Voting for the champion of CUTimes25 Final Four, which honors the most influential leader in credit unions since 1990, closes Friday. Readers have one final chance to determine who will win: Former NCUA Chairman Dennis Dollar or Fiserv executive Mark Sievewright.

The two men defeated former WesCorp CEO Dick Johnson and National Credit Union Foundation executive Lois Kitsch, who rounded out our Final Four. Read about these distinguished credit union leaders in the profiles below. Full length features will be published in the Dec. 16 print issue of Credit Union Times.

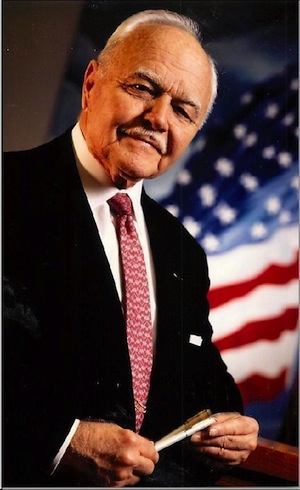

Dollar's Influence Felt Decades Later

Dollar's Influence Felt Decades Later

He's in the running to be named the most influential leader in the credit union industry since 1990 for CU Times' 25th anniversary. However, former NCUA Chairman Dennis Dollar humbly said he was honored just to be on the list that started with 64 and is now down to the final two.

While he may be out of the regulatory limelight, his influence during the last few decades is still felt by credit unions today. President George W. Bush named Dollar chairman of the NCUA board in 2001. Previously, President Bill Clinton had appointed him to the three-member board in 1997.

Recognized as an architect of some of the most innovative regulatory actions in the board's recent history, Dollar implemented Access Across America, RegFlex, incidental power and field of membership modernization. Also during his tenure on the NCUA board, Dollar also served as vice chairman of the Federal Financial Institutions Examination Council.

Dollar's foray into public service began when he was elected as one of the youngest legislators – at the time he was 22 – to the Mississippi House of Representatives. He served a two-term stint in public service before gaining credit union experience firsthand.

From 1991 to 1997, he was the president/CEO of then Gulfport Veterans Administration Federal Credit Union, a $32 million institution with more than 12,000 members and 150 employer groups along the Mississippi Gulf Coast.

That experience gave him the firsthand knowledge of the inner workings of a credit union, experience his fellow NCUA board members at the time lacked. It was that experience that Trent Lott, then Senate Majority Leader and fellow Mississippian, sought out for a seat on the NCUA board. With Clinton in the White House, Dollar was confirmed by the Senate as the sole Republican on the board.

Dollar relocated to a suburb of Birmingham, Ala., after leaving the NCUA in 2004. He continues to influence credit unions through his consulting business, Dollar Associates, co-founded with his former NCUA chief of staff and counsel to the chairman Kirk Cuevas. The two consult with credit unions, trade associations, leagues and others on a host of issues, including government relations, regulatory compliance, strategic planning, management training and field of membership issues.

Sievewright Keeps Credit Unions Tech Savvy

Sievewright Keeps Credit Unions Tech Savvy

Mark Sievewright, president of Credit Union Solutions at the Brookfield, Wis.-based Fiserv and championship finalist in the CUTimes25 Final Four, has spent almost 20 years making a difference in the industry.

“Over the years I've just tried to make certain that credit unions were aware of what was coming, helping them anticipate technological changes, which have been so prevalent over the last 10 years,” he said.

With 30 years of financial services industry experience, the Welsh-born Sievewright held senior leadership roles at HSBC in London and MasterCard International in Brussels before moving to the United States in 1997.

That was when his symbiotic relationship with credit unions began.

“Credit unions had not been part of my life up until then,” Sievewright recalled.

He moved to New England in 2000 to run Tower Group, where he helped propel engagement with credit unions.

“That is where I really began espousing the importance of credit unions remaining relevant,” Sievewright said.

He spoke at more than 250 credit union events between 2000 and 2004 when he joined Fiserv. He continued to advocate for credit unions and in 2011 became president at Credit Union Solutions at Fiserv, which pulled siloed businesses together under one umbrella.

The unit now drives technology for more than 2,300 of America's credit unions and recently won a deal to do the same in the UK.

He said one of the most meaningful things that happened to him was being merited the 2010 Ambassador Award by WOCCU for his many years of service to credit unions.

“What I've tried to do consistently is to advance the very unique differences credit unions have and try to advance that in advising and guiding them around technology strategies and solutions,” Sievewright said.

Financial Capability, Not Literacy, Is the Answer: Kitsch

Financial Capability, Not Literacy, Is the Answer: Kitsch

Growing up in North Dakota on a farm, Lois Kitsch never thought about a career or even leaving the state, let alone the country.

“I didn't have those dreams of being an astronaut or anything like that,” she said. “I didn't have that vision or realize what I could be until I fell into the credit union movement.”

While her introduction to credit unions began as a job, once she understood the cooperative model and philosophy she was hooked. As national program director at the National Credit Union Foundation, Kitsch has motivated and challenged others to rethink how to serve marginal markets through facilitation, mentoring and consensus building.

Helping people by providing access to education and financial services as a path to economic empowerment has been the driving force behind her 35 years in the credit union industry. Much of that time has been spent working internationally in support of credit unions in over 40 countries and Kitsch's positive impact in countries such as Macedonia, war-torn Afghanistan and the Philippines is still felt today.

She said credit unions need to be clear about the desired outcome of their financial literacy efforts, beyond just getting people to attend.

“Stop talking about financially literacy as the big answer. Access to information is not how we change the way people live,” she said. “Student debt is a new big problem. What are we doing to improve the financial capability of our members? Are we teaching our employees how to talk to members about money, recognize the signs of struggle and have the right language to provide guidance at the early stages?”

The act of being financially literate, while important, won't accomplish much unless coupled with efforts that build financial capability and offer real guidance to change behaviors, she said. For example, the first step many financial counselors take with those who earn low wages is to give them a budget. Having grown up in a low wage working class family she said most manage their money well, there just isn't a lot of it.

“It's when faced with an emergency, the struggle is not just about money but time. Sometimes credit unions are quick to judge members' rash decisions to go to alternate financial providers like payday lenders,” she said. “But while others may have time to analyze the emergency situation, for these members it's about choosing the best option at the time.”

Given that a one-time convenient option is better than having no option, the challenge becomes what can the industry as a whole do to deliver equally convenient options and build awareness.

She said it begins with building meaningful member relationships, beyond just saying a cursory good morning. The credit union has to be a safe place where members can go to get good advice without fear of ridicule and judgment.

“Lead with empathy and compassion, then you can get into the logistics of teaching skills,” she said.

Johnson's Leadership Inspires Generation of Credit Union Executives

Johnson's Leadership Inspires Generation of Credit Union Executives

Not only was Richard Myles “Dick” Johnson instrumental in building the corporate credit union system, he taught many current credit union leaders the true meaning of leadership, according to Wright-Patt Credit Union CFO Matt Davidson.

“The ability to listen, learn and communicate professionally, all with an appropriate sense of modesty, kindness and humor, are some of his gifts,” Davidson wrote in a July 7 CU Times letter to the editor. “Although I didn't even work at WesCorp, I learned how to lead by simply watching and listening to him.”

The California credit union leader mentored many credit union executives in the West and was an instructor at CUNA Western Management School. In fact, he was such an influence in 1999 the California Credit Union League gave its foundation his name. One of the RMJ Foundation's primary objectives is to develop future credit union leaders.

Johnson retired from his long-time position as president/CEO of Western Corporate FCU in 2002 after 26 years at the wholesale credit union. According to a 2001 CU Times profile, Johnson credited former NAFCU President Ken Robinson for getting him into the industry.

“We were both on active duty in San Diego. My tour was up and they were sending me back to Washington for the fourth time. Ken came and said there was a credit union job open at the Marine Corps Recruits Depot (CU).”

Johnson managed Marine Corps Recruits Depot FCU in San Diego for a little more than four years before joining WesCorp as CEO. He also filled in as interim CEO at the California Credit Union League in 1989 and 1990, between former CEOs Bill Broxterman and David Chatfield.

He joined WesCorp when its assets were just $70 million, and had three employees. At the time of his retirement, it had $17 billion in assets, 400 employees, served credit unions in 31 states and had $1 billion in capital.

WesCorp, caught up in the corporate credit union meltdown, was placed into NCUA conservatorship in 2009. The corporate credit union was officially dissolved in 2012. course of 20 years, that trend reversed and all the income previously earned by banks was retained by the credit unions.”

Johnson said he has learned as much from his decades of credit union service as he did during his military career. Several of those lessons cross the boundary between his two stints of service.

Training employees to pay attention to members and their wants and needs is what sets credit unions apart, he explained, adding that in that same way, credit unions must understand the humanity within their staffs and respond accordingly, both to improve their service to the credit union and the credit union's service to them.

“As the years roll by, everything will change except people's quest for acceptance,” Johnson added. “When the inevitable day comes – as it will for us all – the only thing that will have counted are the people.”

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.