Efficiency ratios are like golf scores – the lower your number, the better your game. Golfers with the lowest scores are considered pros, and their performances are hard to beat.

Efficiency ratios are like golf scores – the lower your number, the better your game. Golfers with the lowest scores are considered pros, and their performances are hard to beat.

Credit union efficiency ratios tell much the same story. The ratio measures how much money it takes a credit union to earn $1 of revenue. The less a credit union spends earning each dollar, the more efficient its operation and the better its use of resources. That's good news for both the institution and its members.

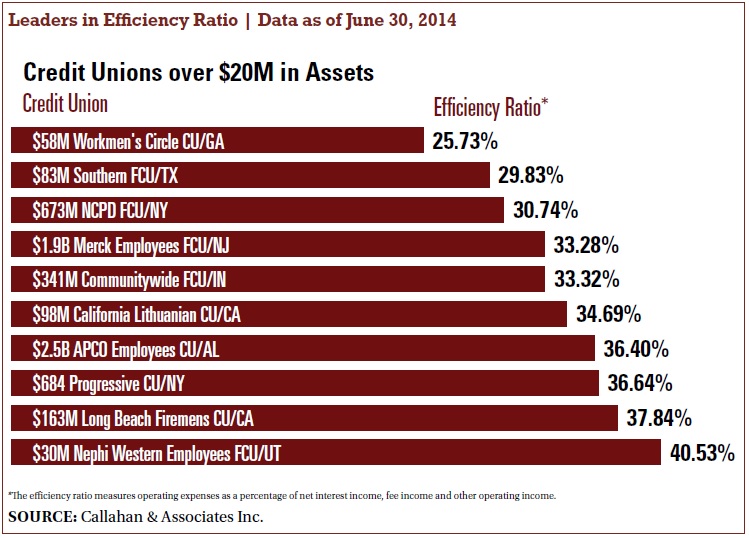

According to data analyzed by Callahan & Associates for CU Times, in calculating the Top 20 credit union efficiency ratios, the data was drawn from NCUA's 5300 Call Reports for all credit unions with $20 million or more in assets. Analysts measured operating expenses as a percentage of net interest income, fee income and other operating income. The calculations did not include stabilization expenses. Click on the chart above to expand.

Results showed that credit unions of all asset sizes have found ways to operate efficiently. The largest credit union on the list, the $6.7 billion Star One Credit Union based in Sunnyvale, Calif., came in at 13th with an efficiency ratio of 41.3%. The smallest institution, the $23.8 million Consumers Cooperative Federal Credit Union in Alliance, Neb., ranked 19th with a ratio of 44.2%. Consumers Cooperative also ranked 10th in the Top 20 ROA category with a return on assets of 2.99%.

But credit unions in between the two asset extremes have even more interesting tales to tell. Old-fashioned values and high-tech alternatives proved to be the key to efficiency for two different institutions.

Ask Chris Miltiades, president/CEO of the $58 million Workmen's Circle Credit Union in Savannah, Ga., the secret to his credit union's success and his answer would be a “simple” one.

“I'm very old fashioned and I try to keep it simple,” Miltiades said. “We do lending based on collateral, capacity, character and credit scores. I don't have MBL loans with more than a 75% loan-to-value ratio.”

High quality loans and responsible lending practices have been the key to Workmen's Circle's efficiency ratio of 25.73%, the best among the nation's credit unions according to Callahan's analysis of figures current as of June 30, 2014. The credit union's accompanying ROA of 2.72% positions it among the top 20 credit unions in that category as well.

The credit union began in the early 1900s as a cooperative for Jewish merchants who pooled their funds to lend money to Jewish immigrants to keep them safe from loan sharks. In the 1950s, the members converted their cooperative to a credit union to take advantage of tax laws, Miltiades said.

The credit union's name is derived from The Workmen's Circle or Der Arbeter Ring, an American Jewish fraternal organization committed to social justice, the Jewish community and Ashkenazic culture, a designation that refers to Jews of German origin, according to the credit union.

Workmen's Circle picked up where the original cooperative left off in terms of cultivating a culture of community, quality and economy, Miltiades said. Since his arrival in 1997, the executive has managed to streamline processes, reduce overhead and, most importantly, improve earnings and increase services for the credit union's 1,300 members.

“Our loan-to-share ratio is 89%, up from 40% when I first got here,” Miltiades said. “I keep us short, I keep us liquid. We have good capital, and that's a big help there.”

Workmen's Circle's services are limited and aimed at profitability, Miltiades said. The credit union offers home equity lines of credit, certificates of deposit and money market accounts, which offer the same rate as standard savings accounts. The credit union does not offer credit cards or other services that would provide a lower rate of return.

“We spend money wisely and we don't have a lot of services but the services we do have, we do well,” Miltiades said.

Workmen's Circle also keeps its overhead low, to the point where Miltiades has just four staff members to help him run the credit union. Overhead control also has contributed to profitability.

“My last job here each week is to take out the trash,” Miltiades said.

Read more: Keeping expenses low in pricey Southern California …

Credit union values combined with high tech alternatives to help propel $1.4 billion F&A Federal Credit Union in Monterey, Calif., into the 20th position among Callahan's Top 20 credit unions. F&A posted an efficiency ratio of 45.35% as of June 30.

“We do monitor our efficiency but we don't set it as a goal,” Mike Harden, the credit union's EVP and chief information officer, said. “We do whatever is necessary to serve members, and it's more of the philosophy of how we do business that's contributed our efficiency.”

F&A serves members of the Los Angeles County Fire Department, employees of the Agricultural Commissioner/Weighs and Measures for Los Angeles County and some 51 city and county governments. Members tend to be better off financially, especially during southern California's wildfire season, when area firefighters put in a lot of overtime, Harden said.

The credit union's members have an average of $25,000 in combined deposit accounts, or $40,000 for the average family funds on deposit, he noted.

“It is a business philosophy, but we typically try and pay among the highest dividend rates in country, so money rarely leaves here,” Harden said. “We've continued in an upward growth pattern because of that.”

The credit union has always kept a close eye on expenses, an idea that led the credit union board in the 1980s to look toward increased automation in terms of service delivery.

“The board felt the future of financial services was electronic and they wanted to become an electronic credit union,” Harden said. “President/CEO Rich Andrews and I started in 1986, and it's been relatively easy to build on that philosophy.”

F&A has been using the same data processing system that it first installed in 1982, but its capabilities and sophistication has grown exponentially along with Harden and his staff's ability to manage credit union operations to a very exacting level. The credit union has more than 1,000 separate custom software programs that are used in daily operation and to extract member data, Harden said.

F&A operates on what Harden said are very thin margins in order to pay members higher dividends. When an employee leaves, responsibilities from the open job are generally parceled out to remaining staff first before refilling the position is considered.

The focus on members and electronic service delivery are the two philosophical and operational factors that has helped the credit union thrive and maintain a high efficiency ratio, Harden said. F&A shows little sign of slowing down in the future.

“We've redesigned our organizational structure to deliver more benefits to more members more quickly,” Harden said. ”We're rolling out mobile banking, launching a new website and making other improvements focused on delivering benefits. Then, it's a matter of onboarding the members into other products as quickly as possible.”

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.