This past week, six credit unions welcomed new professionals to their staff or board, while another credit union said goodbye to a longtime CEO. Plus, a lending CUSO hired a new executive.

WEST

The $580 million Clark County Credit Union in Las Vegas promoted Dennae Peoples to executive assistant. In her new role, Peoples will provide a wide range of administrative, project and office support for the CEO and senior management team. Peoples has been a player in the financial services industry for the past 10 years and has been with the CCCU team since 2013.

The $185 million Altier Credit Union in Tempe, Ariz., named David Skilton president/CEO, a move that will take effect Oct. 1, 2016. With more than 20 years of senior executive experience in the credit union industry, Skilton joined Altier as SVP/CFO in 2008. He has been responsible for a long list of accomplishments, including a net worth recovery strategy that helped Altier successfully navigate the hardships of the great recession.

The $185 million Altier Credit Union in Tempe, Ariz., named David Skilton president/CEO, a move that will take effect Oct. 1, 2016. With more than 20 years of senior executive experience in the credit union industry, Skilton joined Altier as SVP/CFO in 2008. He has been responsible for a long list of accomplishments, including a net worth recovery strategy that helped Altier successfully navigate the hardships of the great recession.

The $4.3 billion Ent Credit Union in Colorado Springs, Colo., promoted Jeremy Hudson to mortgage loan officer. Hudson will be the second mortgage loan officer dedicated to serving members in the Pueblo area from Ent's Pueblo Main location at 300 West 5th Street. During his eight-year career with Ent, Hudson has held a number of member service positions of increasing responsibility. He most recently served as Ent's south service center coordinator.

The $4.3 billion Ent Credit Union in Colorado Springs, Colo., promoted Jeremy Hudson to mortgage loan officer. Hudson will be the second mortgage loan officer dedicated to serving members in the Pueblo area from Ent's Pueblo Main location at 300 West 5th Street. During his eight-year career with Ent, Hudson has held a number of member service positions of increasing responsibility. He most recently served as Ent's south service center coordinator.

The $7.5 billion San Diego County Credit Union in San Diego is deeply saddened to announce that Rod Calvao, who served as president/CEO from 1992 to 2007, passed away peacefully at the age of 69. Calvao first joined the credit union's supervisory committee in January 1973 and was then elected to the board of directors in December 1974. Over the years, Rod served in various roles on the board of directors. During Rod's 15-year tenure as president/CEO of SDCCU, the organization continued to succeed and grow from 11 branches and $499 million in assets to 24 branches and $4 billion in assets.

The $7.5 billion San Diego County Credit Union in San Diego is deeply saddened to announce that Rod Calvao, who served as president/CEO from 1992 to 2007, passed away peacefully at the age of 69. Calvao first joined the credit union's supervisory committee in January 1973 and was then elected to the board of directors in December 1974. Over the years, Rod served in various roles on the board of directors. During Rod's 15-year tenure as president/CEO of SDCCU, the organization continued to succeed and grow from 11 branches and $499 million in assets to 24 branches and $4 billion in assets.

SOUTH

The $435 million BrightStar Credit Union in Sunrise, Fla., appointed Greg Cassamajor as marketing manager. Cassamajor will be responsible for overseeing the strategic planning of community outreach and marketing campaigns. A leader in the banking and finance industry for more than 15 years, Cassamajor has assisted in increasing revenue and sales at various high-profile financial institutions including Bank of America, Commerce Bank, HSBC Bank and TD Bank.

The $435 million BrightStar Credit Union in Sunrise, Fla., appointed Greg Cassamajor as marketing manager. Cassamajor will be responsible for overseeing the strategic planning of community outreach and marketing campaigns. A leader in the banking and finance industry for more than 15 years, Cassamajor has assisted in increasing revenue and sales at various high-profile financial institutions including Bank of America, Commerce Bank, HSBC Bank and TD Bank.

MIDWEST

From Aug. 1-23, 2016, employees from the $1 billion Firefly Credit Union in Burnsville, Minn., participated in a school supply drive in partnership with 360 Communities. The credit union has been donating to local schools for more than 10 years. Crayons were one of the most needed items for this upcoming school year and Firefly guaranteed a 100% crayon match. Employees surpassed their goal and donated 32,364 crayons and with the crayon match implemented, the total came to 64,728 crayons donated.

EAST

John Murga, CEO of the $133 million Hidden River Credit Union in Pottsville, Penn., has been appointed to the board of directors of the Pennsylvania Credit Union Association. Murga will fulfill a three-year term that started in May 2016 and represent credit unions in the asset category of $50 million to $250 million. The board vacancy is a result of a merger between credit unions with executives who both held seats on the association board. Since 1998, Murga has served as the CEO of the Pottsville-based credit union.

John Murga, CEO of the $133 million Hidden River Credit Union in Pottsville, Penn., has been appointed to the board of directors of the Pennsylvania Credit Union Association. Murga will fulfill a three-year term that started in May 2016 and represent credit unions in the asset category of $50 million to $250 million. The board vacancy is a result of a merger between credit unions with executives who both held seats on the association board. Since 1998, Murga has served as the CEO of the Pottsville-based credit union.

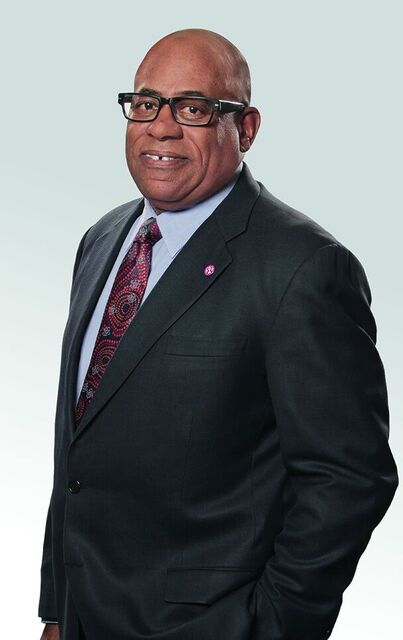

The $2.5 billion Municipal Credit Union in New York City announced James Durrah has assumed the position of chair of the board of directors. Durrah, who has served on MCU's board of directors since 2010 and most recently served as first vice chair, replaces former Board Chair Honorable Sylvia G. Ash. In addition to Durrah assuming the position of Board Chair, C. Richard Wagner was elevated to the position of first vice chair and Loretta Y. Jones was elevated to the position of second vice chair. These changes in positions follow the rules outlined in MCU's bylaws regarding board vacancies. MCU is also moving forward in filling the vacant board seat, per its bylaws.

The $2.5 billion Municipal Credit Union in New York City announced James Durrah has assumed the position of chair of the board of directors. Durrah, who has served on MCU's board of directors since 2010 and most recently served as first vice chair, replaces former Board Chair Honorable Sylvia G. Ash. In addition to Durrah assuming the position of Board Chair, C. Richard Wagner was elevated to the position of first vice chair and Loretta Y. Jones was elevated to the position of second vice chair. These changes in positions follow the rules outlined in MCU's bylaws regarding board vacancies. MCU is also moving forward in filling the vacant board seat, per its bylaws.

CUSOs

CU Recovery and The Loan Service Center promoted Chris Becker to the newly created position of COO. In his new role, Becker will direct the organization in meeting growth, financial and operational goals. He will work with the leadership team to develop operational strategy and policies to ensure the expectations of their clients are met while keeping service as the number one priority.

CU Recovery and The Loan Service Center promoted Chris Becker to the newly created position of COO. In his new role, Becker will direct the organization in meeting growth, financial and operational goals. He will work with the leadership team to develop operational strategy and policies to ensure the expectations of their clients are met while keeping service as the number one priority.

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.