The nation's five largest credit unions filed financial information with the NCUA last month that will be used for stress testing in compliance with the regulator's new rule.

The nation's five largest credit unions filed financial information with the NCUA last month that will be used for stress testing in compliance with the regulator's new rule.

The results of those tests – and the safety and soundness of a significant percentage of industry assets – will not be made public.

The credit unions undergoing the testing shared mixed opinions on that topic. They include the $62.5 billion Navy Federal Credit Union, Vienna, Va.; $29.1 billion State Employees' Credit Union, Raleigh, N.C.; $18.6 billion Pentagon Federal Credit Union, Alexandria, Va.; $12.7 billion Boeing Employees Credit Union, Tukwila, Wash.; and $10.4 billion SchoolsFirst Federal Credit Union, Santa Ana, Calif.

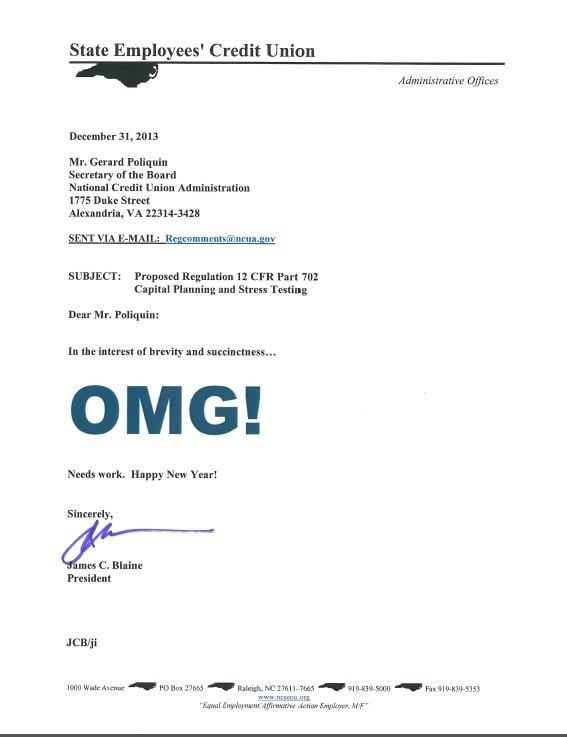

Not surprisingly, the Jim Blaine-led SECU supports stress test transparency. Blaine's comment letter addressing the rule when proposed is shown at left. (Click on the letter to expand.)

Blaine told CU Times he thinks the NCUA's mandate that the results remain confidential is out of step with the cooperative philosophy. He pointed out that banking regulators require public disclosure of bank stress test results.

“Publishing the information would require the agency to be more exact in its analysis, which is good protection for the public and for credit unions,” Blaine said. “We want the NCUA to be strong and transparency helps us all. Lack of transparency simply makes them appear weaker.”

Banks are required to publish their stress test results so that sophisticated investors in their institutions, not depositors, have the information necessary to make prudent investment decisions. That realization has been one of the cornerstones of the NCUA's decisions about test result transparency

Credit unions lack outside investors. At the NCUA board's April meeting, Scott Hunt, director of the Office of National Examinations and Supervision, argued that “publishing stress test results requires the proper due diligence and care to assure that the correct message is conveyed. If results were misinterpreted they could cause undue harm to the institution. Disclosure (of test results) would speak to an audience that does not exist.”

Blaine disagreed.

“Two million SECU members do exist and have the right to know about the cooperative they own and operate,” he said.

Chip Filson, chairman of Callahan Associates and a former NCUA executive, also disagreed with the notion of confidential stress test results.

“(The) NCUA's statement that there is no body of interest in this information is completely false and takes away the fundamental rights of the members of the institutions,” he said. “I think the NCUA is uncertain of its own capabilities, or they are misunderstanding the role of cooperatives.”

Pentagon Federal Credit Union also came down on the side of transparency in its Nov. 14, 2013 comment letter.

“Public disclosure should be required,” wrote Frank R. Pollack, PenFed's president/CEO at that time, noting that several rounds of stress testing should occur to make sure the process is functional. “At the bottom, large credit unions should be just as transparent as banks.”

Read more: Most prefer confidentiality …

In terms of test results disclosure, however, the majority of the credit unions and trade groups who submitted comment letters sided with the NCUA to keep stress test results confidential. The commenters were less concerned with questions about the NCUA's capabilities to stress test than they were with having to interpret complex financial processes for members who may lack the sophistication to understand what it ultimately means to credit union safety and soundness.

“Trying to explain results to the average would be difficult given the complexity of the models,” Katherine Elser, CFO and SVP of finance and administration for BECU, said. “Furthermore, we as credit unions are not even sure that we will have total transparency into the models and assumptions used by the NCUA making it difficult to explain or defend the results.”

SchoolsFirst Federal Credit Union, another of the five credit unions being tested, agreed that test results should remain confidential for much the same reason.

“We are recommending not incorporating a requirement to disclose the capital stress test results at this time due to potential inaccurate conclusions and misinterpretations regarding the health of credit unions,” wrote Francisco Nebot, Schools First's SVP/CFO. “It would not be beneficial and could potentially cause unnecessary alarm to credit union members.”

For Navy FCU's Vince Pennisi, chief investment and risk officer, revealing stress test results is more a matter of timing. As a new project, now is not the right time, he said.

“This is a new process for our regulator and one in which we're all learning,” Pennisi said. “We think there's a natural learning curve between the credit unions, the NCUA and BlackRock. Until there is a certainty that everything is being modeled accurately we should keep the information confidential,” he said.

“We're hopeful this turns out to be a fair and accurate interpretation of risk,” Pennisi added. “Once the process and outcomes are stable releasing the information becomes the regulator's decision.”

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.