Projections generated by Fannie Mae reported the good news in its latest edition of Housing Insights.

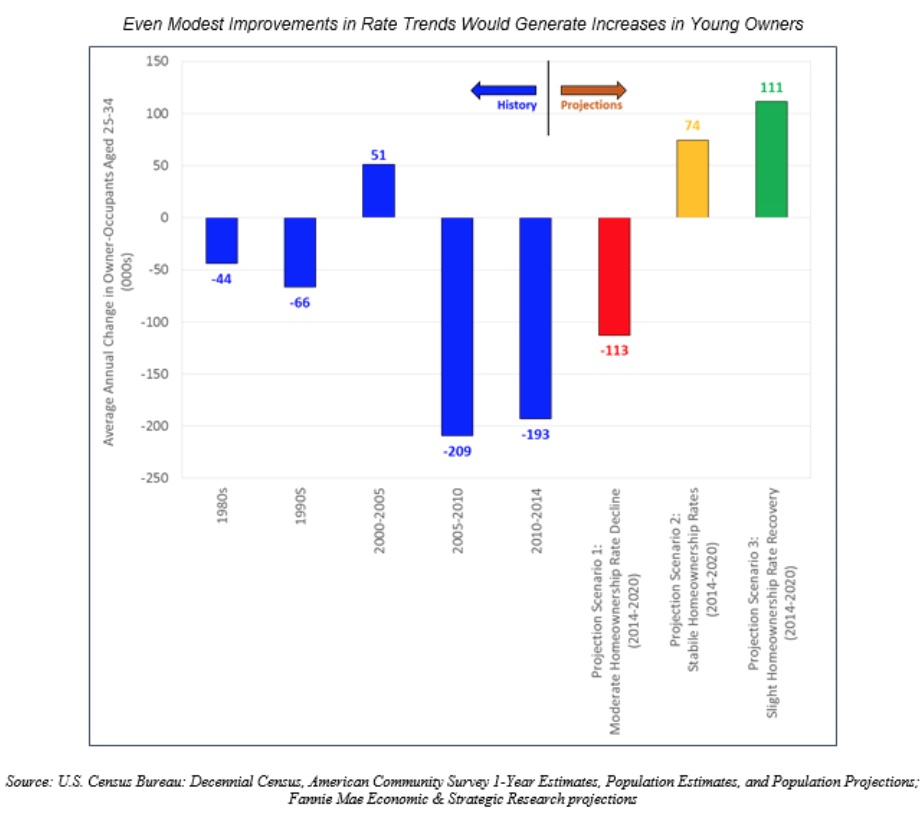

After the number of owner-occupants between the ages of 25 and 34 plummeted by more than 300,000 annually during the Great Recession, young adult homeownership rates have stabilized, Patrick Simmons, director of Fannie Mae's Strategic PlanningEconomic & Strategic Research Group said. Numbers were essentially flat in 2014.

Recommended For You

"Given that the young-adult population is expected to expand robustly during the second half of the decade, it would take only modest further improvements in homeownership rate trends for the number of young homeowners to return to growth," Simmons wrote in his commentary.

Using Census Bureau population projections, Fannie Mae's researchers produced three scenarios for future growth in the number of young homeowners. If homeownership rates continue to decrease at the current pace, the number of young homeowners would also decrease, but at a substantially slower pace than during the housing bust, Simmons wrote.

If rates merely stabilize, projected strong population growth would increase homeownership for the group at a slightly faster pace than during the housing boom.

And, if rates recover just slightly, the rate of young homewoners would increase twice as much as it did during the boom.

Simmons wrote that it is difficult to predict which scenario will play out, but as young adults obtain jobs and earn income, modest improvement in homeownership rates is certainly plausible.

"Recent efforts to expand mortgage credit for first-time home buyers also could help nudge the young-adult homeownership rate in a positive direction," he wrote.

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.