Charles Spilman knows that baby boomer generation members constitute almost half the share certificate and mortgage business at United Federal Credit Union in St. Joseph, Mich. But Spilman, director of product planning and card services at the $1.8 billion institution, has no intention of creating a separate portfolio of products and services for his boomer members.

“We've been designing and offering products for boomers for decades, but we don't specifically target boomers with programs,” Spilman said. “Our approach has been to meet the needs of each individual member by having a broad range of products.”

As the aging demographic enters retirement, baby boomers still carry a significant amount of financial clout. Boomers as a group earn an estimated $2.4 trillion annually that accounts for 42% of all after-tax income, according to the U.S. Bureau of Labor Statistics' Consumer Expenditure Survey. Experts say that boomers are and will remain a financially significant – and a significantly large – age cohort for the next 30 years.

Despite the fact that the generation born between 1946 and 1964 is financially active, credit unions caught up in the media buzz over courting Gen X, millennial and even centennial generation members may not be fully tapping the financial resources they already have in hand. Because of that, the performance of services for some of credit unions' most loyal and economically viable members may be suffering.

Many credit unions are addressing boomer needs, but some of the most effective programs avoid AARP-like menus of specially designed services in favor of taking a tightly targeted, yet fully integrated approach to serving the age cohort, according to Bill Cheney, president/CEO of the $11.4 billion SchoolsFirst Federal Credit Union in Santa Ana, Calif.

“Understanding each member's needs and situation and providing them expert financial guidance is our best strategy for serving them,” Cheney said.

Statistics show that, in some cases, boomers need all the financial advice and service they can get.

As a generation, baby boomers are at a turning point in their financial and social lives as they face and, at an increasing level, embrace retirement. But unlike their parents' generation, which was steeped in the deprivation and sacrifice of the Great Depression and World War II, boomers have spent more and saved less in preparation for their golden years.

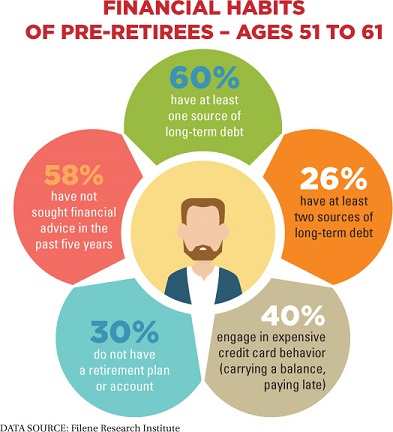

According to a 2014 Filene Research Institute study, “Financial Capability Near Retirement: A Profile of Pre-Retirees,” boomers as a generation are characterized by risky spending behaviors, high debt loads and financial illiteracy, activities that in many cases put boomer members at risk for financial instability that may delay their retirement years. The implication for credit unions, the report said, is a need for more pre-retirement financial counseling and planning to help boomers better cope with financial demands in the years to come.

But those same conditions have also produced a generation that's more robust and creative in navigating its retirement path. Many boomers are delaying retirement, or abandoning the idea completely based either on financial or personal needs. Generally well-educated and healthier than previous generations, boomers are anticipating longer lives than their parents did and adjusting their financial activities to accommodate those extra years.

From a financial activity standpoint, this means continued savings and borrowing activity with an eye toward both wealth accumulation and lifestyle enhancement, experts have said. Plainly put, boomers will keep on spending and, with an aggregate overall wealth estimated to be in the trillions of dollars, credit unions can better serve those members by providing integrated financial products that actively address boomers' financial needs and personal objectives.

But at least some of those products should also take into account retirement and end-of-life needs, according to Eric Hansing, vice president of life, AD&D and media for CUNA Mutual's TruStage product line.

“According to research, 62% of boomers say they worry about their financial stability every day, but are proud of the fact that they can still make ends meet,” Hansing said. “But in terms of preparedness for retirement, I'd give them a C+.”

Personal goals and objectives matter greatly for boomers, according to “What Matters Now: Insights from the Middle,” a TruStage research study that explored middle class segments of multiple demographic groups. Survey results showed that boomers shared many values with other demographic groups.

Raising children to become good adults and having a good spousal relationship ranked highest among the two million consumers TruStage surveyed. Having enough money to be financially stable and staying in good health tied for third place, while a strong relationship with a higher power rounded out the top five goals.

Each of the five goals comes with its own challenges, but financial security is one in which boomers can take specific steps toward success, Hansing said.

“Saving for retirement is a big deal, and the shocks that can come from loss of job or healthcare expenses can be huge disruptors,” Hansing explained. “Insurance products that provide financial support in the face of health issues and death are the center of the bullseye.”

For many boomers, that means a return to traditional, whole life insurance policies that provide a significant death benefit, Hansing said. Boomers also like to buy whole life policies as gifts for grandchildren so they have some level of insurance protection as they mature.

For many boomers, that means a return to traditional, whole life insurance policies that provide a significant death benefit, Hansing said. Boomers also like to buy whole life policies as gifts for grandchildren so they have some level of insurance protection as they mature.

In addition, CUNA Mutual offers health insurance and a variety of other coverage through TruStage, but the Madison, Wis.-based insurer has stopped offering long term care coverage, CUNA Mutual spokesman Phil Tschudy said. Lack of demand may have led to the deletion of this business line, he added.

TruStage currently serves the insurance needs of more than 4,000 credit unions and their members, bringing additional advantages to these individual institutions, Hansing said.

“The three areas on which boomers get stuck when it comes to life insurance are assumptions about affordability, understanding policy intricacies and concerns that insurance is hard to get,” Hansing explained. “Credit unions that get behind TruStage programs see more of their members protected, while letting us do all the promotion and work.”

At United FCU, insurance certainly plays a role, along with a more holistic approach that addresses individual needs of boomer members, Spilman said. It's necessary, he added, because the demographic itself is fragmented.

“The boomer cohort is so large that there are multiple segments within it with very different financial needs, and boomers continue to change the rules of the game as they have almost from their start,” Spilman said. “It used to be true that as a generation aged, it became less likely to need a mortgage. Boomers have broken that trend, partly because they are working longer and are more mobile, but also because they desire to trade up and/or purchase second homes.”

Boomers make up just 31% of United FCU's membership, yet they hold 49% of share certificates and mortgages, Spilman noted. They also hold 39% of total loan balances and 51% of total deposits, making them a viable and highly active member segment.

“We take a needs-based approach to sales at UFCU, so we don't target any products specifically to boomers,” Spilman said.

The numbers are similar, and so is the strategy at $178 million Chaco Credit Union in Hamilton, Ohio. Boomers comprise 31% of the community credit union's membership base and hold 40% of the credit union's total assets, according to Chaco CU President/CEO Jim Schultheiss.

“Boomers are very financially active,” Schultheiss said. “They use an average of 2.44 services per household, have an average of $10,000 in loans, not counting mortgages, and have a long connection to the credit union.”

Like other credit unions, Chaco CU does not isolate a list of services specifically tailored toward boomers. Instead, Schultheiss said, member service representatives are trained to isolate and address individual financial needs specific to individual members' situations, providing service at as many levels as possible.

“We believe in serving each member as an individual, thus feel all of our marketing of individual products is specific,” Schultheiss explained. “Our focus on providing sound information, as opposed to strong bank sales tactics, has been very successful in the baby boomer demographic and as a whole.”

SchoolsFirst FCU's Cheney would agree with Chaco's approach. Although the credit union doesn't measure individual member profitability, Cheney knows that boomers comprise 26% of the educational credit union's 651,000 members, and as such are a financial force to be reckoned with.

“Baby boomers are experiencing a wide range of life events, from meeting the needs of teenage children, to sending their children to college, planning for retirement, or enjoying retirement,” Cheney said. “Our role is not to put them in broad segments, but instead to understand them individually and ensure our products and services meet their unique needs, with the goal of bettering their financial lives.”

Bucking trends has been the hallmark of baby boomer culture from the beginning, and serving nontraditional personalities with a nontraditional approach to financial products is critical for continued success, Cheney said.

“We serve our baby boomer members today and will continue to understand their needs now and in the future,” he added.

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.