Source: Experian

Source: Experian

The automotive lending market appeared to generate a perfectly positive storm for credit unions as 2018 came to a close. Consider the following:

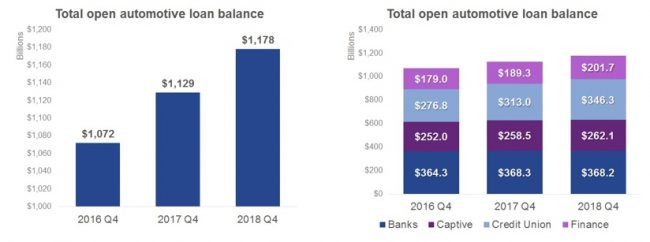

- Automotive lending is up overall – total loan balances grew to a record-high $1.178 trillion in Q4 2018, up from $1.129 trillion in Q4 2017.

- Subprime lending remains below 20% – subprime and deep subprime loan market share fell from 19.87% in Q4 2017 to 19.69% in Q4 2018.

- Average credit scores for both new vehicle loans (715) and used vehicle loans were up (659).

These trends – a hot market, a shift to prime lending and high-credit customers – all play into credit union strengths. After all, credit unions tend to focus on prime lending for their typical customer.

So, how did it all play out?

Recommended For You

Credit unions grew their total loan dollar volumes by 10.7 percent from Q4 2017 to Q4 2018. In fact, credit unions continue to close the gap on banks for overall dollar volume leadership. In Q4 2016, credit unions trailed banks by $87.5 billion in total dollar volume. By Q4 2018, that deficit had been cut to just $21.9 billion.

In that time, credit unions increased their open automotive loan balances to $346.3 billion, up from $276.8 billion in Q4 2016. Banks, while still owning the highest share of the automotive lending market, have seen relatively flat growth in the past two years, going from $364.3 billion in Q4 2016 to $368.2 billion in Q4 2018. In fact, banks actually saw total dollar volumes drop year-over-year from $368.3 billion in Q4 2017.

Captives and finance companies both gained in terms of loan volumes. Captives jumped from $258.5 billion in Q4 2017 to $262.1 billion in Q4 2018, while finance companies moved from $189.3 billion in Q4 2017 to $201.7 billion in Q4 2018.

High Credit Standards Lead to Lower Credit Union Delinquency Rates

Delinquencies continue to be an important bellwether of automotive loan industry health. The year-over-year change in delinquencies was relatively stable, with 30-day delinquencies dropping slightly, while 60-day delinquencies showed a slight uptick.

The overall 30-day delinquency rate was 2.32% in Q4 2018, down from 2.36% in Q4 2017. Credit unions saw their 30-day delinquencies fall from 1.34% in Q4 2017 to 1.28% in Q4 2018.

While the market overall ticked up slightly for 60-day delinquencies from 0.76% to 0.78 percent year over year, credit unions saw improvement, dropping from 0.34% in Q4 2017 to 0.33% in Q4 2018.

Source: Experian

Source: Experian Lending Shifts Toward Prime Consumers

The final trend working in favor of credit unions is the shift toward customers with better credit. Many prime borrowers have shifted into used financing, which is where credit unions tend to be the most active.

Credit unions cater to borrowers with better credit, and loans in the low risk tiers are growing. In Q4 2017, 61.17% of loan balances were in the prime or super prime risk tiers. In Q4 2018, prime and super prime risk tier share grew to 61.81%. This shift has average credit scores for leases and new- and used-vehicle loans rising as well. New vehicle leases are up two points to 724 and average new vehicle loans were also up two points to 715.

Source: Experian

Source: Experian Credit scores for used leases also jumped from 656 in Q4 2017 to Q4 2018.

Credit unions can leverage these data points to help them make the right lending decisions in the year ahead. If these trends hold true, credit unions should see clear skies ahead in 2019, even if overall auto sales show a slight dip. While the industry as a whole tries to keep delinquencies in check, prime borrowers will continue to be in demand. This is highly likely to play to credit union strengths.

Melinda Zabritski is Senior Director of Automotive Solutions for Experian. She can be reached at 714-830-7734 or [email protected].

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.