By far, auto loans were the clear and consistent lending leader this year as the sector left its counterparts eating its dust with both credit unions and other financial institutions in the drivers' seat.

In late November, the Federal Reserve said so far in 2014, American consumers financed $105 billion in auto loans, which was the highest peak since 2005. That figure did not include this year's holiday season, which is traditionally a strong period for vehicle sales.

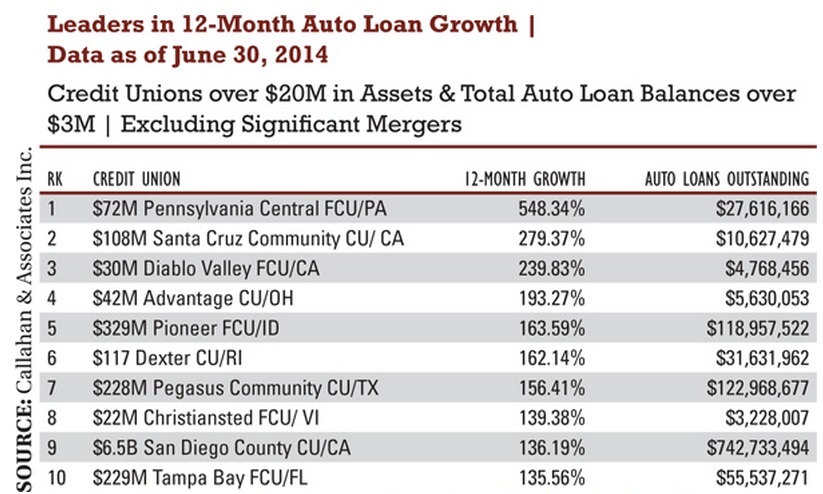

Two credit unions took sharply different paths to secure a spot among the top 20 credit unions that posted the strongest auto lending growth between June 2013 and June 2014, according to data analyzed by Callahan & Associates for CU Times. Click through to page 2 to see the list.

The $32 million Diablo Valley Federal Credit Union in Concord, Calif., increased the balances in its auto loan portfolio by 239% and closed the period tracked with roughly $4.8 million in auto loans on the books, the data showed. The 2,700-member cooperative ranked third on the CU Times' list of growth leaders.

Instead of ramping up a major auto lending program, John Pamer, president/CEO of Diablo Valley, said the credit union was happy working with other credit unions to make the loans.

Participations, or buying parts of other credit unions' loan portfolios, provided the most efficient way for a credit union like Diablo Valley to take advantage of the surge in auto lending, he explained.

“For a credit union of our size, it just didn't make sense to hire another two people for auto loans,” Pamer said. “Loan participations were just a lot easier and more cost effective.”

While Diablo Valley financed auto loans to its own members whenever they needed them, the credit union lacked the resources to get deeply involved in the auto lending surge, Pamer said.

Instead, the cooperative focused on those types of loans, such as home equity, where member demand was stronger and the competition was not as stiff.

“We still make auto loans to our members, but we just don't have the staff to launch an indirect program or other higher volume auto lending effort,” Pamer said.

According to Experian, credit unions had more than $191 million in auto loans outstanding as of the second quarter of 2014, which was $25 billion over the figure for the same period last year.

Read more: Central Florida Educators FCU makes the right move at the right time …

The $1.5 billion Central Florida Educators Federal Credit Union in Lake Mary, Fla., contributed to that boon by reviving its auto lending program after scaling back during the Great Recession. The effort paid off as the cooperative increased it auto loan portfolio by 114% and secured $212.9 million in auto loans on its books as of June, according to the CU Times' ranking. The 141,139-member credit union ranked 13th on the list of growth leaders for the category. Click on the list at left to expand.

The $1.5 billion Central Florida Educators Federal Credit Union in Lake Mary, Fla., contributed to that boon by reviving its auto lending program after scaling back during the Great Recession. The effort paid off as the cooperative increased it auto loan portfolio by 114% and secured $212.9 million in auto loans on its books as of June, according to the CU Times' ranking. The 141,139-member credit union ranked 13th on the list of growth leaders for the category. Click on the list at left to expand.

Suzanne Dusch, CFE vice president of marketing, said part of the credit union's success came through a return to auto lending at about the same time that many of its members returned to auto buying.

“We believe firmly in doing what is right for our members,” Dusch said. “During the Great Recession, we were concerned about our members' debt levels so we dialed our lending way back.”

In fact, all lendingat CFE, not just auto, slowed as the credit union and its members went through the shock and pain of weathering the economic downturn in Florida, one of the worst hit states in the country.

“As the Great Recession drew to an end and we sensed that our members were more employed and were in better shape financially, we realized we needed to come to lending too since we had a couple of years with actual negative loan growth,” Dusch said.

She added, “They had spent a number of years holding their old cars together with duct tape and we spent those years watching our finance income shrink. So, we all needed to see a change get made.”

Initially, CFE focused on changing the way its auto loans were priced and slowly restarted an indirect lending program that had shut down in 2009.

The changes in loan pricing shifted the focus away from extremely credit-worthy borrowers who could shop for loans from a wide variety of lenders to a middle tier of borrowers with credit scores around 640 or 650, according to Brian Hartwigsen, SVP of lending and business services for CFE.

The loans were nearly still sound ones but they brought more finance income compared to loans made to the AAA borrowers who demanded the lowest rates, he noted.

Read more: Giving indirect lending a second try …

When CFE set out to renovate and revive its indirect lending program, it meant reintroducing the credit union to the dealerships that it planned to partner with. A CFE employee was put in charge of monitoring the relationships and helping dealers stay in the loan program, Hartwigsen said.

As a result, CFE began to see more auto loan originations almost as soon as it announced it was lending again. Dusch and Hartwigsen recalled an experience that took place in May 2012 that proved the credit union was on the right track.

Dusch described how occasionally, an auto buyer with ties to CFE would host an auto-buying event, typically at a local state park or other open space targeted exclusively at the credit union's members.

“It made sense for us,” Dusch said. “We sent some staff with their laptops for a day or two and booked a few hundred thousand in loans.”

On that extraordinary day in the spring of 2012, CFE's members showed the credit union it was nowhere near to tapping into the pent-up demand.

“We had good crowds all day, including when the skies clouded up and it began to pour rain with strong winds,” Dusch said. “We were concerned for our members and came out with bullhorns to get them to come in from the open field where the cars were parked, but they had already picked out the cars they wanted and didn't want to risk someone else getting them so they stayed on the field in the rain throughout the storm.”

That day, CFE booked $2.7 million in loans, the most ever, Dusch said.

“So, we knew we were onto something,” she recalled.

Soon afterwards, a car dealer approached the credit union with the first of what became a series of dealer-sponsored events. In exchange for CFE putting staff on site during the sale and marketing it to current members, the dealer agreed to expand its reach to the general public and included the credit union in its advertising and marketing promotions.

While most of CFE's growth in auto loans came from a mix of strategies, Dusch acknowledged the credit union may not be able to keep up that pace.

“We have already started to see some of our loan pace slack off a little,” she said.

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.