As the banking industry hurtles headlong into the digital age, the differences between banks and credit unions will take on a new twist. Will mission driven non-profits have the same appeal they've had in the past? Is it possible to be both mission-driven and offer the latest in financial technology? Will consumers increasingly want convenience above anything else?

As the banking industry hurtles headlong into the digital age, the differences between banks and credit unions will take on a new twist. Will mission driven non-profits have the same appeal they've had in the past? Is it possible to be both mission-driven and offer the latest in financial technology? Will consumers increasingly want convenience above anything else?

To find answers to these questions, we at MX surveyed more than 1,000 random U.S. consumers over the age of 24. What we found has implications for the way credit unions market to members and prospective members.

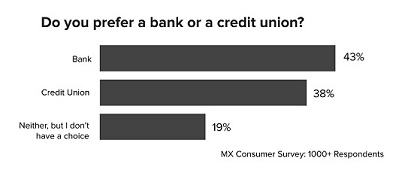

First, we found that while 43% of consumers said they prefer a bank and 38% said they prefer a credit union, a full 19% say that they don't like either option. This doesn't bode well for traditional institutions, given that alternative choices such as Lending Club continue to grow.

It's clearly time for traditional players to aggressively advocate for consumers so they can maintain their preferential lead against alternative lenders for decades to come.

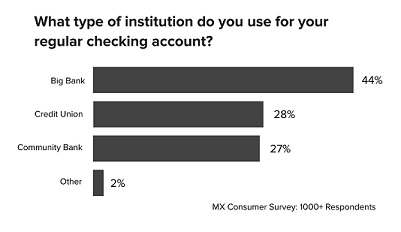

To get a feel for the current state of the industry, we also asked consumers which type of institution they actually use for their regular checking. We found that 71% said they use a bank (44% big bank and 27% community bank) while 28% use a credit union.

To get a feel for the current state of the industry, we also asked consumers which type of institution they actually use for their regular checking. We found that 71% said they use a bank (44% big bank and 27% community bank) while 28% use a credit union.

The disparity between this question and the last one is worth noting: Thirty-eight percent of consumers say they prefer a credit union, but only 28% actually use them for their checking. This is a gap that credit union marketers can help close by articulating more clearly how their checking accounts offer consumers the most benefits.

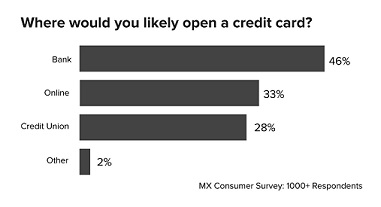

Consumers are also more likely to open a credit card with a bank, or use options that are primarily online such as Amazon or Capital One.

Consumers are also more likely to open a credit card with a bank, or use options that are primarily online such as Amazon or Capital One.

However, consumers are more likely to open an auto loan with a credit union than anywhere else. This signifies an area where credit unions can double down — making this value proposition even more pronounced.

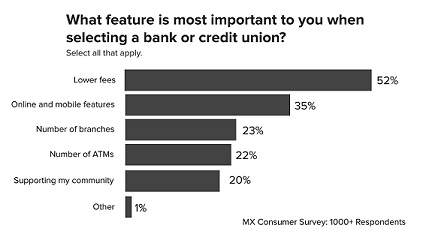

Our most important finding, though, has to do with the features that consumers say they're looking for when selecting a bank or credit union. More than anything else, consumers are looking for lower fees and better digital (online and mobile) features.

We also asked for open-ended responses and grouped them by topics. In this section we found that 39% of consumers said they look for better rates and fewer fees, 21% said convenience, and only 3% said member owned.

We also asked for open-ended responses and grouped them by topics. In this section we found that 39% of consumers said they look for better rates and fewer fees, 21% said convenience, and only 3% said member owned.

Only 3%.

Taken together, this data indicates that credit unions have an opportunity to market themselves on two major fronts. The first is to stake a claim in being the go-to solution for getting the cheapest rates and lowest fees, especially for auto loans. The second is to make strides to offer cutting-edge technology.

That's it.

If a credit union spends time trying to win on the fact that they're member owned, they're fighting a losing battle. Consumers don't care. Instead, consumers want better rates and better technology whether those benefits come from being member owned or not.

If a credit union spends time trying to win on the fact that they're member owned, they're fighting a losing battle. Consumers don't care. Instead, consumers want better rates and better technology whether those benefits come from being member owned or not.

Fortunately for credit unions, they can win on both of these fronts. They can be known for offering better rates (because they generally do), and they can either develop cutting edge technology or partner with the right fintech company.

By focusing exclusively on these two fronts, credit unions are in a good spot to lead the future of banking.

Jon Ogden is director of content at MX. He can be reached at 801-669-5500 or [email protected].

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.