Andrew Downin is the innovation director at the Filene Research Institute.

Contact

608-661-3746 or [email protected]

Unless you’ve already gone into winter hibernation, it's impossible to be unaware of the two newest influencers in the fast-changing mobile payments arena: Apple Pay and Merchant Customer Exchange.

While most credit unions are wondering which direction the winds of mobile payments will blow based on these platforms, all the while keeping other systems including CU Wallet in mind, a larger question remains necessary for credit unions to consider. What exactly is your institution's mobile payments strategy?

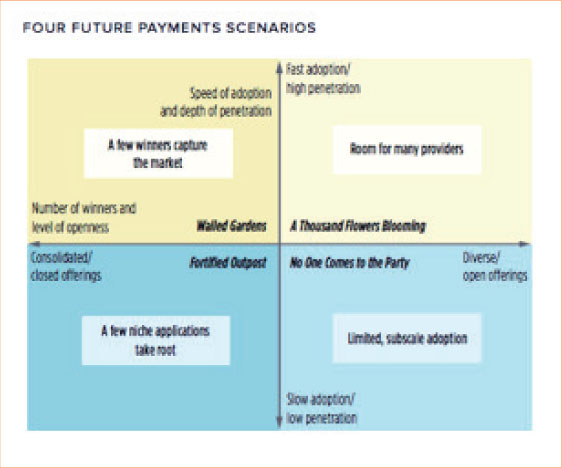

Earlier this year, the Filene Research Institute published a free report titled Future of Payments: Credit Union Implications that highlighted research and observations from a colloquium on the topic.

The report noted that while there is still a tremendous amount of uncertainty about how shifting technologies will impact payments, member loyalty, and profitability, credit unions should consider a number of steps to chart a course of action.

Foremost is establishing a clear overall strategy for the mobile revolution. What is your credit union's objective for considering this technology? Is it member acquisition, deeper engagement, revenue expansion? What is your institution's appetite for risk and willingness to be among the first to dive into mobile payments?

Beyond strategic considerations, it is critical to understand your members’ needs, behaviors, and desires to chart a digital payments path that will be attractive to your core segments. One novel idea is to consider identifying core member segments most in tune with technology and invite them to participate in focus groups to give you guidance.

No one knows where the shifting sands of mobile payments will take us in the next few years, let alone next few months. But by asking and answering key strategic questions, your credit union will better prepared to maintain solid footing on the changing terrain.

The report is the latest in a series of exclusive content from Filene available to CU Times readers. Check out these other reports:

- Filene's Digital Strategies

- Credit Union 2.0: An Opportunity to Build Collaborative Partnerships.

- Only Up: Regulatory Burden and Its Effects on Credit Unions

- Credit Union Implications of Living Trusts

- Gen Y Personal Finances: A Crisis of Confidence and Capability

- Impacts of Mergers on Credit Union Costs: 1984 – 2009

- Channel Delivery for Tomorrow

- From Presence to Purpose: Developing Social Media Strategies and Metrics for Credit Unions

- Improving Social and Environmental Sustainability: A Credit Union Assessment and Comparison

- Mortgages and Credit Union Performance: 1980-2011

- Future of Payments: Credit Union Implications – A Colloquium in Salt Lake City

- Asset-Liability Management: Theory, Practice, Implementation, and the Role of Judgment

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.