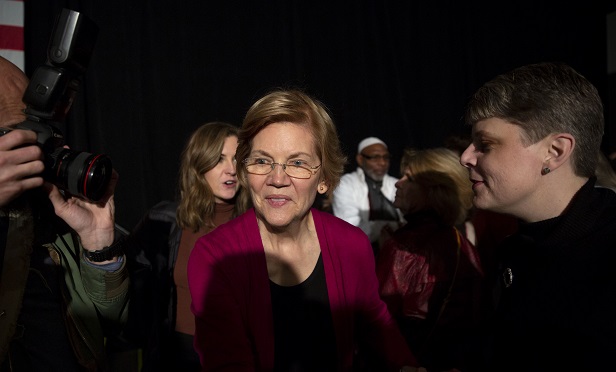

Sen. Elizabeth Warren, D-Mass., spoke at a presidential campaign organizing event. (Photo: Daniel Acker/Bloomberg)

Sen. Elizabeth Warren, D-Mass., spoke at a presidential campaign organizing event. (Photo: Daniel Acker/Bloomberg)

It takes the typical first-time American homebuyer a dozen years to both pay off student loans and save enough to make a 20% down payment on a median-priced home, Redfin, a real estate brokerage, reported Friday.

Enter Sen. Elizabeth Warren's plan to cancel up to $50,000 of student loan debt. Redfin analyzed the Democratic presidential aspirant's plan, and found that under it a typical first-time homebuyer could knock three years off the time needed to save for a full down payment.

Recommended For You

In Redfin's analysis, a typical potential first-time homebuyer was someone earning the national average salary of $65,879 for the Census Bureau's 24–44 age bracket, with an average student loan of $17,938, based on data from LendingTree.

If the hypothetical aspiring homebuyer spent 10% of income ($549 per month) on debt repayment at the average 5.8% interest rate, it would take three years to pay off the student debt.

If after doing so, he or she started saving that 10% of income toward a full 20% down payment on the national median-priced home ($308,000), it would take a total of 12.3 years to pay off student loans and accumulate enough money for the full down payment ($61,600), assuming home price and income had not changed.

Under Warren's debt cancellation plan, the time it would take to save for a down payment would shrink to 9.4 years, the analysis concluded.

"The idea of taking on a mortgage when you're still paying off tens of thousands of dollars in student loans is a nonstarter for many people," Redfin chief economist Daryl Fairweather said in a statement.

"If student debt were eliminated, college grads would be able to start building wealth through homeownership, laying down roots and contributing to their communities years earlier in their lives. An influx of young, educated homeowners could have positive impacts on neighborhoods and society at large."

Redfin's analysis included a look at the effect of Warren's student debt forgiveness plan in major metropolitan areas. The median 24- to 44-year-old homebuyer in Detroit, where the typical home costs $130,000, could save for a down payment in just 4.2 years — the shortest time in the nation — down from 7.4 years currently.

At the other end of the spectrum, that homebuyer's counterpart in San Francisco would need 23.3 years to save $120,587 for a full down payment on a house that typically costs $1.4 million, down from 24.9 years currently.

Metro areas with the highest ratios of student debt to income could see the biggest decrease in the time it takes to save for a full down payment. In particular, student-debt laden homebuyers in the South stand to benefit most — for example, Memphis by 4.3 years, Birmingham by four years and New Orleans by 3.9 years.

Yet Redfin says that the plan "could actually make overall affordability worse as demand for homes would increase with a surge of new buyers," it said, concluding that "the key to solving the housing affordability crisis is to dramatically increase the supply of homes by building more homes in the places where people want to live."

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.