The $73.6 million Community Resource Federal Credit Union in Lathan, N.Y., kept the refinance wave going for its members even as the lending channel dried up for other cooperatives.

The 6,700-member credit union closed June 2014 with roughly $18.2 million in first mortgage loans on its books, meriting a 188.53% increase, according to data analyzed by Callahan & Associates for CU Times.

Recommended For You

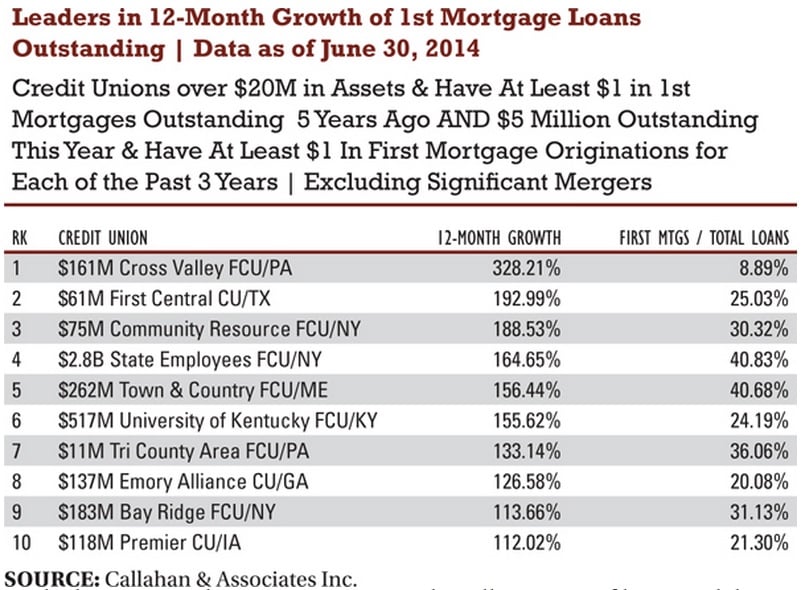

Community Resource ranked third in the top 10 list of credit unions that were leaders in first mortgage growth as of June 2014. Click on the list above to expand.

"We had more or less retreated from the home equity market and let a number of home equity loans run off our books," Terry Langlois, president/CEO of Community Resource, said. "We recognized there were a number of people who would refinance once and then refinance again a few months later and decided we couldn't see the sense in that."

Instead, Langlois said the 6,700-member Community First waited until rates hit bottom and then crafted a loan product with enough appeal that it would draw members in.

The winning formula was a combination of charging no fees to refinance, a lower rate and the opportunity to pay off the entire note.

"We called it the Erase Your Mortgage program and deliberately aimed it at members in their late 40s or 50s who might be interested in paying off their house," Wendy Meola, marketing director at Community First, said.

The credit union used a variety of ways to get the message out to members who had at least a 640 credit score, lived locally, had a mortgage with another institution and had at least 50% equity in their homes.

The loans ranged from $50,000 to $250,000, carried fixed annual percentage rates from 2.99% to 3.49% and had 10- or 15-year terms.

The pitch was sent to people who were willing to refinance one more time and pay a slightly higher interest rate in exchange for getting rid of the mortgage altogether at about the time they might retire, Langlois explained.

In addition, the higher equity meant the loans were smaller and more secure so Community Resource was able to keep their members refinancing when borrowers at other financial institutions stopped.

In 2013, the most positive trend within the housing industry was the shake-off of the lingering effects of the Great Recession, according to some industry watchers.

RealtyTrac and other market tracking firms said nearly every county in the nation saw housing prices rise this year as a wave of cash-heavy investors moved in to scoop up real estate-only properties and other financially distressed real estate.

The housing sector's less positive news was a sharp drop in the number of mortgages refinanced due to rising interest rates. Mediocre to poor performance in the market for new mortgages or purchase money loans that went to borrowers who did not already have an existing housing note to refinance also created a disadvantage.

Read more: New York's State Employees FCU controls its destiny …

Still, the $2.8 billion, State Employees Federal Credit Union in Albany, N.Y., raised its first mortgage balances by 164.55% to roughly $628.4 million on the books as of June, according to CU Times' top 20 list first mortgage growth leaders. The 316,000-cooperative ranked fourth on the list.

Robert MacLasco, president of SEFCU Mortgage Services, said the credit union was able to grow by having a wholly-owned mortgage CUSO that focused solely on helping borrowers, particularly first-time and new applicants, get through the process and into a home.

MacLasco said the credit union's approach focused on broadening its mortgage offerings so that it could meet the demands of members' different situations including tailoring the loans to the borrowers. These included offering loan programs from the Federal Housing Authority, Veterans Administration, U.S. Department of Agriculture and local governments.

"Having the CUSO allows us to devote staff exclusively to mortgage origination and not have to share loan officers among different products," MacLasco said.

Another successful strategy was the introduction of products such as hybrid adjustable rate mortgages that combined low interest rates for the first five or three years of a loan and then were switched over to a more traditional ARM.

Young families just starting out on their first home and didn't anticipate remaining in a property for more than five years found these loans to be a very good and less expensive option than standard 30-year fixed loans, MacLasco said.

Some of SEFCU's lending approaches were necessary because the credit union grew significantly beyond its original state employee select employee group.

"Our members have not been majority state employees for 10 years," MacLasco said.

According to SEFCU's website, the credit union serves dozens of SEGs as well as 32 cities and localities as part of its field of membership.

Community Resource, SEFCU and other credit unions that made the CU Times' list of first mortgage growth leaders also dealt with other factors that shook up the housing market.

A harsher and colder than normal winter across much of the country contributed to a lackluster purchase money market as did a matrix of new rules and underwriting policies designed to protect the economy from another Great Recession.

These regulations and the procedures they spawned, in the words of one executive, made the process of obtaining a mortgage loan feel invasive and impossible to many consumers who were discouraged from even trying to finance the purchase of a new home.

That reluctance prevented the purchase money market from achieving predicted growth, according to some trade groups including the Mortgage Bankers Association.

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.