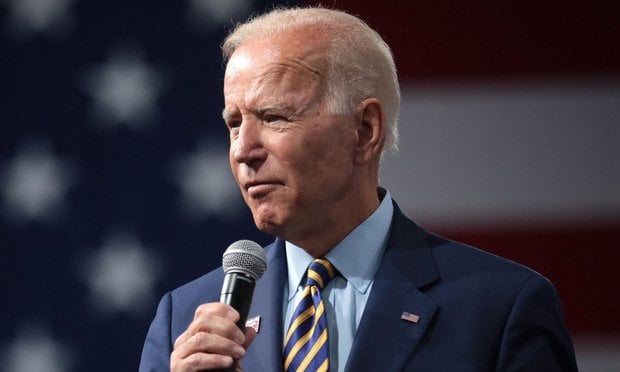

Senate Majority Leader Chuck Schumer, D-N.Y., and Sen. Elizabeth Warren, D-Mass., are calling on President Joe Biden and Vice President Kamala Harris to cancel up to $50,000 in federal student loan debt by executive order.

In a recent CNBC op-ed, the senators use a relatively novel argument, tying student loan debt to the plight of borrowers 50 and older.

Recommended For You

About 6.3 million of the more than 43 million student loan borrowers are age 50 to 64, and 1 million are over age 65, according to the senators. Together these two groups account for $290 billion, or about 19%, of the total federal student loan debt burden.

"Like the massive debt burden on younger Americans, trying to balance this mountain of student debt inevitably drags our seniors down, too," according to the senators.

Thirty-seven percent of Americans over 65 with federal student loans are in default, which allows for the federal government to garnish up to 15% of their monthly Social Security checks, according to AARP.

"The federal government has turned its back on Americas young and old with student loan debt, " write the senators. "The system failed them, and today, they're drowning in debt when they should be experiencing retirement security in their golden years."

If they can't pay their debt, the Social Security Administration can garnish their Social Security benefits and almost three-quarters of those garnishments were applied toward student loan fees and interest, and not principal, according to the two senators.

"No older person should have to make life-altering decisions between paying their student loan payment, putting food on the table, or keeping themselves and their families safe and healthy, especially during this public health crisis … ," wrote the senators. "And they definitely shouldn't have their hard-earned Social Security stripped from them."

What Older Borrowers Owe

A new report from the Employee Benefit Research Institute found that 15% of households headed by someone 55 and older have student loan debt, and their debt levels had grown 321% since 1992. Close to half the debt was for their own education, about 44% was for their children, and the remaining debt was for both.

The report also found that families with incomes or net worth in the top half of Americans owed almost two-thirds of student loan debt outstanding, which is why EBRI does not support student loan forgiveness for everyone.

"A universal student loan forgiveness program which has been discussed in some policy circles would be of greater benefit to those with higher incomes," wrote Craig Copeland, author of the report. He favors a targeted program that would focus on those "most in need."

Biden's Student Debt Plans

President Biden, who campaigned on plans to cancel up to $10,000 in student loan debt, has said he wants Congress to pass such a bill, but he did not include that provision in the $1.9 trillion economic relief proposal he sent to Congress.

Others, like Sens. Schumer and Warren and the Project on Predatory Student Lending associated with the Legal Services Center of Harvard Law School, say Biden could use an executive order to direct the Department of Education to cancel federal debt.

On Biden's first day in office, however, he extended the moratorium on payments for federal student loans that was due to expire on Sept. 30, 2021.

Warren, along with several labor and consumer groups, is also calling on Biden to replace Mark Brown, the head of federal student aid at the Department of Education, who was appointed by the former Education secretary, Betsy DeVos.

"Whether it was incompetence, malice, or a mix of both, the Department of Education's student loan bank under Betsy DeVos was a disaster and oversaw the illegal garnishment of the wages of thousands of struggling borrowers during the pandemic," Warren said.

The March 2020 economic relief package, known as the Coronavirus Aid, Relief and Economic Security (CARES) Act, temporarily banned wage garnishment for federal student loan borrowers who had defaulted on their loans.

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.