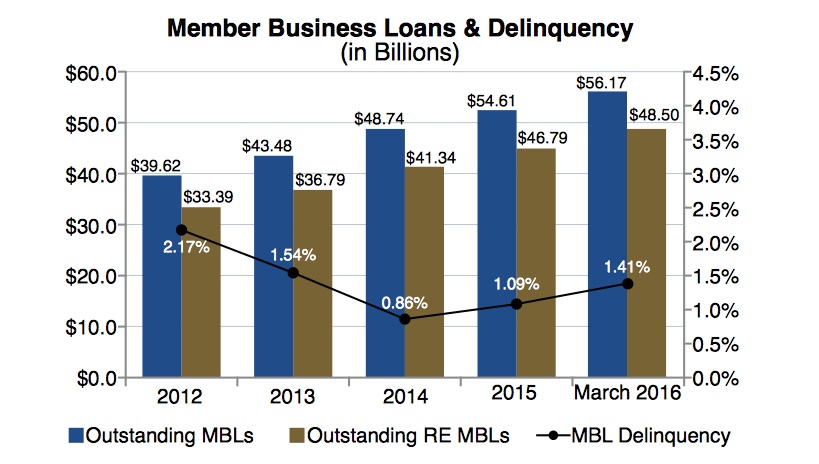

However, loan delinquencies and charge-off rates also rose, with member business loan delinquencies increasing even more. (Click on the graphs to expand.)

That led NCUA Chairman Rick Metsger to issue a warning.

Recommended For You

"Credit unions making such loans should take note and ensure that they perform proper due diligence to mitigate the risk," he said.

The NCUA released the statistics on Friday; they are based on call reports for the quarter ending March 31.

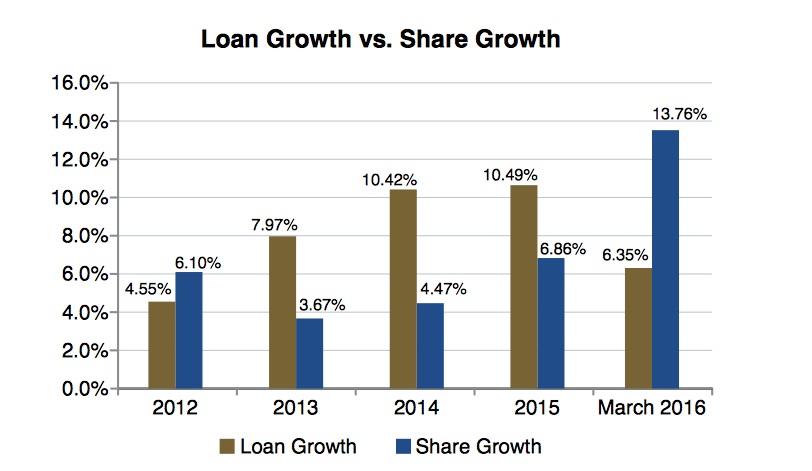

Total loans reached $799.5 billion at the end of the first quarter, an increase of 10.7% from a year ago.

Total loans reached $799.5 billion at the end of the first quarter, an increase of 10.7% from a year ago.

New auto loans led the way, with a 15.4% increase while used auto loans increased 13.2%. Net member business loans grew 13%; first mortgage loans outstanding climbed 10.4%. Payday alternative loans rose 8.1%. Those controversial loans reached $106.1 million at an annual rate.

"The credit union system again experienced solid performance during the first quarter of 2016," Metsger said. "Overall, new and used auto lending was especially strong, and the system gained one million members. With an influx of deposits, federally insured shares at credit unions also neared the $1 trillion mark coming in at $991.7 billion."

The delinquency rate at federally insured credit unions was up 2 basis points—reaching 71 basis points in the first quarter of the year. Member business loan delinquencies reached 141 basis points by the end of March.

Total investments, which are defined as investments of more than three months, numbered $272.4 billion, down 2.8% from the past year. Investments with maturities of more than 10 years were unchanged, but were down 14.9% from the first quarter of 2015, the NCUA said.

"As credit union lending has increased, long-term investments have declined and reduced the system's interest rate risk," Metsger said.

The number of federally insured credit unions fell to 5,954 at the end of the quarter, 252 less than a year ago. The decline was centered on the number of credit unions with assets of fewer than $10 million. As in the past, credit unions with more than $500 million led the system in loans, membership and net worth.

The number of federally insured credit unions fell to 5,954 at the end of the quarter, 252 less than a year ago. The decline was centered on the number of credit unions with assets of fewer than $10 million. As in the past, credit unions with more than $500 million led the system in loans, membership and net worth.

Total assets rose to more than $1.2 trillion at the end of March; that was an increase of 7.1%. Deposits increased as well, to nearly $1.1 trillion – a 6.8% increase.

Membership grew to 103.7 million during the first quarter, a 3.8% increase from the first quarter of 2015.

Reacting to the report, Alix Patterson, partner at Callahan & Associates in Washington, said, "Consumers continue to show their trust in not-for-profit cooperatives when it comes to their daily financial lives. That shows in how the credit union industry continued setting new records in the first quarter of 2016, driven by loan, share and member growth despite economic uncertainties."

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.