By all accounts, credit unions have connected with the booming U.S. economy, and the industry's fourth-quarter 2014 financial performance clearly reflects it, according to Callahan & Associates' 4th Quarter Trendwatch webinar.

By all accounts, credit unions have connected with the booming U.S. economy, and the industry's fourth-quarter 2014 financial performance clearly reflects it, according to Callahan & Associates' 4th Quarter Trendwatch webinar.

Rising wages, declining unemployment and a national GDP of 2.4% have created a consumer confidence level that, in turn, has driven credit union key performance ratios to near record levels, said Callahan EVP Jay Johnson, one of multiple presenters at the Thursday online event.

Thanks to strong asset quality, record capital and net income levels, and rapidly growing loan portfolios, credit unions are in an extremely good position to ride the wave as the overall economy continues to crest, said Johnson, who used the Washington consulting firm's Peer-to-Peer Analytics to chart the industry's growth trajectory.

Recommended For You

"All aspects of the portfolio are moving up and asset quality continues to improve," Johnson added. "The economy's momentum will continue to propel credit union growth."

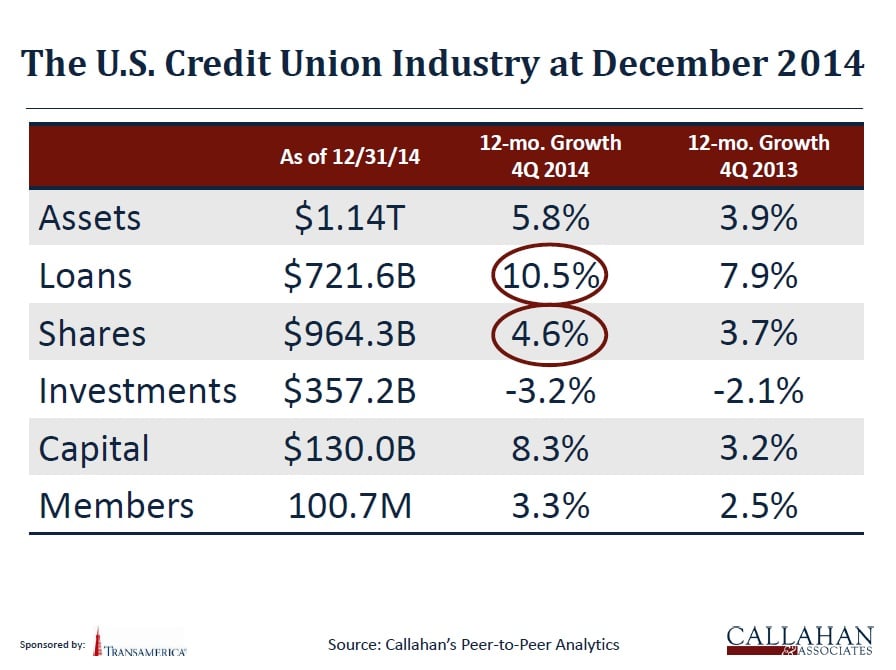

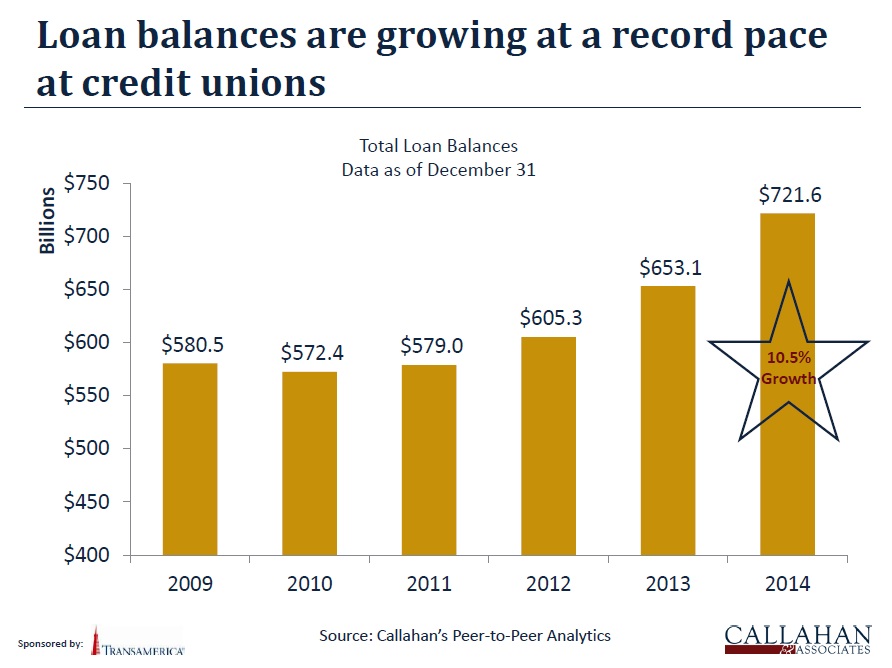

As of Dec. 31, 2014, credit union industry assets totaled $1.14 trillion, a 5.8% increase during calendar year 2014, which compares favorably for the 3.9% growth during 2013, according to Callahan statistics. Loans totaled $721.6 billion for 2014, reflecting a whopping 10.5% growth rate for 2014 that beat the 7.9% growth posted for the previous year.

As of Dec. 31, 2014, credit union industry assets totaled $1.14 trillion, a 5.8% increase during calendar year 2014, which compares favorably for the 3.9% growth during 2013, according to Callahan statistics. Loans totaled $721.6 billion for 2014, reflecting a whopping 10.5% growth rate for 2014 that beat the 7.9% growth posted for the previous year.

Shares also increased 4.6% to $964.3 billion, beating 3.7% growth for the previous year. Capital increased 8.3% to $130 billion, up from 3.2% in 2013, and aggregate membership jumped to 100.7 million, a 3.3% increase that compares favorably to a 2.5% membership increase in 2013.

Only investments took a hit, declining 3.2% to $357.2 billion, a further slide when added to the 2.1% decrease in 2013, Johnson said.

Credit unions also hold more than 10% of the deposit market share in 27 states across the U.S., Johnson said. Alaska tops the list with an impressive 40.3% deposit market share, followed by New Mexico (21.4%), Washington (21.1%), Vermont (20.7%) and Idaho (19.5%) to round out the top-five list.

The 4.6% share growth rate proved to be a mixed bag of gains and losses. IRA/Keogh accounts and share certificates declined slightly in 2014, offsetting a more impressive 8.5% growth in regular shares, compared to 7.8% in 2013. Share draft accounts grew 10.3% in 2014, compared to 6.8% for the previous year.

However, loan growth remained the true credit union success story, Johnson said.  Every loan category posted faster year-over-year growth compared to the previous year, but new auto loans sped to the front with 21% growth in 2014 compared to 12.7% in 2013. MBL's grew 14.1%, last year, compared to 11.3% during the previous year, and used auto followed with 13% growth in 2014, compared to 10.5% in 2013.

Every loan category posted faster year-over-year growth compared to the previous year, but new auto loans sped to the front with 21% growth in 2014 compared to 12.7% in 2013. MBL's grew 14.1%, last year, compared to 11.3% during the previous year, and used auto followed with 13% growth in 2014, compared to 10.5% in 2013.

Despite a downturn in first mortgages, credit union mortgage market share topped 30% in 11 metropolitan statistical areas in the U.S. Binghamton, N.Y., ranked highest in the group with 36.06% market share, with Utica-Rome, N.Y., brought up 11th place with 30.45%. In terms of total dollar amounts, 4th place entry Burlington-South Burlington, Vt., ranked highest with almost $1.7 billion in mortgage originations.

"First mortgage originations fell 20% compared to the previous year, but credit unions still performed better the overall market, which dropped 40% during the same period," Johnson said. "A decade ago we talked about credit unions moving from 2% of the mortgage market to 10%, and we're almost there."

Strong financial performance puts credit unions as institutions and as an industry in a good position to address interest rate risk and risk-based capital concerns, Johnson said. He encouraged credit unions to stay involved in any and all risk-based capital discussions with the NCUA.

"Credit unions maintained stable capital during the recession, and any failures were largely due to fraud, making this a supervisory issue rather than a capital-based issue," Johnson said. "Risk-weighting has been a big focus of RBC discussions, but RBC should be used as an exam tool. Making it a hard rule in the books doesn't make any sense."

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.