Banking today isn't what it used to be. Credit unions are expanding beyond traditional accounts and are not only looking for ways to increase wallet share from existing members, but also attract new consumer and business members.

Banking today isn't what it used to be. Credit unions are expanding beyond traditional accounts and are not only looking for ways to increase wallet share from existing members, but also attract new consumer and business members.

Offering a full range of products and services, such as cross border payments, is one way to accomplish this goal. There are multiple payment methods: Which is the best for your members?

International wires have been the traditional choice for sending USD or foreign currency payments, as they are a secure and reliable option. In comparison, the relatively new international ACH provides the same capability but is more cost effective.

Both options involve two domestic payments: One that is received in your provider's USD account to pay for the transaction, and the other sent from your provider's foreign currency account to settle the transaction. USD payments sent internationally are converted to foreign currency by the foreign bank if the receiving account is not held in USD.

Both methods are perfect for Regulation E compliance as they provide exact exchange rates and totals for the disclosures.

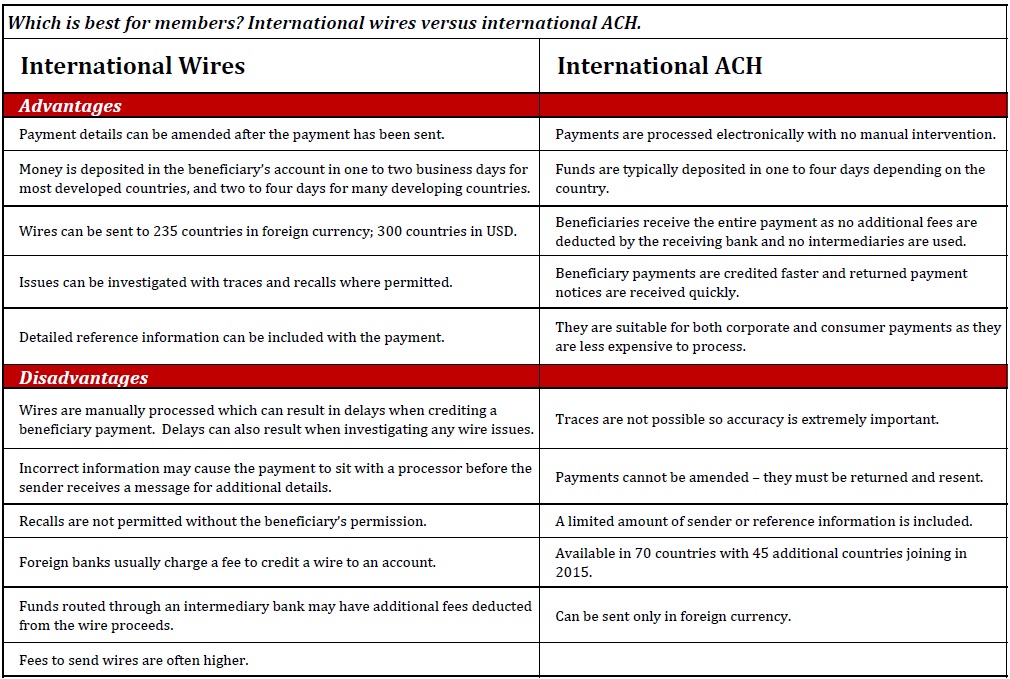

Each method has advantages and disadvantages, as detailed in the graph shown at left. (Click on the graph to expand.)

Each method has advantages and disadvantages, as detailed in the graph shown at left. (Click on the graph to expand.)

Offering only one method limits your ability to serve your members, so it is important to understand their needs to be able to proactively select the appropriate payment method.

To determine the best option for your clients, you should take the following into consideration.

Wires are best to use when:

- a lot of reference information must be included,

- an international payment must be sent in USD, and

- delivery timing is critical.

ACH is best to use when:

- cost is a major factor, or

- the amount is a low-value payment.

Members are loyal to their credit unions but if they require a product or service that you do not offer, they'll have no choice but to look elsewhere. Credit Unions that do not offer cross border payments risk losing some of their most profitable members to their competition.

Partnering with a provider is a cost effective way to protect your membership base.

Dan Caputo is vice president of global treasury solutions for AscendantFX Capital Inc. He can be reached at [email protected] or 877-452-7186.

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.