All businesses survive or thrive based on the capabilities of their personnel, and that includes credit unions.

Staff members are not only the credit union's most expensive resource, but also its most volatile, and numerous laws and regulations exist to make sure staff members are treated fairly and equitably in the workplace.

However, human resources issues are growing in complexity, putting added pressure on both HR personnel and executive staff to follow the letter of employment law without compromising the safety, soundness and security of the credit union, according to attorney Robert E. Gregg, an employment law specialist with the Madison, Wis.-based law firm Boardman & Clark LLP.

Often, it's the little things that can cause the biggest headaches.

“My view of the important issues are not always the ones seen by HR people as being important,” Gregg said. “I'm concerned about the day-to-day items like documentation, communication and confidentiality.”

But there are other trends afoot unique to the current business climate to which credit unions should pay special attention, Gregg said. Here are five issues that will likely keep HR directors busy throughout 2015.

1. More Overtime Costs? Wage and hour laws have everything to do with treating employees equitably, and possible changes to the Fair Labor Standards Act could lead to the reclassification of some salaried staff as non-exempt. That means that employees who heretofore have been working however many hours it takes to get their jobs done could suddenly be eligible for overtime pay, and that could be challenge credit unions at both the financial and personnel levels.

1. More Overtime Costs? Wage and hour laws have everything to do with treating employees equitably, and possible changes to the Fair Labor Standards Act could lead to the reclassification of some salaried staff as non-exempt. That means that employees who heretofore have been working however many hours it takes to get their jobs done could suddenly be eligible for overtime pay, and that could be challenge credit unions at both the financial and personnel levels.

”The Department of Labor is in the process of issuing new regulations, but they haven't come out yet,” Gregg said. “Everyone is waiting to see what the changes will mean to their employee classifications.”

Employees are exempt from FSLA requirements based on the tasks and responsibilities outlined in their job description, as well as the salary level at which the position is pegged.

Right now the current salary threshold for exempt employees is $25,000, a figure that's remarkably low, Gregg noted.

“We anticipate there will be a major change in who can be classified as exempt salaried employees,” Gregg explained. “If the Department of Labor raises that threshold astronomically, it may mean that a lot of companies may have to start paying overtime to current managers for the same amount of work that they're used to getting.”

Changes in wage and hour laws don't happen very often, the attorney said. The last revision was in 2004, although aspects of the law have not been updated with the 1930s.

The current scenario has a lot of managers, especially of smaller enterprises, worried about the impact the changes may have on their wage and salary budgets.

“Many rules do not match the modern workplace, and every time they are revised it creates a number of changes,” Gregg said. “What's coming down the road could throw a lot of the current practices out and make people rethink and reconfigure their staff profiles.”

2. Who owns your data in an increasingly electronic world? These days every aspect of both personal and professional lives is governed by electronics, and that can pose problems for credit unions unaware of the nebulous nature of data ownership.

2. Who owns your data in an increasingly electronic world? These days every aspect of both personal and professional lives is governed by electronics, and that can pose problems for credit unions unaware of the nebulous nature of data ownership.

“The main question facing employers is how to control the electronic system, prevent the improper use of that system and maintain the ownership of the work that is done within the credit union,” Gregg said.

Employers who allow or even require employees to use their own electronic devices for business purposes in the workplace face a big liability.

Employees allowed or required to mix company data with personal information have entered a gray area when it comes to data ownership, one that won't necessarily favor the employer.

“If I as an employee am required to network and socialize with your clients or customers and I move on to another employer, can you claim that any list of customers or employer information is really yours if it is on my device?” Gregg asked. “Using personal devices for business purposes is incredibly dangerous and proliferates the inability to enforce confidentiality.”

Such data mix-and-mingle policies aren't very healthy for the employees, either.

In more litigious situations, Gregg said, employees may be required to turn over their personal electronics and let the court sort the information out, including any embarrassing selfies that might appear on the devices.

“This is a continuing headache for people in charge of managing these processes and HR staff who have to deal with employees,” Gregg added.

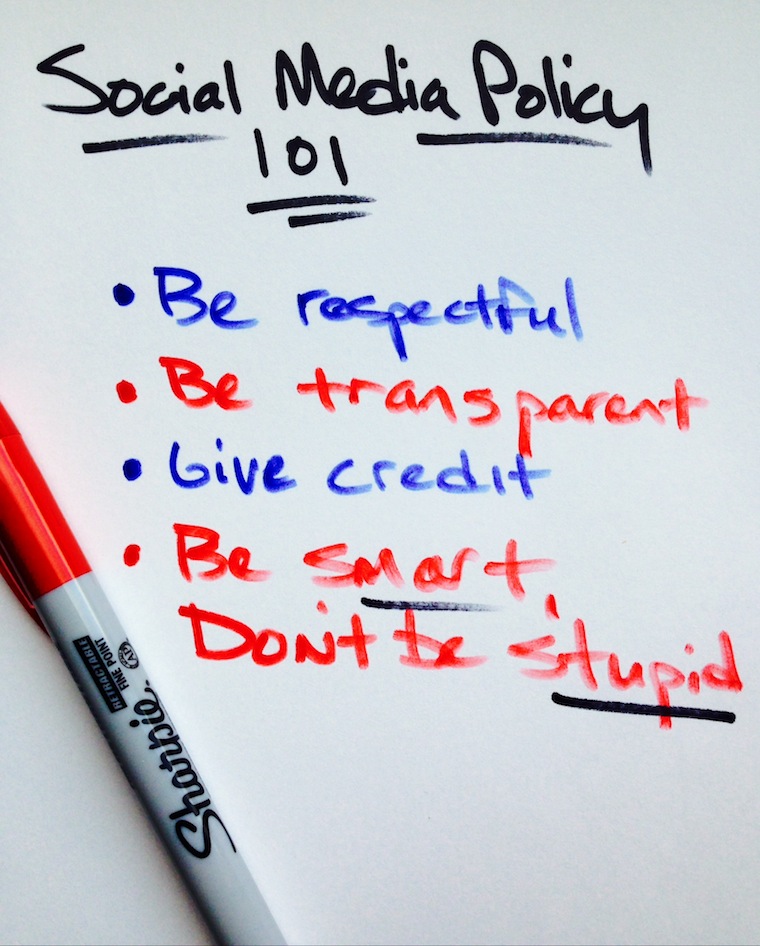

3. How anti-social can workplace social media get? If an employee at work posts on his personal social media account that his boss is a moron, does the maligned boss have any disciplinary options?

3. How anti-social can workplace social media get? If an employee at work posts on his personal social media account that his boss is a moron, does the maligned boss have any disciplinary options?

“A response could be considered a protection of the employer, or it could be considered an invasion of the employee's privacy,” Gregg said. “If there is a line that's drawn, it's getting much harder to find.”

National Labor Relations Act standards go a long way to protect the rights of the employees regardless of whether or not they have a union, Gregg explained. Employees can be their own worst enemies, however, if they brag about playing 18 holes after calling in sick, and that can come back to bite them. But their right to free speech in the electronic format remains sacrosanct, the attorney said.

“Employees have the absolute right to complain about wages, hours and conditions of employment over social media, and the NLRB has been coming down and assessing penalties in situations where employers try to suppress those opinions,” Gregg said. “You can't prohibit employees from badmouthing their companies on social media because they have a right to, and that drives companies nuts.”

4. Why can't I fire employees that I have specifically told can't talk about their salaries? NLRB weighs in this issue, too, especially when it comes to employment policies and job handbooks. And the day of forbidding staff to discuss salaries is long past, Gregg said.

4. Why can't I fire employees that I have specifically told can't talk about their salaries? NLRB weighs in this issue, too, especially when it comes to employment policies and job handbooks. And the day of forbidding staff to discuss salaries is long past, Gregg said.

“I can't talk about my salary? That's a violation of my rights,” Gregg said. “Any attempt to discouraging staff from badmouthing their organization is prohibited. You can call the boss a jerk and unless you use a sexual, racial or religious slur you are probably covered.”

5. How about that ObamaCare? No matter what your political persuasion, pending Supreme Court decisions regarding repealing parts of the Patient Protection and Affordable Care Act, or ObamaCare, could change the face of the health care coverage you offer employees, Gregg said.

“The Supreme Court will either leave things as they are, or they will throw a very large wrench in the gears,” Gregg said. “Everyone has been preparing for the Affordable Care Act, and if they do that it's all up in the air.”

Private employers like credit unions that have been adjusting health care policies, making required adjustments to what they thought would be the new reality.

But despite almost 50 attempts in the U.S. House and Senate to repeal the health care law, the court's ruling on King V. Burwell could start a domino effect that may cause the whole plan to collapse. And that could change the face of health care even for those who aren't ACA participants.

“Employers have made adjustments to accommodate the program, but it if all falls apart, we don't know what that will mean for employer-sponsored plans,” he said.

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.