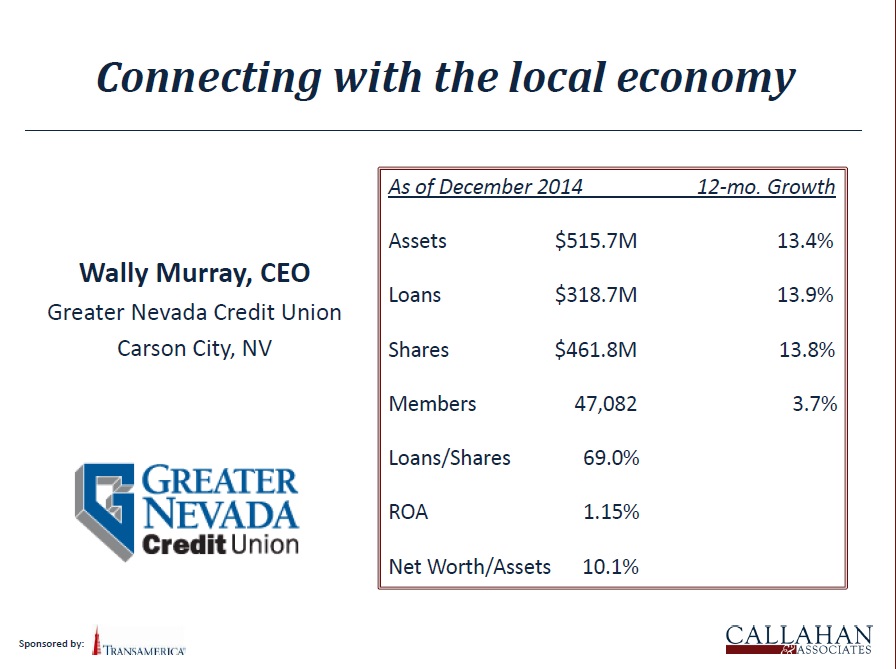

Various credit union scenarios were illustrated by slides throughout Callahan & Associates' 4th Quarter Trendwatch webinar Thursday. The most compelling was a presentation by Wally Murray, CEO of the $515.7 million Greater Nevada Credit Union in Carson City, Nev.

Various credit union scenarios were illustrated by slides throughout Callahan & Associates' 4th Quarter Trendwatch webinar Thursday. The most compelling was a presentation by Wally Murray, CEO of the $515.7 million Greater Nevada Credit Union in Carson City, Nev.

Greater Nevada serves a community devastated by the recession and was all but abandoned by businesses and community banks.

The credit union is helping members get back on their feet in the face of high unemployment and home values that have declined as much as 60% with innovative programs and community involvement efforts designed to bolster the community and its economic recovery.

Recommended For You

Mortgage down payment assistance programs, government guaranteed loans and volunteering in community development efforts have helped strengthen the community economically and psychologically, Murray said.

The CEO also noted Greater Nevada also benefitted from those efforts, growing its assets 13.4% to $515.7 million, increasing loans 13.9% to $318.7 million and driving shares up 13.8% to $461.8 million during 2014.

"We operate from the inside out, and our main competition is ourselves," Murray said. "We were largely consumer-oriented and still are, but the exodus of community banks has given us some great opportunities on the business lending side. That's going to be big for us."

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.