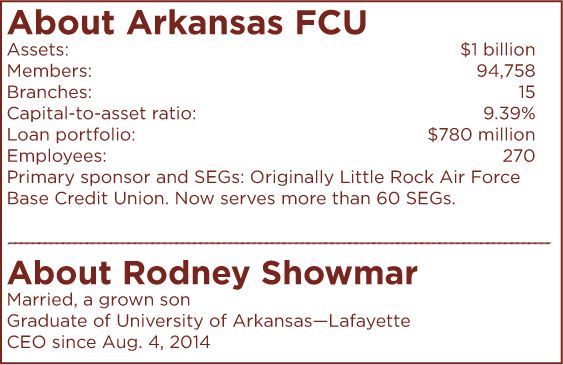

When the announcement that Rodney Showmar would be the new president/CEO of Arkansas Federal Credit Union hit the desks of savvy trade press editors, it caught their attention.

What sparked their interest was the fact that Showmar's background is in marketing. That used to be more common. But today, most credit union CEOs bring backgrounds in accounting, finance or similar fields, and their résumés list jobs with financial institutions instead of department stores.

Does Showmar think there could be a trend back to marketing credentials? He chuckled.

“I could say I hope so,” he quipped. “I guess it depends on the individual credit union and what needs they have. Thankfully for me, at this credit union, the board thought we needed more of a marketing and operations background.”

Until moving into the CEO slot Aug. 4, Showmar served as AFCU's SVP and COO. Prior to joining the credit union in 2001, he was a senior buyer with Dillard's Department Stores. He has also served as senior marketing research analyst at Reliant Energy and as founder and president of Partygras Party Rentals in Little Rock, Ark.

Showmar believes the marketing and operations know-how he gained in those jobs has a major impact on his work at the credit union.

“It was a great training ground for today,” he said. “We think of banking and credit unions as maybe different industries. In reality, we have stores, just as Walmart and others have stores. We have to create an experience for our members coming into our stores.

“That was a huge help in my career, to understand consumer behavior from a retail perspective. It's a little more difficult for credit unions because we really don't have a product that we're selling. Dillard's sells shoes, and if my wife goes to Dillard's and buys shoes, and she loves those shoes, then she loves Dillard's. But members don't come in here and walk away with things. The only thing they walk away with is the interaction they had with us.”

Marketing research ties in, Showmar explained, because if you can figure out how members are going to react to a certain promotion or product or service, that helps you understand what you need to provide.

He tells new employees the credit union is in a commodity business. Pretty much everything members can get at an AFCU branch they can obtain at another financial institution that's a five-minute drive away. The member experience is the only thing that is different. Someone has to want to drive past seven different banks and credit unions to visit AFCU.

“We have to do whatever we need to do to make the member want to come here instead of someplace else,” Showmar said.

Then there's his entrepreneurial spirit that started Partygras. Back in the mid-1990s, one of Showmar's cousin, who was in the party rental business, decided it would be great if they could open their own company.

“It was very successful, it was fun and very educational,” Showmar recalled. “The business still continues today.”

Turning back to AFCU, he said today's financial environment is extremely competitive. From a regional or state perspective, the credit union faces a typical set of rivals ranging from community banks to national banks. Then there are newer names, nontraditional institutions such as Apple, Google, PayPal and Walmart.

Those new kids on the block are going to try to figure out how to get into financial services, Showmar said. The competitors credit unions see right now are not necessarily going to be the major challengers in the future. It's the unseen, unknown contenders that concern him going forward.

“The only thing a checking account does is help you pay for stuff,” Showmar stated. “So, if somebody can help you come up with a way to pay without needing a bank or credit union, they're going to start taking market share away. If there's a way for members to acquire goods without needing a loan at the credit union, that's competition.”

A major challenge is trying to figure out the next step for technology. The pace of change continues to grow exponentially, and Showmar predicted the speed of innovation in the next five years will outstrip the previous decade.

As for AFCU joining the Billionaires Club, Showmar said the credit union did it the old fashioned way: going out and earning business. There has only been one small merger.

Instead the credit union has worked to boost wallet share. There has also been a huge push into indirect lending. Instead of being open on Saturday and Sunday, AFCU lets the car dealers remain open and take care of members as they're buying vehicles.

Staff at the credit union credit outgoing President/CEO Larry Biernacki for much of AFCU's growth, pointing out that he drove the bus. Biernacki, in turn, is quick to praise employees and members.

“This accomplishment reflects the dedication of our board and the commitment of our staff to our vision – to improve each member's financial life,” he said. “Our members' support is shown in our growth.”

AFCU is spread across the state, and if you walk into various branches you'll see demographics that reflect each community. In some areas, there may be older members. In others, college students may dominate and in another city, there may be large numbers of urban businesspeople.

Showmar can relate to Arkansas demographics. He's a self-described home-town boy who was born in Little Rock, attended the University of Arkansas, and joined Little Rock-based Dillard's right out of college.

Married and the father to a 24-year-old son, Showmar likes to spend his weekends and evenings hiking, on a golf course, out for dinner, or playing cards or board games at his house or a friend's home.

His advice to other CEOs is simple: “I hire people who are smarter and better than I am. Let them go, see what they do best, and stay out of their way for the most part.”

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.