While most players in Washington will focus their attention on the fall elections, the regulatory machine is expected to continue to churn out rules affecting credit unions and other financial institutions in a largely unabated fashion this season.

The CFPB and the NCUA are expected to issue proposed and final rules that will make a big impact on credit unions across the country.

The CFPB has had a busy summer, while the NCUA has been a bit quieter, NAFCU Director of Regulatory Affairs Alexander Monterrubio said.

Still, the NCUA is likely to issue final field of membership rules sometime in October, he said. The proposed rules were issued in November 2015, with comments due in February.

Bankers are already rumbling about suing over those rules. Recently, the Independent Community Bankers of America filed suit to challenge the NCUA's member business lending rules and indicated they are simply waiting for the FOM rules to be issued before filing suit again.

The MBL suit is pending in federal court and any ruling in that lawsuit could also greatly impact credit union lending.

Outside of formal rulemaking, the NCUA is also conducting a formal review of the call report and exam flexibility process. Those proposed changes may be coming soon.

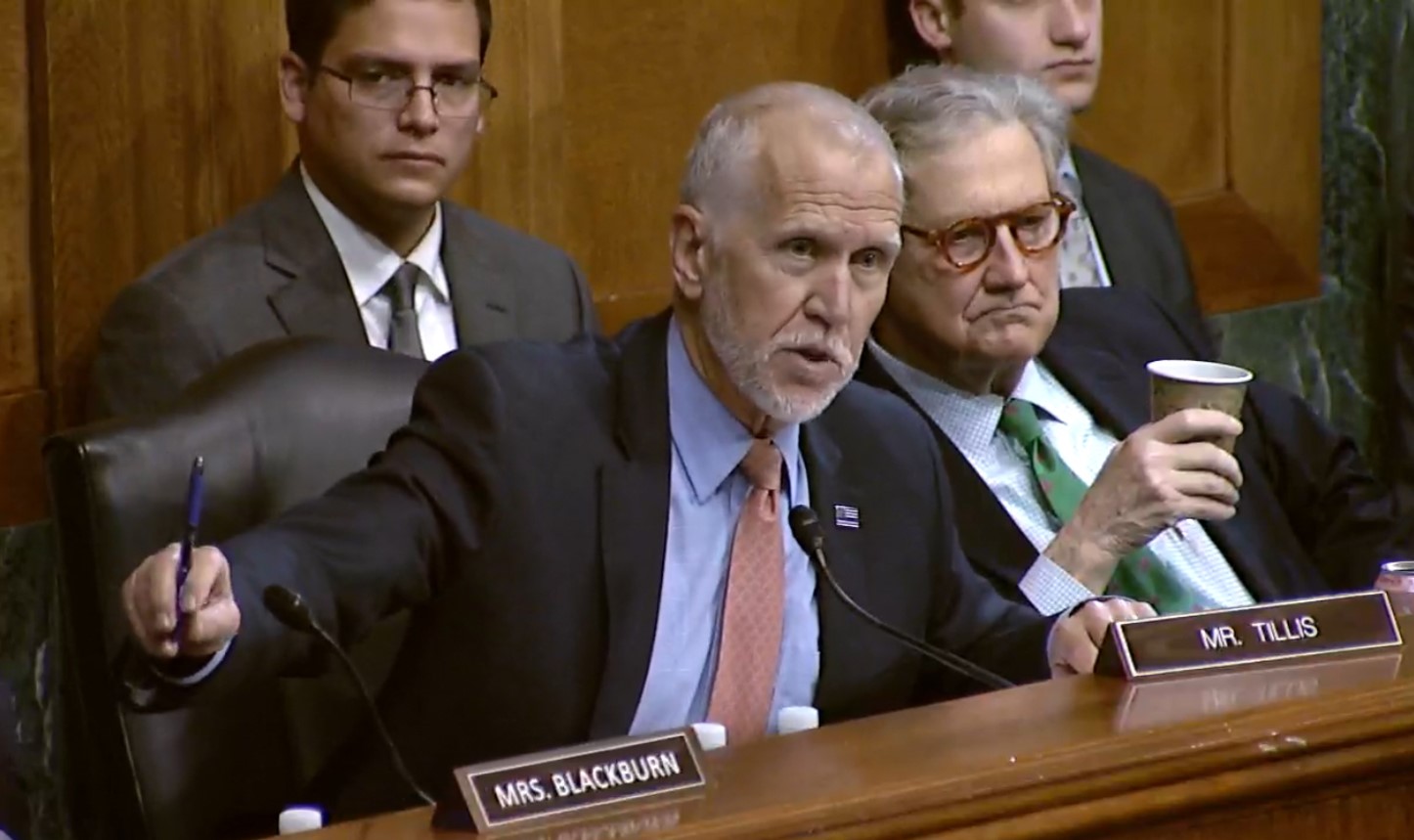

Monterrubio also said NCUA board changes could have a significant impact on the agency's rulemaking. Board Member J. Mark McWatters has been nominated to a seat on the Export Import Bank and John Herrrera has been nominated to a seat on the NCUA board. However, neither nomination has moved in the Senate and both nominations expire at the end of the year.

Then, there's the CFPB.

“They have had so much on their plate,” Monterrubio said. “It has definitely been a busy summer for the CFPB.”

The CFPB is expected to issue proposed rules governing overdrafts, although those rules may not be issued until next year, according to Leah Dempsey, CUNA's senior director for advocacy and counsel.

Final payday lending rules – which have garnered a lot of attention – probably won't be issued by the end of the year, CUNA's officers said. The proposed rules were posted in July, and so far, almost 100,000 comments, which were partially driven by a campaign initiated by payday lending companies, have been sent to the CFPB. Comments on those rules are due Oct. 7 and credit union trade groups are expected to file detailed comments on the proposal before that deadline.

Final payday lending rules – which have garnered a lot of attention – probably won't be issued by the end of the year, CUNA's officers said. The proposed rules were posted in July, and so far, almost 100,000 comments, which were partially driven by a campaign initiated by payday lending companies, have been sent to the CFPB. Comments on those rules are due Oct. 7 and credit union trade groups are expected to file detailed comments on the proposal before that deadline.

Those rules will have a major impact on credit unions and credit union officials have been attempting to help the agency understand that, CUNA Chief Advocacy Officer Ryan Donovan said.

“We've worked pretty hard to help them understand,” he said.

The CFPB has also issued proposed rules governing third-party debt collectors. Those rules are expected to have a limited impact on credit unions. However, Monterrubio said the agency is expected to issue proposed rules governing first-party debt collectors this fall. Those rules are expected to have a much greater impact on credit unions.

The CFPB is also expected to issue proposed rules governing overdrafts, but when exactly those rules will be issued remains unclear.

“I don't think we'll see overdrafts this year,” Dempsey said.

The CFPB rulemaking process requires an assessment of the impact of proposed regulations on small businesses. That review includes the convening of small business review panels.

But because of limited staff in the agency's advocacy office, the CFPB only manages one small business review at a time, Donovan said.

Donovan also said the CFPB is unlikely to issue final rules governing mandatory arbitration agreements in financial contracts by the end of the year. Those rules may be issued sometime in 2017.

Meanwhile, federal agencies are handling the fallout from rules that already have been issued.

For instance, on the mortgage front, the CFPB will continue to give guidance and answer questions about the Know Before You Owe mortgage disclosure rules it has already issued, said Josh Friend, CEO of InSellerate, an automated sales company in Costa Mesa, Calif., that focuses on mortgages.

“People had a lot of open questions about how to do things,” he said.

Even last year, questions were being raised about the implementation of those rules. For instance, CUNA questioned the need for credit unions that made five or fewer mortgages in a calendar year to comply with the rules.

Friend also said federal regulators are likely to maintain their focus on mortgage marketing and ensure consumers are not misled by marketing materials. Friend said in the past, a credit union that had 50 or 100 loan officers allowed those officers to market loans the way they wanted.

“They've been running their own businesses for years,” he added.

Those days have ended, since the CFPB and regulators are closely examining marketing materials.

In addition to facing rules from those two agencies, credit unions are adjusting to new IRS rules that are tightening the use of the agency's tax verification system, said Curtis Knuth, SVP at NCS, a company that obtains tax transcripts of mortgage applicants for financial institutions.

He said in June, the IRS began requiring a huge slew of information from credit union employees who might have access to a mortgage applicant's tax information. For instance, the IRS is requiring credit unions to give employees access to such information and provide the agency with the last four digits of applicants' Social Security numbers.

Knuth said the rules appeared to be geared more toward tax practitioners than credit unions. Nonetheless, the IRS has made it clear that it may expand those requirements.

“We're expecting more,” Knuth said.

Complete your profile to continue reading and get FREE access to CUTimes.com, part of your ALM digital membership.

Your access to unlimited CUTimes.com content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Breaking credit union news and analysis, on-site and via our newsletters and custom alerts

- Weekly Shared Accounts podcast featuring exclusive interviews with industry leaders

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical coverage of the commercial real estate and financial advisory markets on our other ALM sites, GlobeSt.com and ThinkAdvisor.com

Already have an account? Sign In Now

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.