Around 16 million new U.S. households – many of them diverse – are expected to emerge over the next decade, bringing credit unions and banks big mortgage lending opportunities, industry experts said.

Around 16 million new U.S. households – many of them diverse – are expected to emerge over the next decade, bringing credit unions and banks big mortgage lending opportunities, industry experts said.

“We need to remember the low rates of household growth we have seen in the last five years have not been usual,” Mortgage Bankers Association Vice President of Research and Economics Lynn Fisher said in an interview about the expected growth wave.

The Great Recession slowed new household growth and expanded existing households' sizes because fewer jobs prevented young people from moving out of family homes, Fisher explained. It also forced families to move in together due to foreclosure or to save money, she added.

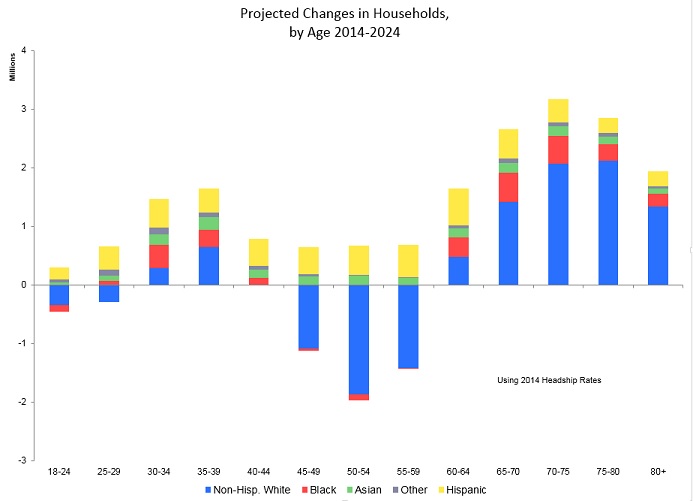

However, as jobs continue to grow and existing households undergo life changes, Fisher forecasted as many as 16 million additional households by 2024 in all age categories. However, she said the growth won't be similar to historic household growth periods.

The Washington-based MBA used U.S. Census Bureau data to make several predictions.

First, baby boomers will lead a new housing wave.

“Housing demand for age-appropriate housing will increase among [boomers] as compared to the amount of 70-year-old appropriate housing available in 2014,” she said.

Second, millennials will add 5.1 million new households with members aged 18 to 44 by 2024, Fisher forecasted.

Immigrants and minorities will also drive household growth. By 2024, Fisher said, there will be 5.7 million more Hispanic households, 2.4 million more African-American households and 1.9 million more Asian households compared to 2014.

“Averaging 1.6 million additional households per year, housing market growth over the next decade would be among the strongest the U.S. has ever seen,” Fisher wrote in “Housing Demand,” a demographic white paper she published in August 2015 with Jamie Woodwell, the MBA's vice president of commercial/multifamily research.

Fisher observed more households won't necessarily translate to more homeowners, but said dynamics within each age group make homeownership growth likely.

For example, homeownership becomes more likely with age, Fisher said. The well-documented trend of millennials delaying starting families favors their entry into the purchase market sometime in the next decade, she noted.

Robert Dorsa, president of the American Credit Union Mortgage Association, said he agreed with the MBA's numbers, particularly those on minority and immigrant household growth. He also said credit unions must continue to build trust and create mortgage loan awareness among members to help fulfill the increasing demand for mortgage loans.

“I believe maintaining a high degree of trust with the members and creating and offering loan programs that appeal to all levels of consumers and household foundations are key,” Dorsa said.

“Credit unions are community lenders for the most part. If a few in the community are aware that credit unions not only exist to provide a free checking account but are trustworthy institutions capable of providing quality mortgage loans, we have a chance of not only holding on to our almost 10% market share but seeing growth. Promoting the credit union story at the local level is at the heart of any successful growth path in my opinion.”

Dorsa also emphasized strengthening consumer awareness of credit unions as cooperatives.

“As you know I have literally grown up in the credit union system,” Dorsa said. “After 40 years observing the 'unknown and mysterious' feeling consumers get when the term credit union is mentioned, I believe it is on us to remove this dark cloud. I still strongly believe using or adding the term 'cooperative' in the credit union's name or branding may be the spark that creates high growth. On the other hand, conducting business as we do now could be the recipe for little or no growth. If that is the case, even I do not see much optimism for our brand of banking.”

Ron Shevlin, director of research for the Scottsdale, Ariz.-based financial institution consulting firm Cornerstone Advisors, said while he has not seen the MBA's analysis, it resonated with forecasts he saw that pointed to household growth of eight million in the next five years.

He also said the new households will reside in purchased homes rather than in rented apartments or houses. But, he conceded that for every data point that supports strong future homeownership for millennials, there could be two data points that support a counter argument.

“The real problem is with our ability to research any of this in a very meaningful way,” Shevlin commented. “It's just very difficult to ask a 25-year-old what they are going to want in five or 10 years. Right now, when you're 25, single and work close to where you live or in an urban area with good public transportation, it's easy to say I don't need to buy a car or house. But in a few years, after they start a family and priorities shift, they discover they really do need a car and a house.”

Like Dorsa, Shevlin urged credit unions to keep building trust with members, adding they should incorporate mortgage education and specialize in helping first-time buyers.

He also reported 30% of millennial credit union members who considered taking out a mortgage loan received education about the process, compared to only 15% of non-credit union member millennials.

“Becoming known as place with reliable, trusted information about mortgage options and getting a mortgage could be a real differentiator for credit unions in a crowded market,” Shevlin said.

Credit unions looking to take advantage of household growth might also find a new Fannie Mae program helpful.

Dubbed the HomeReady Mortgage, the new program combines prospective homeowner education with significantly changed underwriting criteria to benefit both lenders and borrowers, according to Fannie Mae.

Lender advantages include tying the program into Fannie Mae's software, allowing the software to automatically identify potentially eligible loans, the Washington-based government-sponsored enterprise said in a Sept. 29 announcement. HomeReady loans also carry improved and simplified pricing, and are easier to sell to the secondary market, Fannie Mae said.

Borrower advantages include the potential for 3% down payments. Underwriters are also allowed to include income from members of non-borrower households when calculating debt to income ratios. The loans will also allow for non-occupant borrowers and permit underwriters to include rental income from an accessory dwelling such as a basement apartment and boarders, Fannie Mae said.

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.