Mobile cameras are vital for businesses looking to engage millennials, and banking is the top industry in which that age group wants more mobile-capture functionality (40%), according to findings from new survey.

Mobile cameras are vital for businesses looking to engage millennials, and banking is the top industry in which that age group wants more mobile-capture functionality (40%), according to findings from new survey.

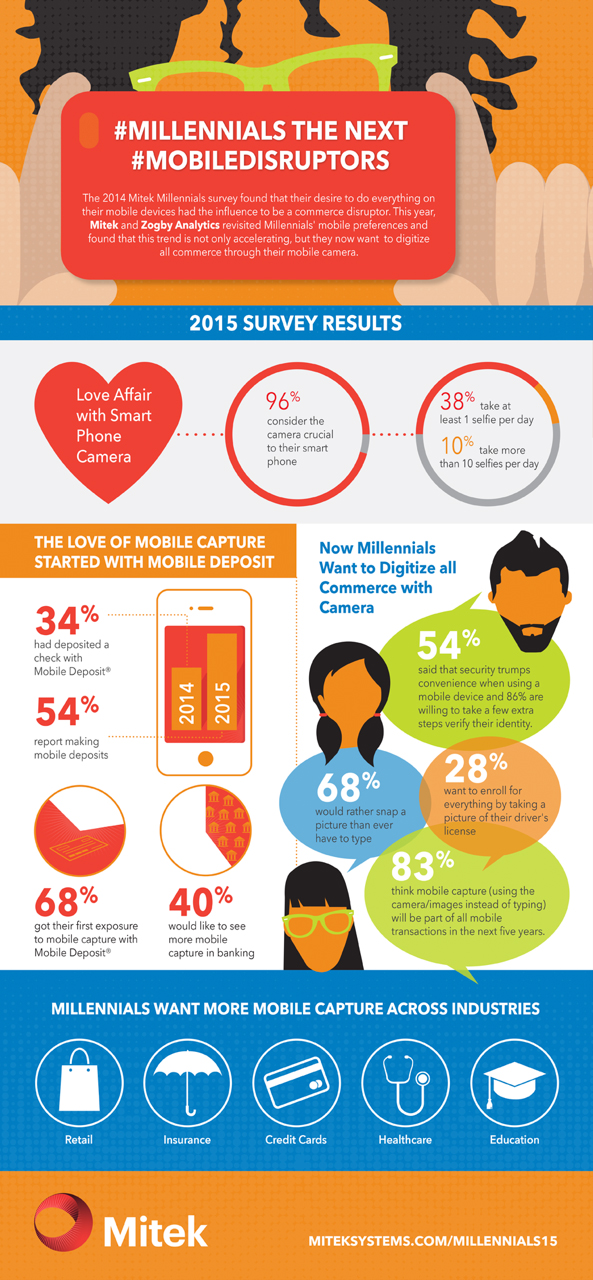

The study, “Millennial – The Next Mobile Disruptors,” from San Diego-based mobile payment provider Mitek and Utica, N.Y.-based Zogby Analytics, examined the mobile preferences of more than 1,000 consumers ages 18 to 34. It revealed millennials want to digitize all commerce through their mobile camera.

Almost all respondents (96%) said their mobile camera function is either very or somewhat important to them.

The survey suggested that as the largest age demographic in the United States today, and representing 90% of smartphone owners, millennials' mobile spending has huge economic impact and potential.

“We found that millennials love the convenience of taking a picture for data capture and they want to be doing more of it,” James B. DeBello, president & CEO, Mitek said. “Businesses need to take notice and add mobile capture to their apps, because just being mobile isn't enough anymore.”

Other key findings from the survey include:

- Mobile banking was the gateway that introduced millennials to mobile capture. Interestingly, 68% received their first exposure with mobile check deposit. The more money millennials make, the more they want mobile capture.

- Millennials want to digitize all commerce through their mobile cameras. In fact, 68% said that they would rather always use mobile capture instead of manually typing information on their smartphone, and 28% want to enroll for everything from a new credit card to a gym membership by snapping a picture of their driver's license.

- Mobile means money for businesses racing to capture millennials. Eighty-six percent of respondents made purchases and conduct transactions from their mobile phones, with 11% doing so daily; 42% made a decision on where to spend their money, or switched companies, based on what the organization allowed users to accomplish with a mobile device.

- Fifty-four percent said that security trumps convenience. Top obstacles stopping millennials from using their smartphones were concerns about data security (53%) and concerns about identity fraud (52%).

“What started with the selfie has evolved to commerce: From banking, to shopping and to peer-topeer lending,” the research noted.

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.