Source: Experian

Source: Experian

Credit unions had been steadily increasing their market share in the automotive financing space for years, but the Q1 2019 data showcased a surprise: That trend has taken a hiatus.

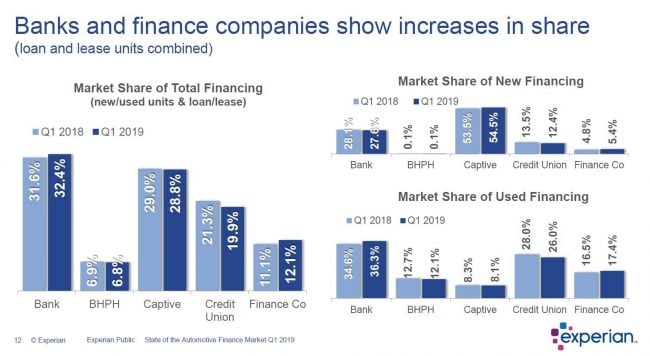

There was a slight dip in market share for credit unions in Q1 2019, based on Experian's most recent "State of the Automotive Finance Market" report. Credit unions saw their total automotive market share drop 6.6% to 19.9% in the first quarter, but the decline in market share doesn't necessarily mean credit unions are in for a gloomy 2019. The current trends in the automotive finance market present a prime opportunity for credit unions.

Recommended For You

Based on Experian's data, automotive lending is up significantly overall with an increase of total loan balances growing from $1.108 trillion in Q1 2019 to a record high of $1.181 trillion in Q1 2019. More and more consumers are relying on financing to purchase a vehicle, including those in higher credit tiers. This is one of the contributing factors to the fact that the percentage of subprime and deep subprime total loan share remains low – below 23% in the first quarter.

While credit unions have experienced tremendous amounts of growth in the auto financing space within the past eight years, what does that decrease mean for credit unions moving forward?

The fall in market share is surprising considering the favorable lending conditions credit unions have experienced these past few years, however credit unions are still poised for growth. Credit unions still saw their total open automotive balances reach $351.4 billion, which shows significant growth in just two years – from $286.8 billion in Q1 2017. Although banks held the largest share of the auto lending market at $367.5 billion, their numbers have been fluctuating year-over-year and saw a decrease from $368.7 billion in Q1 2018.

Prime Borrowers Lean Into the Used Vehicle Market

As vehicle affordability continues to be a topic of conversation in the auto industry, trends suggest that consumers continue to favor used vehicles over new. The percentage of prime (61.88%) and super-prime (44.78%) consumers choosing used vehicles reached an all-time high. The used vehicle sector has typically been an area where credit unions have thrived. As more prime consumers shift to the used vehicle market, credit unions have an opportunity to cater to a wider consumer base.

When considering the rising costs for both new and used vehicles, the prime shift to used vehicles isn't surprising. The average loan amount for new vehicles saw a $733 change in balance since Q1 2018, reaching $32,187 in Q1 2019, while used vehicle loan amounts were up $601 year over year, surpassing $20,000. The increases weren't isolated to loan amounts, though, as average payments continued to rise for new and used vehicle loan amounts, reaching $554 and $391 in the first quarter of 2019.

Source: Experian

Source: Experian When it comes to the financing options consumers are using to purchase vehicles, credit unions saw a slight drop in market share of used financing from 28% in Q1 2018 to 26% in Q1 2019, but they still hold the second largest share over all other lender types. Banks and finance companies were the only lenders that saw their shares increase to 36.3% and 17.4%, respectively.

Prime and super prime consumers made up 57.3% of total loans, while total subprime loans stayed below 23%. The average credit scores for new vehicle loans remained steady at 719, while used vehicle loans rose to 657.

Slight Uptick in Delinquencies as Average Payments Rise

The auto industry continues to keenly watch delinquency rates. While there was an increase in 30-day delinquencies to 1.98% in Q1 2019, up from 1.9% a year ago, it is important to keep in mind that this is still better than the record high numbers the industry reached in Q1 2009, when total 30-day delinquencies peaked at 2.81%.

Despite the overall uptick, a closer look at the Q1 2019 numbers shows that credit unions had the lowest delinquency rates among the different lending types at 1.15%. Banks and finance companies saw their delinquencies decrease as well. Thirty-day delinquencies for credit unions fell from 1.17% in Q1 2018 to 1.15% in Q1 2019. Sixty-day delinquencies remained relatively stable at 0.68% year-over-year.

Source: Experian

Source: Experian Despite the slight decrease in market share for credit unions in Q1 2019, there are still numerous factors that make the current auto finance market a prime one for credit unions, including an increase in prime consumers financing vehicle purchases and consumers shifting into the used vehicle space. Understanding these trends can help credit unions ramp up their strategies and make the right lending decisions to return to an increased market share in the future.

Melinda Zabritski

Melinda Zabritski Melinda Zabritski is Senior Director, Automotive Finance Solutions for Experian. She can be reached at 714-830-7734 or [email protected].

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.