Congress could be closer to changing a financial services company risk management program that it developed in the wake of the Great Recession.

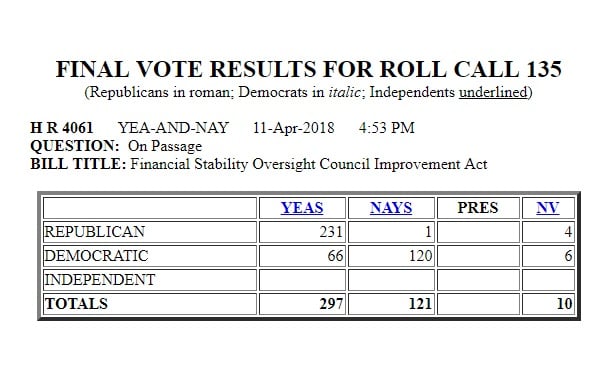

Members of the U.S. House on Wednesday voted 297-121 to pass H.R. 4061, the Financial Stability Oversight Council Improvement Act bill.

All but one of the 232 Republicans who voted supported the bill.

The bill also received an unusually high level of support from House Democrats: 66 of the 186 Democrats who participated voted for the bill.

Getting the support of one-third of the Democrats in the Senate would give supporters a good shot at getting the bill through the Senate under “regular order” rules. Republicans hold 51 seats in the Senate. Under regular order rules In the Senate, an ordinary bill needs 60 votes to reach the Senate floor.

The bill was introduced by Rep. Dennis Ross, R-Fla.

A Child of the Great Recession

If passed as written and implemented as drafters expect, H.R. 4061 would require FSOC to use a more open process when deciding whether life insurers and other non-bank organizations are “systemically important financial institutions,” or SIFIs.

Congress put the SIFI program in the Dodd-Frank Act of 2010, in an effort to give federal financial services regulators a tool for stepping in when it looks as if the meltdown of a company other than a bank might shake the U.S. financial system.

Executives at American International Group Inc., brought a festering financial crisis out in the open in September 2008, when they warned federal regulators that they faced an enormous, escalating need for cash to serve as collateral for the company's credit defaults swaps operation.

The credit default swaps unit provided a kind of financial insurance against the risk that mortgage-backed securities would go bad. AIG ran into trouble when mortgage-backed securities that once looked like good risks started to go bad.

Many people involved with life insurance have argued that AIG's credit default swaps business had nothing to do with ordinary life insurance operations, that ordinary life insurance operations pose little or no threat to the stability of the U.S. financial system, and that the SIFI designation process has created costly, nerve-wracking headaches for life insurers.

MetLife Inc., for example, went to court to free itself from SIFI status and won. In April 2016, a federal judge ruled that the process FSOC used to designate MetLife as a SIFI was arbitrary and capricious.

Supporters of the current SIFI designation system say that federal regulators need a vehicle they can use to address big problems at companies other than banks and securities brokers, and that the program has to be flexible and opaque enough to keep the companies' managers from evading necessary federal oversight.

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.