Two former Republican members of the NCUA Board and two former Democratic members have called for the return of budget hearings at the NCUA.

Two former Republican members of the NCUA Board and two former Democratic members have called for the return of budget hearings at the NCUA.

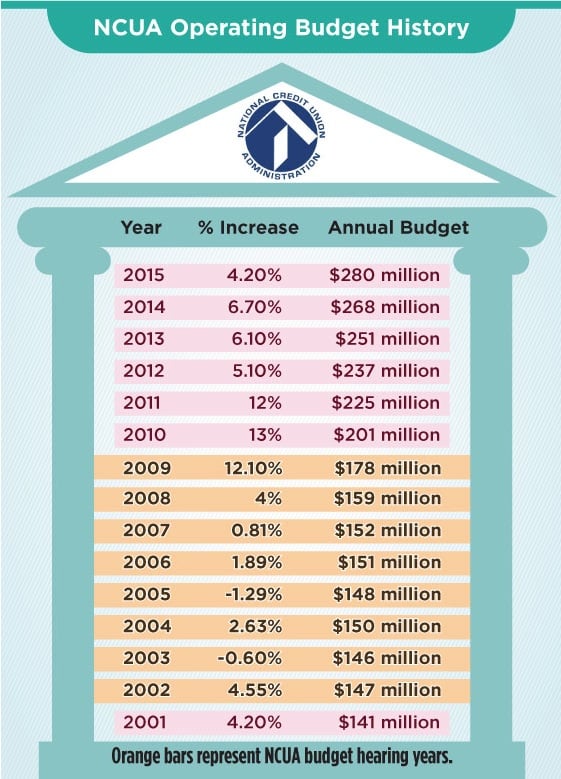

The history of the NCUA's operating budget is shown in the chart at left. Click on the chart to expand.

“I am a firm believer in the more transparency by a governmental entity to its stakeholders, the better the credibility of the policy decisions that come from the process,” former NCUA Chairman Dennis Dollar, a Republican, told CU Times. Dollar initiated budget hearings as chairman in 2001.

He added, “It is certainly possible, and even required by law at times through mandatory public comment periods and open meeting requirements, for a regulator to consider the views of its stakeholders without sacrificing his or her integrity to make the best independent decision possible. Elected and appointed officials do so every day.”

Dollar said there is more public confidence among stakeholders and Congress when a regulator has considered all viewpoints before making a final agency decision.

“Certainly, a $280 million budget that was $178 million only six years ago when the budget hearings stopped would fall into that category – the more transparency, the more credibility. And, unfortunately, vice versa,” Dollar said.

“I've always said that if a budget can stand the light of public scrutiny before it is passed, it is more likely to have greater credibility when it is finalized – whether it is changed as a result of the more open process or not,” he noted.

During the Nov. 20 NCUA Board meeting, NCUA Board Member Mark McWatters suggested the agency resume budget hearings and allow the industry to view the budget in advance of the full board vote on the proposal.

NCUA Chairman Debbie Matz, who discontinued the public budget hearings in late 2009, told CU Times after the meeting that having budget hearings where trade groups question the agency could result in regulatory capture.

“Each board member is entitled to their own beliefs. I do not believe it's prudent to release our budget in advance or to hold hearings on our budget,” Matz said. “Congress specifically provided the board with the statutory authority to determine how we spend our money. They gave us the authority to raise funds from the credit unions but they specifically gave the board the authority to determine how the funds are spent.”

Matz said regulatory capture existed previously in the agency.

“We had hearings on the budget. We reduced [fulltime equivalents] by a total of 71 in a five year period of time from 2003 to 2008 and when I came on in 2009, the industry was on the verge of collapse and we didn't have the resources that we needed in order to protect the industry so we were playing catch up,” she added.

CU Times asked Dollar and former NCUA Chairman Mike Fryzel, also a Republican, if the budget hearings were the reason the NCUA Board reduced the agency's budget before the corporate crisis.

“The reductions in the growth of the NCUA budget we were able to accomplish from 2001-2004 were driven by increased efficiencies such as reducing the number of NCUA regional offices from six to five – an action that stemmed directly from the fact that credit unions, even then, were merging at a rate of one per business day,” Dollar said.

He continued, “(The) NCUA regulates credit unions and insures the deposits in those individual institutions. When the number of regulated institutions has gone from 12,000 to less than 6,500 since 2000, the agency that regulates them should look for ways to be more efficient as it does so. Bigger government does not always produce better government. In fact, it rarely does.”

Dollar also said credit unions did very well during the RegFlex era of 2001 to around 2008.

“I would argue that the credit union industry as a whole weathered the storm of the financial crisis largely on the back of the capital they built during that period of time where earnings were up, regulations were more measured and the agency prioritized itself to be a more effective and efficient regulator,” he said.

Fryzel emphasized that the board makes the final decision regardless of what is said at budget hearings.

“I find it hard to believe that the budget would be reduced strictly because of public hearings. If a certain budget is needed and the agency can explain why, then the hearings become strictly informative,” he said.

“If the hearings produce good ideas or ways to save, they can be productive. Either way the process is open and transparent. The Board has the final say on the budget regardless of what may be said or discussed at the hearing. Hearings open up the process to allow stakeholder input,” he added.

Read more: The Dems support transparency, too …

Former NCUA Board Member Geoff Bacino, a Democrat, said he would like to see the NCUA bring budget hearings back.

“It allowed for the agency to explain the process it went through and it gave the stakeholders a chance to voice their opinions,” he said.

Bacino, who was recess-appointed to the board by President Clinton in 2000, said budget hearings do not compromise board members' objectively on the operating budget and industry issues.

“It gave us the views of the people we were regulating and in my time on two regulatory boards, I never found that to be a problem. I found that to be a benefit in terms of understanding what was going on in the industry of which I regulated,” Bacino said.

David Chatfield, a Democrat who was nominated for the NCUA board by President Ronald Reagan, said the agency should make the budget available to the public a few days before it is voted on at the NCUA board meeting.

“I'm firmly on the side of a more open NCUA budget development process, with the proposed budget presented and discussed during public hearings so that all interested parties can clearly see and address budget issues. It's disappointing to hear of resistance to such transparency,” he said.

In 2001, the NCUA operating budget stood at $141 million. In 2003, the budget dropped to $146 million from $147 million the year before. The budget increased to $150 million in 2004 and down to $148 million in 2005. In 2006, the budget increased to $151 million and continued to rise through 2015 to $280 million.

According to NAFCU, credit unions under $100 million in assets will pay $34.5 million of the 2015 budget, those with $100 million to $1 billion in assets will pay $108.9 million and those with more than $1 billion in assets will pay $137.3 million.

Fryzel recalled his decision to publicly propose a large budget increase when he was chairman in late 2008.

“As a result of (the decade's personnel) cuts, I subsequently found out there were credit unions that were not being examined for 18, 24 or 30 months between examinations and that was just totally not acceptable. That's when we moved to increase the budget substantially and re-instate the 12 month examination program,” Fryzel said.

He added, “In 2008, we realized we had gone too far with those budget cuts to the point where we were now threatening safety and soundness. Since that time, we have increased the budget a number of times to the point where two years ago, I finally said, 'okay, we're where we should be. There should not be any more increases.'”

While the number of credit unions is decreasing, Fryzel said they are more sophisticated.

“However, the examination staff can be reduced and as a result of that, you don't just take those people and put them someplace else, you reduce them. If the region says, 'I no longer need three examiners.' Okay, that's a budget cut of three. You don't take those three positions and create other positions,” Fryzel said, referencing the creation of four new positions in the NCUA's 2015 operating budget.

Fryzel said the NCUA should inform the industry about any new positions and explain why they are needed.

“You give them an opportunity to at least talk about it before you put it in place,” he said.

Matz told CU Times regulated entities should not actively participate in the budget process.

“In my previous experience participating in NCUA budget hearings, I was dismayed to find that no matter what level of spending the agency proposed, comments from the industry were knee-jerk reactions demanding across-the-board cuts in the budget and staffing levels.”

Congress, in granting the agency authority to assess fees upon credit unions, also granted unilateral authority for the NCUA Board to determine how those funds are spent, she noted.

“It is important to recognize that no other independent federal regulatory agencies hold public hearings on their budgets,” Matz said. “Universally, federal financial services regulators know that the safety and soundness of the industries they regulate is directly tied to the regulators' independence.”

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.