Major non-bank players have responded to those choosing to escape brick-and-mortar financial institutions while avoiding overdraft fees.

As competitors in the financial services industry grow, stricter regulations on fees have also changed the face of checking. Courtesy pay opt-in has cut the number of members with automatic overdraft protection. Because overdraft fees are still the largest source of noninterest income revenue for many credit unions, that's a big concern for some.

Recommended For You

Increased pressure from regulations and new competition have pushed credit unions to take a closer look at checking and payment products, Bill Handel, vice president of product development for Raddon Financial Group, a Lombard, Ill.-based consumer research firm, said.

The checking market is still dominated by the nation's largest banks in spite of their lack of a totally free checking product, according to RFG research. But new players are entering the field.

For example, Wal-Mart's 4,200 U.S. stores are slated by the end of October to roll out GoBank, a new checking account product that won't charge overdraft fees and doesn't require minimum balance or monthly fees with qualifying direct deposits.

While some analysts have said GoBank is not a threat to credit unions, Handel cautioned cooperatives to be weary of all competitors in the rapidly changing payments space.

What do members really want when it comes to checking, and how can credit union better position themselves in the evolving payments space?

Read more: How credit unions can remain relevant …

Wal-Mart and others entering the payment arena are banking on soaring mobile usage to help them develop primary financial relationships with consumers, Handel said. In order to outrun the competition, credit unions must keep pace with technology and improve the overall member experience, he suggested.

Handel told CU Times that the conversation about technology and other unique products and services needs to be central and embedded in the messaging to members.

"Credit unions have to make sure members are aware about technology that is offered, such as mobile banking, and other products and services that add value to the experience," he said. "It can't be an afterthought."

"Instead of focusing on products and pricing, the messaging needs to focus on the concept of the experience, the sales and service environment," Handel added. "It's all about how you position yourself in the marketplace."

Credit unions should evaluate checking and payment product lines, he suggested. The first step is to review what percentage of members have signed opt-in forms. Banks have experienced higher numbers of opt-ins for overdraft protection, he noted.

Second, credit unions must also evaluate technology, Handel said.

"They don't have to be the leader, but they need to be a fast follower."

Before plunging into any new technology, credit unions should consider the demographics of their membership and historic usage patterns of other products and services.

The use of mobile banking and technology, for instance, seems to be tied as much to income as age, Handel said. Higher income individuals, especially Gen Y members, tend to be the earliest adopters of new banking technology, according to Raddon's research.

Third, Handel said credit unions must also enhance operational efficiency, member relationship development and the overall consumer experience.

"You have to figure out how to make your checking and payment products and the overall experience more attractive to the younger demographic," he suggested.

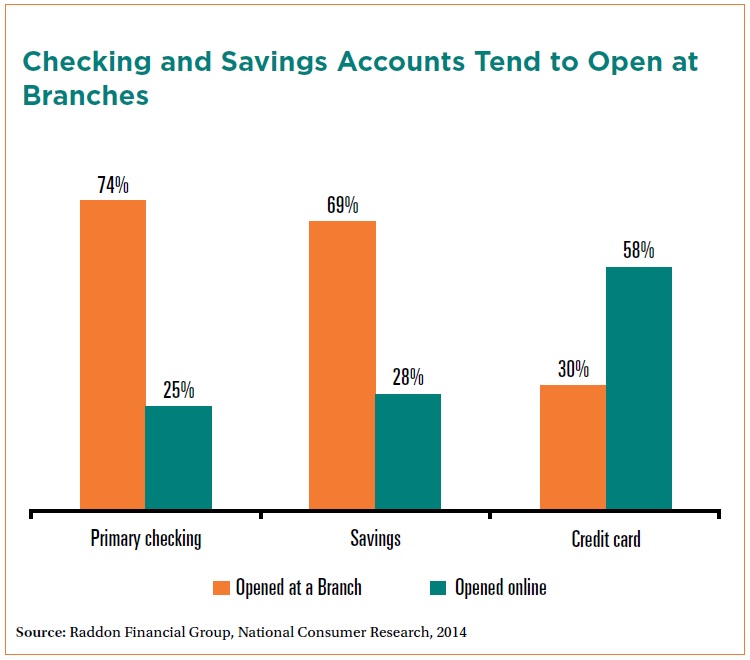

Almost 75% of consumers still prefer to open checking accounts at a branch, according to Raddon's research. Handel said branches should also be equipped with suitable technology to enable members to conduct payment transactions.

"All of our research indicates that branches are not going to die, at least not in the foreseeable future," he added.

But are the days of free checking over at credit unions? From 2010 to 2012, the percentage of free checking accounts dropped from 78% to 72% at credit unions and from 65% to 39% at banks, according to Bankrate's 2013 Credit Union Checking Survey.

Despite the challenges of competition and regulation, many financial institutions are still reaping profit from checking accounts, according to industry analysts.

Research from Pew Trust noted the median size debit card transaction resulting in overdraft was $24, while the average overdraft fee was $34.

Overdraft fees, however, may soon face another swipe by the regulators.

During a Sept. 18 Senate Banking Committee hearing, Travis Plunkett of Pew Trusts submitted written testimony, calling for tighter checking regulations to protect consumers, such as ensuring that overdraft penalty fees reasonable are proportional to the costs of covering the overdraft.

In mid-August, the Wall Street Journal published an article that reported a 14% increase in credit union overdraft fees and compared credit unions to big banks in the headline. Sourcing Moebs Services, WSJ said the median credit union overdraft fee was just $1.50 lower than the median overdraft fee at a bank. Five years ago, that margin was twice as large.

To prepare for more possible regulatory changes and grow their share of primary relationships, cooperatives should start planning now, Handel said.

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.