That's according to data analyzed by Callahan & Associates for CU Times. As of June 30, the $1.5 billion credit union in Clinton Township, Mich., ranked 14th on the list of membership growth for top 20 credit unions with more than $20 million in assets.

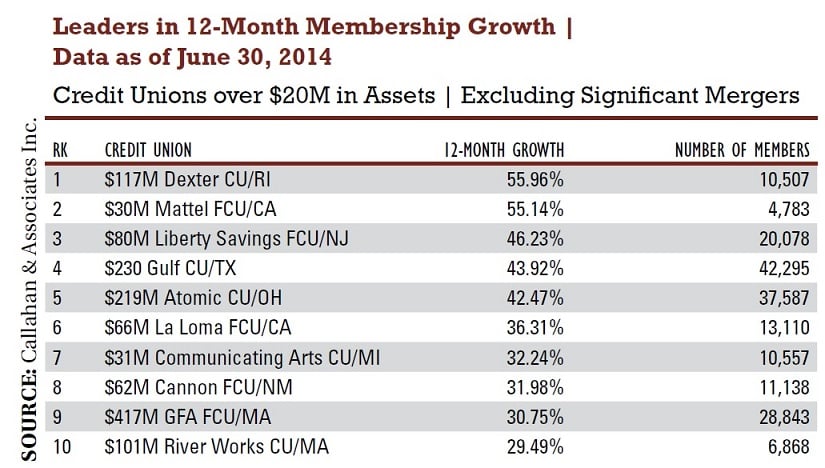

Click on the chart above to expand.

Recommended For You

To put the growth in perspective, more than 50 new members joined every day, day in and day out, including weekends, during the period tracked.

Lorie Dietz, the credit union's vice president of marketing, said the growth is both intentional and sustainable.

"Our credit union has been growing for a long time," Dietz said. "It's part of our business strategy."

Over the past few years, growth has been fueled largely by indirect lending, she noted. Half to three-quarters of the credit union's membership growth came through that loan channel, Dietz. Several years ago, MSGCU hired in-house indirect lending expertise, anticipating indirect lending would be a significant growth driver.

"We are not the largest credit union in the state but we know that we are seventh or eighth in terms of indirect lending," Dietz said. "The competitors ahead of us on that list are Chase and Capital One and Allied – institutions like that. We're the top credit union on that list."

She was quick to point out that even in the absence of its indirect lending growth, the credit union is still adding a significant number of new members.

According to Dietz, MSGCU was also actively engaged in efforts to increase product penetration with those consumers whose membership begins with an indirect auto loan.

"That's the really exciting part of all this. Right now, our cross-sell penetration to indirect members is at about the industry average, maybe 3% [to] 3.5%, but part of our 2015 plan is to make a much more concerted effort to grow that," she explained.

The credit union already has an outbound calling group and will be dedicating more resources to this group next year, Dietz said. The MSGCU marketing department will be providing additional support for in-branch efforts as well.

On the topic of branches, Dietz said the credit union is committed to building one or two new branches each year to support its growth.

"We have a very comprehensive approach to adding branches. We work with an outside firm that provides us with the necessary data," she said.

In 2015, MSGCU is definitely opening one new branch and very possibly, a second one next year, Dietz said. The credit union is anxious to build both branches but is experiencing delays in the acquisition of the property for the second branch, she added.

Dietz said the credit union's various digital channels made a strong contribution to the credit union's growth, especially with attracting non-members.

"In terms of volume, the online channel and our call center are number one and number two for generating new loan applications," she noted.

The online channel has been especially useful in driving the credit union's current auto loan refinance program, a program targeted at non-members.

Dietz said the credit union's message is simple: If you have equity in your car, it makes much more sense to refinance it than to take out an unsecured personal loan.

"It is pretty impressive – the amount of activity we can generate through the Internet channel for the things we promote."

Asked about future growth, Dietz said that she expects the MSGCU to continue posting big numbers.

"I'd say that we're on a more steady pace now. We may not add another 20,000 members this coming year, but it'll be something pretty close to that."

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.