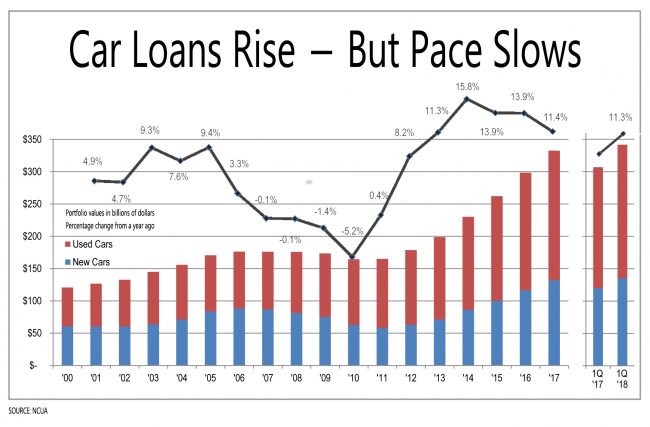

An illustration of CU auto loan volume over the last 18 years.

An illustration of CU auto loan volume over the last 18 years.

Lending for cars and recreational vehicles helped fuel the rapid growth of Mountain America Credit Union, but Jade Beckman is preparing the Salt Lake City credit union for an inevitable slowdown.

Automobile and recreational loan originations from January through April were $404 million, up 6.3% from the first four months of 2017 at Mountain America ($7.5 billion in assets, 746,526 members). Beckman, vice president for consumer loans, said originations for the full year of 2017 rose about 20%.

“That was phenomenal production. That was the highest number we had ever had,” Beckman said. “We're growing over last year, but at a slower rate than we have been.”

New car sales actually declined 1.8% nationally in 2017 – the first drop in seven years. This year, the National Automobile Dealers Association predicts sales will drop 3% to 16.7 million new vehicles.

Used car sales rose 1.8% to 39.3 million vehicles in 2017, and are likely to edge up less than 1% to 39.5 million this year, according to Cox Automotive in Atlanta.

Beckman said Mountain America is starting to see the plateau of automotive lending. He noted a large number of vehicles will be coming off leases in the next year or so, putting downward pressure on used car prices.

For consumers shopping for a used car, the lease flood will be a bonanza. For lenders, it will mean fewer new car loans and greater risk to collateral values.

Rising interest rates mean spreads are slightly better now, and the higher cost for consumers will put more brake pressure on buying, Beckman said. “As rates go up, people tend to borrow less and tend to buy less.”

Callahan & Associates, a credit union consulting company based in Washington, has been crunching first-quarter numbers and sees automotive lending momentum fading across the credit union movement, mirroring the national trend.

For all credit unions, Callahan estimated that new car loan balances rose 12.2% in the 12 months ending March 31, compared with 16.6% growth a year earlier. Used car balances rose 10.1% through March 31, compared with 12.1% the previous 12 months.

“We are seeing some slight deceleration in both new and used growth rates,” Sam Taft, Callahan's associate vice president of analytics, said. “We're still growing at a double-digit rate in both, which is good in any market, but you are seeing that come down from previous years.”

Auto lending is also one of the most dispersed activities among credit unions. In some loan categories the top 10 account for a far greater proportion than their percentage of assets. But the top 10 car lenders account for 15% of credit union assets and 14% of car loans.

NCUA data shows they had slower new car loan growth than other credit unions, but better used car loan growth. The top 10 had $19.9 billion in new car loans on the books March 31, up 9.9%, and $26.2 billion in used car loans, up 12.1%.

Among the 10, the fastest automotive growth occurred at Suncoast Credit Union in Tampa, Fla. ($9.1 billion in assets, 763,709 members). Its total car loan portfolio rose 29.3% to $3 billion in the 12 months ending March 31.

Suncoast is also seeing volume exceeding last year's numbers, but not to the extent it saw in 2017. It expects the slower pace of growth will continue throughout the year.

“There is always an ebb and flow in the auto loan market,” Suncoast Chief Lending Officer Vicki Lovett said. “The economy, gas prices, employment levels and increasing desired technology in vehicles all have an influence.”

Cars took up 45.1% of Suncoast's portfolio in March, up 445 basis points from a year earlier. Lovett said Suncoast is watching its large concentration of auto loans and uses analytics to manage its portfolio. “We anticipate auto loans will remain steady to a slightly lower percentage as we work to increase our mortgage and commercial loan percentages,” she said.

Some of Mountain America's growth is from expansions into neighboring states, and some is from gaining a higher market share in Utah, where it is the second largest credit union behind America First Federal Credit Union of Riverdale ($10 billion in assets, 949,099 members).

Loans for automobiles and recreational vehicles accounted for 46% of Mountain America's loans as of March 31, about the same as a year ago. About 30% of total loans were for cars and light trucks, and 16% were for recreational vehicles.

This year Beckman expects the number will be about the same, with a slightly lower proportion of RV loans. The RV market is not as strong as last year, other parts of Mountain America's portfolio are accelerating and Mountain America has hit its concentration limit on RVs, he said.

“We've pulled back a little bit on that,” he said.

Indirect lending accounts for 60% of car originations and 80% of RV originations at Mountain America.

Indirect lenders said their biggest challenge is keeping members after their loans are paid off. Beckman said Mountain America's best tool has been credit cards.

“We don't have any magic bullet,” he said. “It's just a lot of work and a lot of outreach to get deeper relationships with them.”

Indirect lending had fueled much of the growth in credit union car loans, and participants cite the overwhelming power of convenience. When consumers see the car they want, they want to leave the dealership behind the wheel. They are shopping for metal, not paper.

However, another dynamic is the consumer who has been turned down in the past at a bank or dealership because of poor credit history. The fear of humiliation is enough to drive them to make poor economic decisions, like accepting a predatory car loan.

Some credit unions have abstained from indirect lending, including State Employees' Credit Union of Raleigh, N.C. ($38.4 billion in assets, 2.3 million members).

SECU found a way to maintain its members' bargaining leverage while providing convenience by introducing its “Auto Power” program in 2014.

“Since we do not participate in indirect lending, we lose potential loans from our members who finance at the dealership since it is so convenient, no extra effort on their part,” Mark Coburn, SECU's SVP for lending development, said. “Our challenge has been how to ensure that we do not lose this business.”

The credit union gives members a pre-approved check up to their qualified amount that's good for 60 days. Armed with the check, the member can shop dealers for the vehicle they want at the price they can afford – and still not have to go back to the credit union to complete loan paperwork.

The check comes with a list of instructions for the dealer. The dealership provides SECU with a bill of sale, and SECU mails the paperwork to the member, disclosing the final terms based on the actual cost of the vehicle they purchased.

SECU produces about 800 to 1,000 loans each month through Auto Power, or about 10% of its total vehicle loan volume. The program is especially helpful to members buying new cars. Overall, new cars represent about 12% of SECU vehicle loan originations, but about 20% of its Auto Power loans.

“They do get the benefit of showing up at the dealership with the buying power in hand,” Coburn said.

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.