Millennials and baby boomers are swapping geographies.

Millennials and baby boomers are swapping geographies.

As millennials move to places with better job prospects, baby boomers are downsizing to smaller communities with lower population density, according to a report from real estate data firm RealtyTrac.

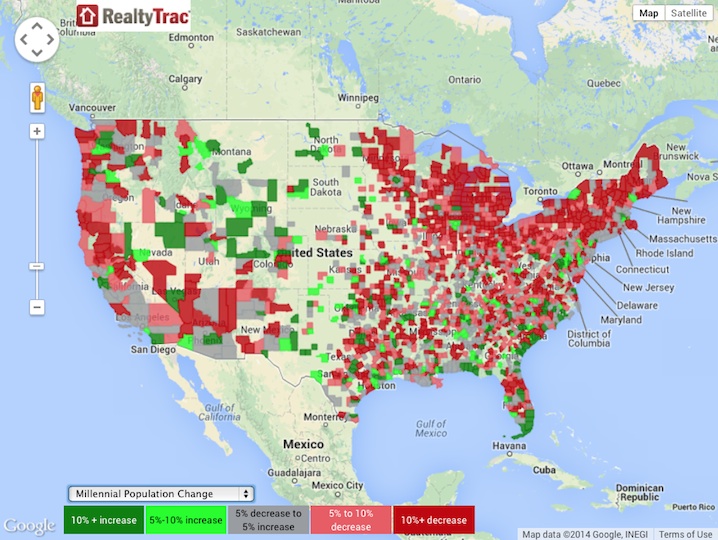

Their migration patters are illustrated in the heat maps at left, with green counties representing net population gains and red counties experiencing net losses. Click on the maps to expand.

Released Thursday, the report analyzed census data between 2007 and 2013 from 1,800 counties nationwide to determine which counties were seeing the biggest shifts in millennial and baby boomer populations. RealtyTrac then added data on median real estate prices, price appreciation and rental rates to get deeper understanding of migration rates and their impacts.

Released Thursday, the report analyzed census data between 2007 and 2013 from 1,800 counties nationwide to determine which counties were seeing the biggest shifts in millennial and baby boomer populations. RealtyTrac then added data on median real estate prices, price appreciation and rental rates to get deeper understanding of migration rates and their impacts.

RealtyTrac found that, in general, millennials moved to areas with lower unemployment and better job prospects, but also with higher home prices and rents. Baby boomers, in general, moved from higher-priced real estate markets to lower priced ones, even though those places tend to have lower median household incomes and slower home price appreciation, RealtyTrac added.

“The millennial generation is the key to a sustained real estate recovery and boomers who are downsizing are helping open the door for many first time homebuyers, while also driving demand for purchases and rentals in the markets where they are moving,” RealtyTrac Vice President Daren Blomquist said.

The counties that saw the largest rise in the number of millennial generation consumers had average household incomes of $62,496, average populations of 587,522, median homes prices of $406,800 and average fair market rents for three bedroom apartments of $1,619. The counties that saw the greatest growth in the number of baby boomers had average household incomes of $46,268, average populations of 261,232, median home prices of $144,875 and average fair market rents for three bedroom apartments of $1,182.

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.