All credit unions hope for a positive return on equity, maybe even an exceptional one, but primarily as a byproduct of successful strategies employed in serving members.

All credit unions hope for a positive return on equity, maybe even an exceptional one, but primarily as a byproduct of successful strategies employed in serving members.

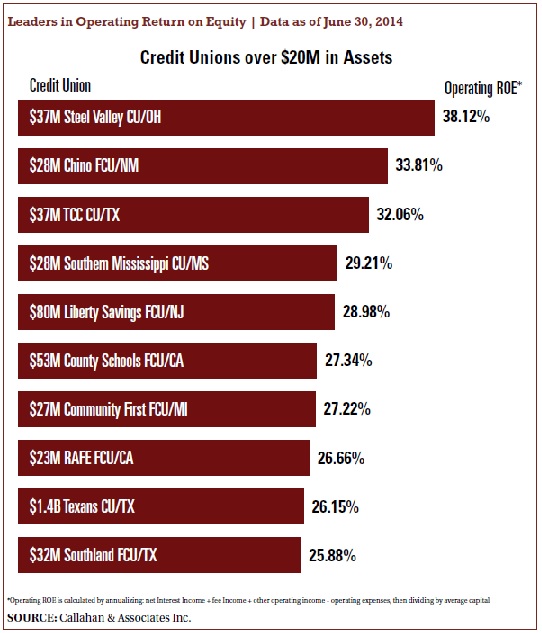

The scores that characterized the Top 10 Credit Union ROEs, according to data analyzed by Callahan & Associates for CU Times, are head and shoulders above those of average performers. Click on the chart to expand.

At least one inclusion in the list was surprising in its presence.

Utilizing data from NCUA's 5300 Call Reports as of June 30, 2014, Callahan identified top contenders starting with the $37.1 million Steel Valley Federal Credit Union in Cleveland, which ranked first with an ROE of 38.12%. Navy Army Community Credit Union, a $2.1 billion institution based in Corpus Christi, Texas, ranked 20th with an ROE of 22.89%.

The institutions in between, from the $22.5 million RAFE Federal Credit Union in Riverside, Calif., in eighth place, to the $2.4 billion University of Iowa Community Credit Union in Grinnell, Iowa, in the 14th slot, had its own story to tell about steps taken to become part of the Top 20 ranking.

For the $28 million Chino Federal Credit Union in Silver City, N.M., which ranked second with an ROE of 33.81%, it's been a strategy of struggle and service, according to Greg Shaver, president/CEO of the cooperative.

Chino serves 6,500 members through a community charter for Grant and Luna counties, the latter of which borders Mexico. The members' and the credit union's wellbeing is governed by the ebb and flow of the Chino Mine, a copper mining operation just outside of Silver City.

“This is a pretty low-income area,” said Shaver, a Texas native who has lived in New Mexico for 15 years. “The unemployment rate is real high, but when the mine is operational, we get members at multiple income levels.”

When the mine closed during the recession of 2008, the credit union and its members were hit hard, Shaver explained. Many defaulted on loans, which caused the credit union significant problems. Fortunately, the turnaround is well underway and Chino is thriving for multiple reasons.

“Our ROE is the result of what we've done to filter out bad loans that the previous CEO had approved,” Shaver said. “They were not really illegal loans, but there were some pretty loose underwriting standards.”

Shaver and his staff created a bad loan portfolio and it took several years for the credit union to gain control by writing off bad loans and eventually, overcoming what could have been a financially crippling situation.

Both the institutions and the community learned an important lesson from the recession, particularly in its impact on auto loans. Shaver borrowed a page from the Hyundai playbook, both to get Chino's auto loan program in order and to better serve the members.

In 2009, the South Korean auto manufacturer initiated a program that offered to buy back Hyundai automobiles from purchasers who lost their jobs within a year of purchase. Hyundai paid the difference between the vehicle's trade-in value at the time the owner filed papers to return the car and the remaining balance on the auto loan up to a maximum of $7,500.

Only 350 people took advantage of Hyundai's programs before it ended in 2011, according to reports on CNN Money, but the company's customer-friendly image was established.

A strong impression also was made with Shaver, who worked with SWBC, a San Antonio-based business insurance provider to establish a similar program with terms akin to the Hyundai offer for Chino members on any make or model of vehicle. For an additional $100 per loan, borrowers could purchase buy-back insurance on the vehicle.

“Used auto loans are the largest part of our overall loan portfolio,” Shaver said. “We started marketing them as the best auto loans in the area and we got the majority of car loan business.”

Now that the mine is back in operation and the price of copper has increased substantially, few members have taken advantage of the buyback program, according to Shaver. The credit union now also offers mechanical breakdown insurance under a similar approach, with the premium the equivalent of one extra car payment, he said.

Increased income from loans, insurance plans and courtesy pay fee income helped bolster Chino's bottom line and the credit union continued to retire bad loan debt.

“When we finally charged off all the bad loans off, we had a very strong net income,” Shaver said.

The credit union also closed one of its three branches, and cost savings have helped strengthen its balance sheet as well as its ROE.

“I can't say we planned it all out. We just knew we needed something different and the pieces fell together,” Shaver said. “Our goal is to offer our members the best products and services and we need income to be able to afford to do those things.”

One of the most surprising inclusions on the Top 10 ROE list was the $1.4 billion Texans Credit Union in Richardson, Texas. The credit union, which came in ninth place with an ROE of 26.15%, has been under NCUA conservatorship since April 2011.

Conservatorship status was assigned to Texans specifically to address service and operational weaknesses. The credit union hit rock bottom financially in December 2011 when it reported a 1.07% net worth ratio and double-digit loan quality ratio.

The NCUA sued former Texans CEO David Addison in December 2012, alleging breach of fiduciary duty, gross negligence, and claims that the credit union's failure resulted from Addison's poor management decisions. A net income loss of $20.7 million through the credit union's CUSO and $15 million in member business charge-offs in 2010 were among the issues fueling both the conservatorship and lawsuit.

Representatives from Texans were unable to respond to questions regarding their current ROE status for the article. A top executive, forced to identify himself only as an “unnamed source” because of the credit union's conservatorship status, received written questions that he agreed to answer and submit to CU Times pending NCUA approval. The answers were not received by press time.

Based on Texans current financial picture, however, the credit union is on the mend and heading back toward profitability, according to Brian Turner, owner and chief strategist for Meridian Alliance, a credit union consulting firm based in Plano, Texas.

“Texans has enjoyed what I think has been a good year,” Turner said. “Through the first half of 2014, they saw a net return on assets of about 1.36% on nearly $10 million in year-to-date earnings.”

The growth contributed to the credit union's average equity, which improved from negative $11.1 million to $4.8 million, the first time equity had turned positive since September 2011, Turner said. The credit union's net worth ratio had similarly improved from 3.64% to 4.28% in the first quarter of 2014 and stood at 4.77% at the end of Q3.

“The return on equity cited by Callahan seems to be more correlated to the credit union's average net worth, which I actually calculated to be closer to 31.8% at the end of Q2 2014,” Turner said. “So, the credit union has $17 million in net worth from achieving at least a 6% adequately-capitalized profile and about $68 million from hitting a comparable equity profile. This speaks well for all the hard work done at Texans and, if recent performance is any indication, they are on a good path of full recovery.”

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.