NAFCU President/CEO B. Dan Berger talks virtually with NCUA Chair Rodney Hood.

NAFCU President/CEO B. Dan Berger talks virtually with NCUA Chair Rodney Hood.

NAFCU's five-hour "State of the Industry" event Thursday included virtual sessions on the economic effects of COVID-19, the regulatory landscape and lending in a post-pandemic environment. Here's a recap of a few highlights from the day's agenda.

Hood Addresses the Role of CUs in Creating Racial Equality

In a one-on-one discussion between NAFCU President/CEO B. Dan Berger and NCUA Chair Rodney Hood, Berger asked Hood what credit unions can do specifically to help promote racial equality in light of the ongoing protests taking place around the world in response to the killing of George Floyd.

Recommended For You

Hood said credit unions' focus should be on addressing issues around economic inequalities. "Credit unions are especially positioned to provide affordable access to credit," he said, noting that part of what protesters are demanding is the need for financial access, such as access to loans and education for their children.

Hood added credit unions must work with marginalized, underserved communities to demonstrate their "people helping people" philosophy. From the NCUA's standpoint, he said he wants to ensure he provides credit unions with the regulatory relief and flexibility they need to provide services to those communities.

Thriving in a Post-Pandemic Lending Environment

Pete Hilger, CEO of Allied Solutions, a Carmel, Ind.-based insurance, lending and marketing company, advised credit unions to be "dynamic and fearless in a responsible way" as they navigate lending and other services in a post-pandemic marketplace.

Credit unions that have been relying on their brand loyalty to build and retain business may be in for an unpleasant surprise in today's competitive environment, according to Hilger. "Can you really leverage that brand as a reason why [members] should do business with you? To some degree, yes, but you have to make yourself different," he said. Here are some of his other top tips for credit union executives for achieving near- and long-term success:

- Keep an eye on fraud. The new types of loans credit unions have been making to assist members during the economic crisis come with fraud risks, so ensure you have a robust lineup of fraud prevention tools in place. "You can get burned pretty quick with fraud on loans that you're not keeping your eye on," Hilger said.

- Evaluate your member communication channels. Hilger said face-to-face interactions were already fading prior to the pandemic, and with many credit unions now closed, the trend is becoming even more pronounced and will become part of the "new normal." He recommended leveraging text, email and video channels, and gaining an understanding of which remote channels members prefer before creating a strategy.

- Invest in digital. He emphasized digital banking tools are critical to being prepared for the future, and noted credit unions should view these tools as ways to engage with members and drive more business, not just transact business.

- Do something with your data. Conducting an analysis of big data in order to determine how to reach members in a purposeful, meaningful way is important.

- Don't be afraid to market more products to members. Hilger pointed to the large influx of marketing emails consumers have been receiving from businesses during the pandemic, and reminded credit unions that some of those emails may be coming from their competitors. "In general, credit unions haven't done a good job marketing themselves as an industry to attract members, or driving new value propositions to increase business with existing members," he said. He recommended considering outsourcing marketing to get more product offers in front of members. "Don't fall asleep at the wheel and don't be afraid to experiment."

- Retain your people. Hilger said at Allied Solutions, as other organizations announced furloughs, layoffs and reductions to employee benefits, he made a commitment not to eliminate any employees as they are his No. 1 asset. "They're the ones who will help us get out of these challenges," he said.

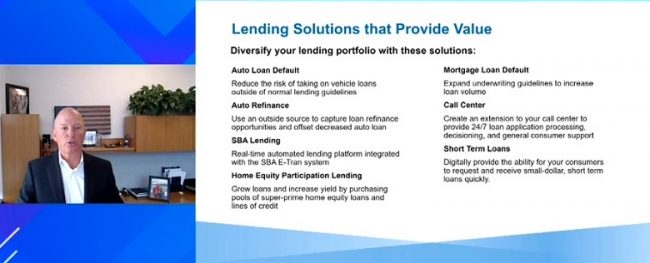

- Offer lending solutions that are valuable for the member. Hilger said there are many great products available that can be delivered digitally and offer consumer value (see list on slide below).

Allied Solutions CEO Pete Hilger discusses lending solutions.

Allied Solutions CEO Pete Hilger discusses lending solutions. CUs Must Embrace Changes to Ways of Doing Business

In a closing keynote, Jim Marous – co-publisher of The Financial Brand, owner and CEO of the Digital Banking Report and host of the podcast Banking Transformed – emphasized that as the COVID-19 pandemic transforms the way we work as well as every other aspect of life, credit unions must also change themselves from the inside out.

"This is the time to disrupt, and to teach [employees] new skills, not just once but on an ongoing basis," he said. "It's time to start both corporate and personal digital transformation journeys."

Marous noted the federal government's relief programs for businesses were only "a Band-Aid on top of a much bigger wound." He gave an example of two restaurants in his neighborhood – one that did not change its business model and shuttered, and another that did change its platform and is more likely to survive.

Credit unions must think similarly, he suggested, especially when it comes to digital banking. He said when the crisis began and credit unions were forced to operate only from drive-thru windows and online, they could "no longer 'fake' digital." He also asserted that it's no longer acceptable to require consumers to visit a branch in person to open a new account or loan.

Marous added that consumers want their financial institutions to proactively reach out to them to initiate their next moves regarding their personal finances. "They want you to know them, look out for them and simplify their lives."

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.