Let's look at a few pieces of data that give us a sense of what has happened and what may happen to the consumer finance sector as a result of the global health pandemic.

Let's look at a few pieces of data that give us a sense of what has happened and what may happen to the consumer finance sector as a result of the global health pandemic.

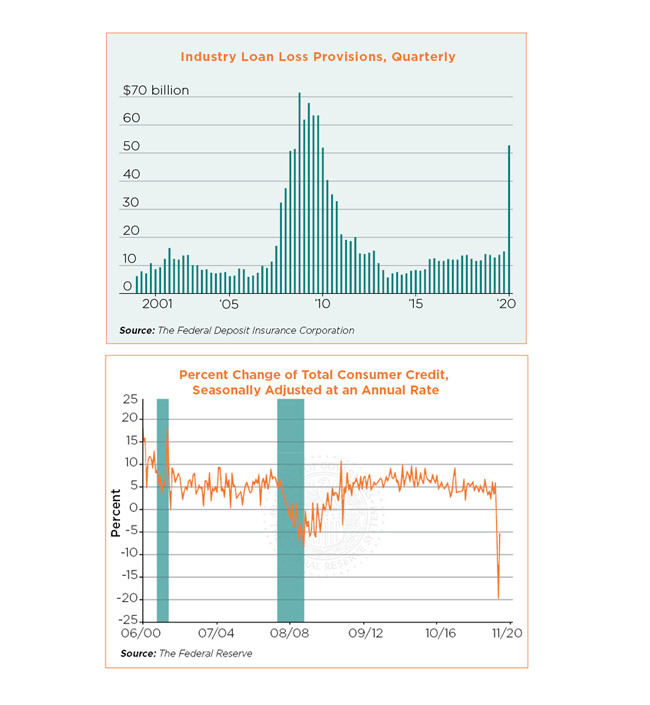

First, a July 12 article in the Wall Street Journal provided data about what the banking industry is thinking as it relates to future loan losses. One can expect even more dramatic provisions once second quarter data is available. If you've ever wondered what a hockey stick curve looks like, your dream has come true (see the chart above from the FDIC).

Second, the accompanying Federal Reserve chart illustrates vanishing growth in consumer credit markets with a 20.25% decrease in April 2020 and a relative recovery to a 5.31% annualized decrease in May 2020. Yeah!

Recommended For You

Finally, the Federal Reserve's Senior Loan Officer Opinion Survey on Bank Lending Practices reported, "Over the first quarter [end of March 2020], a moderate net share of banks tightened lending standards on auto loans, while significant net shares of banks tightened standards on credit card loans and other consumer loans. Significant net fractions of banks also tightened important terms on credit card loans, including credit limits, minimum credit scores required, and the extent to which loans are granted to customers who do not meet credit scoring thresholds." And with a bit of bureaucratic understatement, "Over the first quarter, significant net shares of banks reported having tightened standards for C&I [commercial and industrial] loans to both large and middle-market firms and to small firms."

Effects of a Downturn

I've chosen to share bank data because numerous studies have shown during times of economic downturn, and outright recession, banks pull back on lending quicker and more dramatically than credit unions. Tough economic times therefore invite credit unions to gain new members, grow (on a relative basis) their lending portfolios and change consumer perceptions. The data here provides not so subtle indicators that bankers seem to be reverting to type during this economic "downturn."

Of course, credit unions are not immune to economic downturns. Some credit unions with a heavy focus on certain sectors of economy (travel and leisure), geography (communities in lockdown) or demographics (older consumers) may be more impacted in today's world than more diversified financial institutions. Still, to quote Mike Schenck of CUNA & Affiliates, "Most credit unions have strong balance sheets and are very well-capitalized. For many credit unions, the best course of action is to avoid overreacting and to let their capital do its work. If there was ever a need to allow capital ratios to fall to meet member needs and preserve the credit union, this is it."

Responsibilities During a Downturn

So, what to do? Filene has been thinking about this quite a bit lately. Through in-depth study of up-to-date information resources, discussions with dozens of credit union executives/industry watchers and relying our deep research library, we offer the following considerations:

- Over index your efforts to support members' needs today;

- Put member financial well-being at the center of your credit union's strategy;

- Think and act on the evolving service delivery models; and

- Update your business model for a near zero rate environment.

Let's put some meat on these bones with specific, proactive actions for you to consider.

Credit unions always have supported their members, but the urgency and acuteness of consumer needs today is something that will be new to many. For most consumers, these new needs will be short-term in nature and there are practical things credit unions are/can be doing now. For example, we have observed credit unions of all shapes and sizes offering things like remote funds access, debt forbearance/deferment, fee waivers/reimbursements and short-term, small dollar loans at (or near) 0% APR. As the situation changes on an almost daily basis, a handful of credit unions (and banks) are going beyond the obvious by analyzing ACH transactions as a way to monitor individual member health, triaging member needs and offering customized assistance.

The pandemic is the proximate cause of this economic downturn. And while many consumers will see temporary shocks to their financial situation, some may experience a longer-term, material shift in their financial health, especially previously vulnerable populations. Therefore, credit unions would be well advised to rediscover financial well-being at the heart of the credit union value proposition. You can accomplish this by paying attention to key transitions in members' lives, putting personal financial management tools at the core of your offerings and focusing on credit repair tools.

Public health orders across the country are requiring all business to innovate and evolve service delivery models. The obvious outcome of this trend is the (more) rapid shift to online and mobile delivery. Many credit unions experiencing this digital crash course are finding some weaknesses in their approach, so trusted partnerships with technology providers may turn out to be a short-term key success factor. Also, now is the time to experiment with emerging technologies that help emulate face-to-face interaction in a digital world, including artificial intelligence-based chatbots, advanced data analytics and other models of self-service that replace analog channels.

Finally, credit unions should prepare their business models for a (relatively) long-term, low rate environment. We know there will be tight net interest margins, so you will probably be going through an examination of your underlying expense structure. If you have a more growth-oriented perspective, now is the time to build more muscle in generating member-friendly fee income streams. Also, a low rate environment provides your credit union an opportunity to mobilize low-cost deposits … the raw material, or inventory, for future lending.

A Few Silver Linings

After several months of lockdown, it's easy to get down and think bad thoughts. I'd encourage you to take a step back and recognize a few silver linings.

Credit unions entered this downturn with more than adequate capital – so we can withstand a protracted down economic cycle. Credit unions have conservative lending policies – so we may experience less severe loan losses than most banks. Credit unions are cooperatively owned – so we will engage in pro-consumer behavior, unlike most of our competitors.

These silver linings should give credit unions hope, and while they hold many responsibilities of utmost importance today, they are not without support in this work. There are many resources and many more friendly faces rooting for the work of credit unions to be done, so that you may give hope and energy right back to us all.

George Hofheimer

George Hofheimer George Hofheimer, EVP/Chief Research & Development Officer Filene Research Institute, Madison, Wis.

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.