The revised proposal was approved by a 2-1 vote, with Board Member Mark McWatters voting against it.

Credit unions with up to $100 million in total assets are exempt from the proposed 450-page new rule. The well-capitalized standard dropped from 10.5% in the original proposal to 10%.

Recommended For You

The new rule also lowered risk weights for residential real estate loans and member business loans, removed interest rate risk from risk weighting and extended the rule's effective date from 18 months to three years, effective January 2019. The rule would further change the definition of a current loan to 90 days past due, to provide parity with banking regulations.

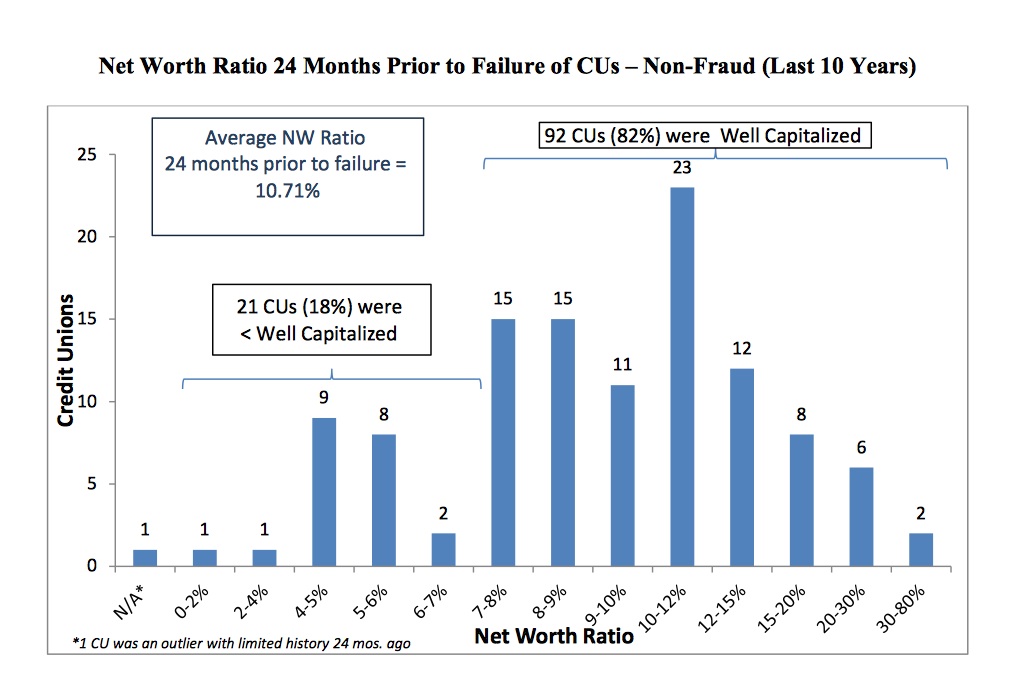

In a preamble supporting the regulation, the NCUA charted how many credit unions were considered well-capitalized under current net worth standards just 24 months before failure. That chart is shown above; click on the chart to expand.

Despite limiting risk weight calculations to include just concentration and credit risk and excluding interest rate risk, the new rule said the NCUA intends to consider alternative approaches to manage interest rate risk.

The agency estimated that the total non-recurring costs of the proposal through 2018 would be $3.7 million. About half the costs were expensed to updating the call report and exam systems, and half to training and communications. Lower costs were disclosed for data systems change management and policies, procedures and guidance.

The total estimated one-time costs for non-complex credit unions totals 101,980 hours or $3,252,142, amounting to an average of $638 per credit union. For complex credit unions, estimated costs total 58,200 hours or $1,855,998, averaging $1,276 per credit union.

"These changes would substantially reduce the number of credit unions subject to the rule, reduce the impact on affected credit unions, and afford those credit unions sufficient time to prepare for the rule's implementation," the board action memorandum said.

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.