Noninterest income, both expected and unexpected, can make a big difference for small credit unions. For two relatively new CEOs and one industry veteran all managing credit unions with less than $50 million in assets, single activities provided a real boost to their respective bottom lines.

At the $42.1 million Commonwealth Utilities Employees Credit Union in Marion, Mass., an accounting change in the handling of interchange fees helped grow noninterest and other income as defined on NCUA's 5300 Call reports by 154.02% through June 30, 2014, according to data analyzed by Callahan and Associates for CU Times.

The Washington-based firm used the same data levels to show a 141.77% increase in noninterest income for $31.5 million Lufkin Federal Credit Union in Lufkin, Texas. The institution's first-time implementation of a courtesy pay program fueled the majority of that growth, according to the cooperative.

A new courtesy pay program also drove significant bottom line growth for the $20 million City Co Federal Credit Union in Pittsburgh. The financial institution, which also has a low-income designation for some areas of the city, spiked a 148.95% growth in noninterest income for the same period.

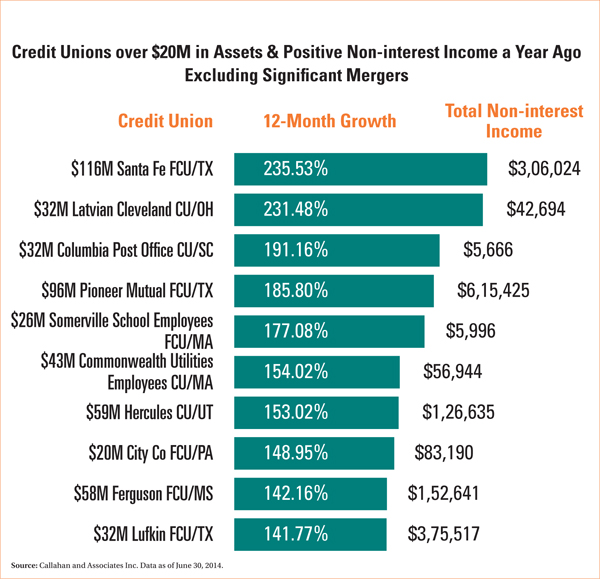

The three credit unions were among the top 10 institutions nationwide to make the greatest gains in noninterest income growth on a percentage basis, according to data from Callahan.

All 10 credit unions in the category were relatively small institutions ranging in size from the $116 million Santa Fe Federal Credit Union, based in Amarillo, Texas, in the top slot with 235.53% growth, to City Co, the smallest on the list, which ranked eighth on the noninterest income leader list.

The courtesy pay program, newly installed in 2014, was a key growth driver for Lufkin, according to President/CEO Julianne Slusher, the credit union's former COO who assumed her new post in January 2014.

Like most courtesy pay programs, members who subscribe to the program are covered if their checking accounts stray into negative numbers. At Lufkin, members can carry up to a $400 deficit for up to 30 days under the program, which costs them $25 each time they have to use it. Slusher was quick to point out that they will not incur additional charges from creditors for bounced checks, and there is no charge if they don't use the program,

“We have a lot of blue collar workers who struggle with every flat tire or burst water heater,” Slusher said. “This program can cover them from paycheck to paycheck.”

She declined to disclose how many of the credit union's 4,700 members take advantage of courtesy pay, but said Lufkin earned $360,000 from the program in 2014. “The members love it,” she added.

Lufkin also realized a windfall of $107,000 paid by CUNA Mutual Group's experience refund program last February for having very few claims during the previous year. The amount is nearly four times the $29,000 the credit union received the prior year, she noted.

“We can control the policies, but not the claims,” Slusher said. “It just so happened we didn't have very many claims that year.”

Slusher was one of six credit union employees who occupied new positions after former President/CEO Linda Smith retired in January 2014. The increase in noninterest income funds allowed many of them to participate in training opportunities and travel to credit union conferences, Slusher said.

Courtesy pay was also the major factor for noninterest income growth at City Co according to President/CEO Cookie Yoder, a 37-year credit union industry veteran and longtime Pennsylvania Credit Union Association board member who has been in her current post a little less than four years.

“We had a quite a few issues when I first got here [in May 2011] and a lot of work to clean up,” Yoder said. “We were looking for noninterest income sources and there just weren't a lot of alternatives.”

Yoder credits data processing vendor Fiserv with introducing her to the courtesy pay concept at one of its conferences. City Co implemented the program last January and it was an immediate success, she said.

“Most of our members are county employees and a lot are blue collar jobs,” Yoder explained. “Our courtesy pay income has grown every month.”

The credit union finished the year with $129,221.88 in courtesy pay program earnings, according to Yoder. Of City Co's 587 checking accounts, 420 had opted for courtesy pay. Each enrolled members pays $33 for each overdraft and is allowed to carry a balance of $300 to $500, depending on the member, for up to 30 days.

Income from the courtesy pay program has been used to underwrite expenses for an automated bill pay program offered at no cost to members, Yoder added.

Continued income from bill pay and other services, including a wildly successful Visa card program that grew from $138,000 in July 2012 to $1.1 million by year-end 2014, will fund continued improvements, Yoder said, including the possible introduction of mobile banking capabilities by the fourth quarter of 2015.

“I truly believe any credit union could become profitable with bill pay,” Yoder said. “I never dreamed this program could be so successful. Never.”

At Commonwealth Utilities, it was an accounting change that netted the institution its high level of noninterest income growth, according to Cathy Diamon, who has been the credit union's president/CEO for just two years. It also set the stage for greater consideration for promoting growth through other income sources in the year ahead.

Under Diamon's direction, last year, the credit union changed the way it accounted for interchange fees. Fees from Visa debit and credit cards were counted as income as opposed to being applied as expenses for those two transaction products, she said.

“I started comparing our ratios to those of several of our peers in southern Massachusetts,” Diamon said. “Their fee income was between 70 [basis points] and 90 bps, much higher than ours, but if they didn't register that as fee income, where would their earnings be?

Unlike some of its competitors, Commonwealth Utilities was profitable even before the change in accounting strategies, according to Diamon. However, income realized from the change led Diamon to look for other ways to beef up noninterest and other income on the credit union's balance sheet.

Commonwealth Utilities started offering gap coverage on auto loans, which is designed to cover gaps between what the insurance company will pay and what the loan may be worth in the event of an accident. Currently, the program nets the credit union an extra $900 per month, Diamon said.

In May, the credit union will stop paying life insurance on loans as part of its data processing system conversion and will reintroduce it in June or July as a product that members can purchase through the cooperative. Courtesy pay and account transfer programs also are on tap for implementation later this year.

“Our members pay very little in fees, and we still charge $12 each for member wire transfers that cost us $20 to make,” Diamon said. “There are a lot of opportunities and I have a whole list of changes that will help get this ship righted in the water and operating more efficiently.”

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.