Executives from the Omaha, Neb.-based digital payment solutions provider Prairie Cloudware said they believe credit unions should take ownership of the digital wallet process. It would allow them to reestablish their trusted payment services role while decreasing fraud costs and improving ROI.

"The process of authenticating the cards or payments that get put into the Apple wallet is different in the sense that financial institutions may not be absent from the process, but they are certainly playing a back-seat role," Doug Parr, chief revenue officer for Prairie Cloudware, whose product integrates with digital banking services, explained. "For all the credit unions that have signed up for Apple Pay, we ask: Why not offer your own branded wallet?"

Recommended For You

Payment processes vary greatly for traditional POS, Apple Pay and NFC-enabled transactions. In a traditional POS transaction, a consumer uses a check or plastic payment card issued by a financial institution, and the authentication takes place at the point of issuance. Then, the process is completed through the legacy payment track via check or card rails.

With Apple Pay, the purchaser creates a credit or debit card-like transaction, which follows the same path as any other card-present transaction. The only difference is that the consumer uses a token rather than the actual card.

When a purchaser taps and pays using an NFC device, the device detects the purchaser's Apple Pay wallet. The payment card issuer then receives an acknowledgement, and the Apple Pay wallet owner provides verification via a fingerprint reader. Next, Apple Pay transmits a token instead of a personal account number (PAN), to the merchant's POS terminal. That token passes through to the merchant processor and then onto the card network. Then, the Visa, MasterCard or American Express card network de-tokenizes the transaction and sends it on to the payment card issuer or processor for authentication. The issuer or processor will then either approve or decline the transaction.

This process reverses the engines, moving the transaction back through the card rails to the merchant while reassembling the token. As a final step, Apple sends out a payment summary and completion message without exposing the purchaser's PAN.

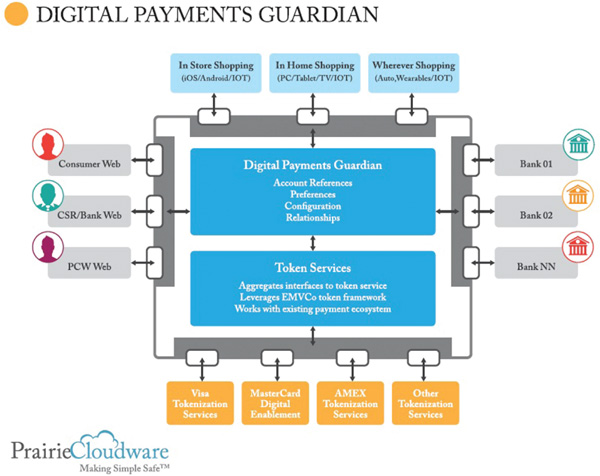

Through its Digital Payments Guardian product, Prairie Cloudware gives financial institutions the ability to provide an Apple Pay-like experience for Android, the company said. Currently, Apple Pay denies access to alternative solutions because it is a closed system.

"We built Digital Payments Guardian to accommodate iOS, so that if and when Apple opens up Apple Pay, which we believe it will, we will be ready to facilitate the financial institutions that use our products to work with it," Mike Carter, chief marketing officer for Prairie Cloudware, said. "In that environment, we would serve as a token switch in most cases. We would route the token from one of the card associations. Our goal is to facilitate that token being put in place by the card association."

Parr assures that his company is not competing with Visa, American Express or MasterCard, but is providing a token switching service on the digital wallet side.

Tokenization is one of three key strategies the payment industry is deploying to reduce fraud, along with EMV, which will assist during POS, as well as end-to-end encryption.

"(Tokenization) is a way to get that card number out of the card ecosystem and replace the PAN with a pseudo number," Parr said.

Parr pointed out, however, that while Apple is far more focused on the user experience, the processes they have in place to authenticate a card at the point of provisioning is creating a hole in the process, which everybody is scrambling to try and fill. The current process allows fraudsters to take a stolen credit card number from a data breach and set it up in an Apple Pay wallet.

Recently, an Apple Pay sign-up flaw led to unusually high rates of fraud originating from thieves using stolen credit card numbers. In these instances, fraudsters loaded iPhones with stolen, card-not-present card information and essentially turned that data into physical cards via Apple Pay.

Cherian Abraham, a Richmond, Va.-based payments and fraud consultant, put the Apple Pay fraud rate at 6%, much higher than the traditional credit card fraud rate of 0.001%. Abraham wrote in a blog post that fraud through Apple Pay "is growing like a weed, and the bank is unable to tell friend from foe. No one is bold enough to call the emperor naked."

As Apple Pay and EMV secure face-to-face and card-present transactions, card-not-present (CNP) payments – Internet, mail or telephone orders, which are sometimes referred to as IMOTO – become a weak link in the defenses against transaction fraud.

Parr explained that credit unions are suited to secure CNP payments because they understand how to authenticate members when issuing payment cards in the first place. He also said he expects financial institutions and Apple to begin working together to add additional authentication to the current provisioning process.

Another difference between Digital Payments Guardian and Apple Pay lies in its integration to the credit union infrastructure – the company has access to customer information files, Parr said. This allows Digital Payments Guardian to send information to the member at the point of purchase via the digital wallet. This information might include a balance, a summary of recent transactions, or an alert, if for example the purchase triggers an overdraft or another fee. The credit union can also offer promotions and coupons via the digital wallet.

Another issue simmering in the payments pot is interchange fees. When Apple Pay launched in October of 2014, it announced that the Apple Pay "wallet" would collect a small levy, 15 basis points (0.15% or 15 cents on a $100 transaction), from the issuer each time their card is used to make a purchase from a merchant.

Investment firm Piper Jaffray's estimate forecasts that this Apple fee will bring in $118 million in revenue in 2015 and increase to $310 million in 2016. Financial holding company Nomura's equity analysts estimated it to be higher, stating it could account for $1.6 billion in revenue by 2017.

"We believe that philosophically, the financial institution needs to play a bigger role in either issuing or controlling digital wallets themselves," Parr added. "If not, they need to make sure they get to the table sooner than companies such as Apple or Samsung on the authentication aspect at the provisioning stage."

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.