SOURCE: The NCUA with data analysis by Jim DuPlessis, correspondent-at-large, CU Times.

SOURCE: The NCUA with data analysis by Jim DuPlessis, correspondent-at-large, CU Times.

When Callahan & Associates held its quarterly Trendwatch webinar earlier this year on Feb. 13, it celebrated a fourth quarter capping off one of the movement's most successful decades of growth and member engagement.

But that environment changed radically within weeks as COVID-19 became a clear threat and was declared a pandemic March 11.

Recommended For You

The change can be seen in overall numbers from Callahan's quarterly estimates that arrive two or three weeks before the NCUA releases bulk data, and from Top 10 data compiled by CU Times from Call Reports released about a month after the end of the quarter.

The change can be seen in overall numbers from Callahan's quarterly estimates that arrive two or three weeks before the NCUA releases bulk data, and from Top 10 data compiled by CU Times from Call Reports released about a month after the end of the quarter.

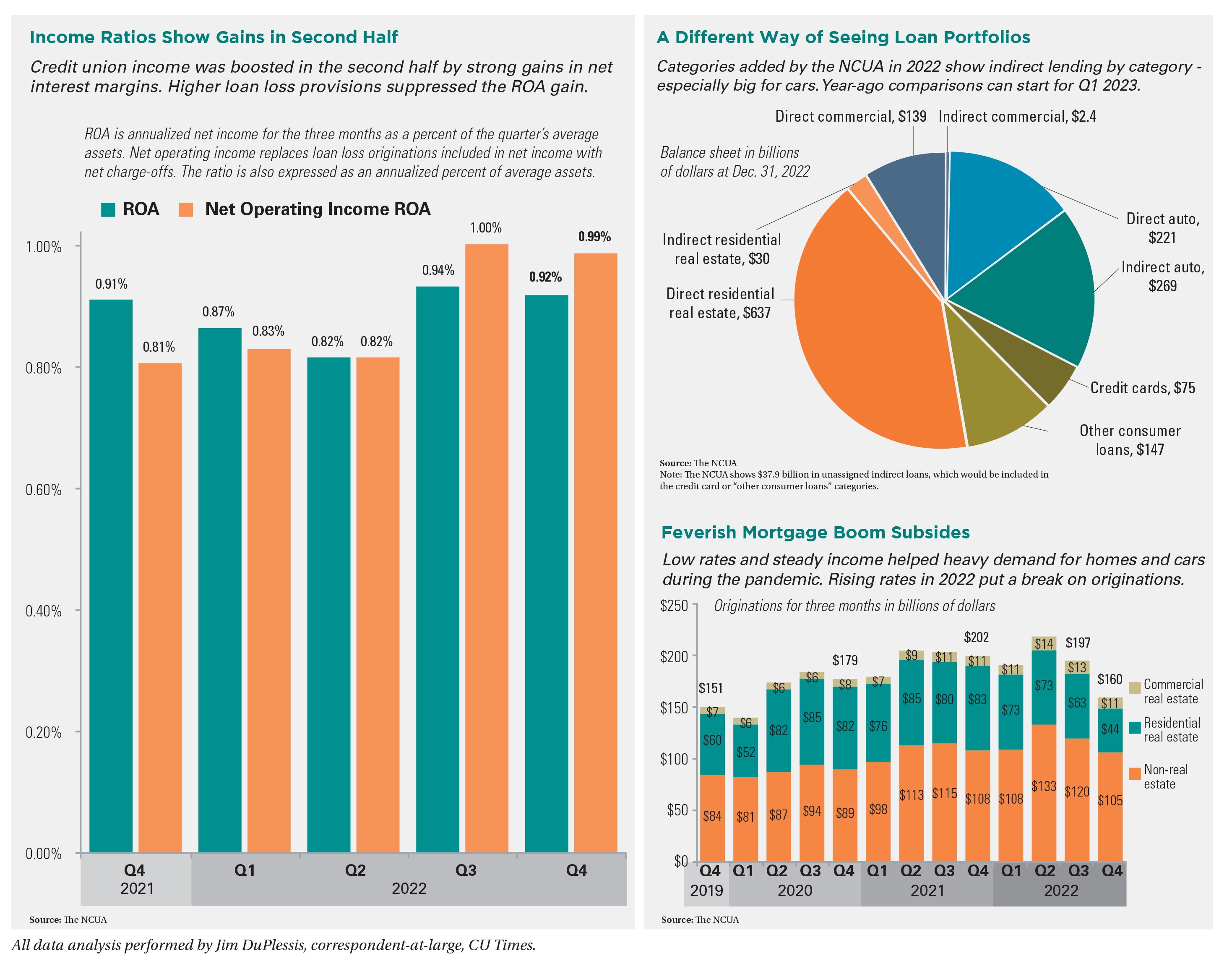

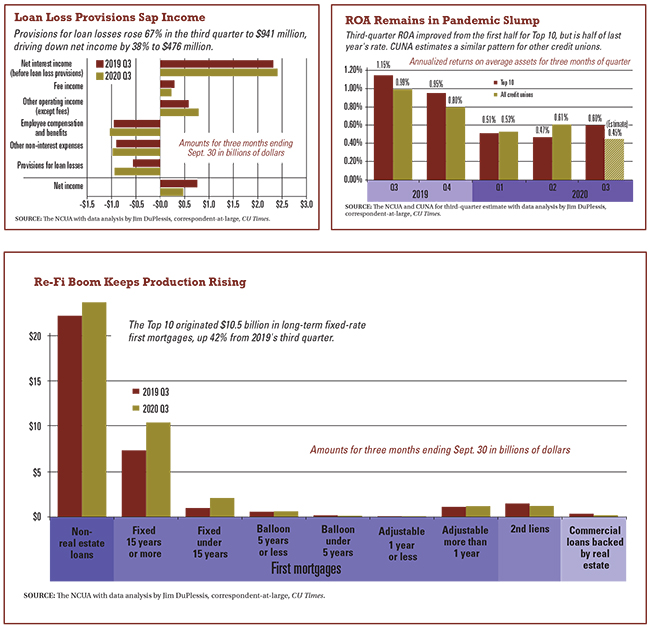

Loan loss provisions have been up sharply all year for both the Top 10 and other credit unions, slicing into net income. But then, as CUNA economist Mike Schenk said, net income for credit unions is a war chest to be used (but not used up) to help members bridge hard times. The coming months might be a time to draw more from that war chest.

Schenk said this final quarter of 2020 will be rougher because the rapid rise in COVID-19 infections is causing people to hunker down, whether or not politicians are telling them to.

Credit unions' annualized return on average assets has been lower in the pandemic recession, but not as bad so far as it was during the Great Recession.

Data released on Nov. 11 by Callahan showed that ROA was about 0.79% for the third quarter for all credit unions – about on par with any quarter in 2016 and a healthy rate for most credit unions.

The judgment of credit union managers is contained in the amount they are provisioning for future losses.

For the Top 10, ROA was 0.60% for the three months ending Sept. 30, down 37 basis points from 2019's third quarter. That change was driven by 29 bps of gains from income minus 18 bps from operating expenses and 47 bps from loan loss provisions.

Overall, Callahan found credit unions took a combined $2.1 billion in loan loss provisions in the three months ending Sept. 30.

Provisions for loan losses were $1.6 billion to $1.7 billion each quarter in 2019, but have climbed steeply since the pandemic. They rose to $2.1 billion in the first quarter and $2.7 billion in the second quarter.

Recent declines in delinquencies and charge-offs might be skewed by forbearances and other accommodations, according to Schenk and Jay Johnson, Callahan's chief collaboration officer.

"We don't quite know where all of this is going to head," Johnson said. "Certainly credit unions are preparing for things to turn the other direction."

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.