While commercial and industrial lending can be critical lines of business for lenders, getting caught up in a frenzy to finance more loans may cause some missteps that could wound portfolios for years to come.

While commercial and industrial lending can be critical lines of business for lenders, getting caught up in a frenzy to finance more loans may cause some missteps that could wound portfolios for years to come.

According to the Aite Group report, The Booming C&I Market: Bankers Beware, because rates can fluctuate with the supply of credit in the marketplace, loan officers at credit unions and banks alike must closely manage and nurture each relationship and monitor every credit exposure in the lending lines of business.

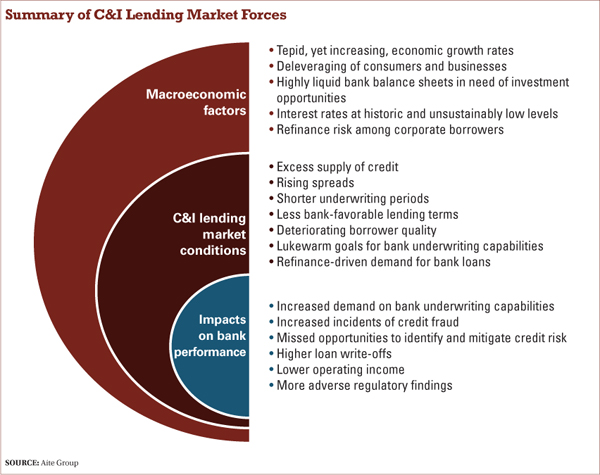

A list of risks summarized in the graph above. (Click on the graph to exapnd.)

Those standards are still important as the demand for bank loans continues to increase, said David O'Connell, senior analyst in wholesale banking at Aite and author of the report. Since 2008, low interest rates have made credit available to companies that would otherwise be unable to borrow.

With many public and private debt issuances bearing terms of between three and five years, Aite expects many public debt borrowers to fail to refinance with their current non-bank debt providers. When such companies seek alternate forms of finance, the expectation is the demand for banks' commercial loans will increase significantly.

Higher spreads on bank loans are another area to watch because as more companies seek bank-provided debt, banks will be in a position to charge higher spreads over their cost of funds. Spreads generally increase and decrease with borrowing rates, O'Connell said.

For credit unions, the potential risks of riding the loan demand and higher spread wave could have stronger implications than for their bank counterparts.

“Credit unions are going upmarket with heavier participation in commercial lending,” O'Connell said. “My prediction is there will be a bunch of borrowers with unsuccessful credit risk in a low rate environment that will not be as creditworthy when rates go back up from where they are now. There's going to be a lot of competition to do two things: book loans or turn down the right loans.”

Indeed, with competition for commercial and investment loans heating up, the increase in reserves could represent a move deeper into the risk pool for some banks, according to SNL Financial, a Charlottesville, Va.-based research firm.

In the second quarter, reserves for commercial loans totaled $26.9 billion, up from $26.57 billion in the first quarter and $25.2 billion in the 2013 second quarter at commercial and savings banks.

As reserves rise, lenders and risk managers at banks who see lending appetite outpacing their underwriting capabilities should consider advocating for either slower C&I portfolio growth or better underwriting capabilities, according to the report.

Aite surveyed senior IT executives at 20 large banks based in North America. When asked about their loan underwriting capabilities, 62% of respondents said they were “satisfied” with these capabilities and the same percentage sought to have “stellar” underwriting capabilities, O'Connell said.

Although those percentages were high, O'Connell said there were three key concerns hiding beneath the surface.

First, underwriting is one of only four core banking competencies, O'Connell said. Though seemingly complex, the business of banking really only comprises gathering deposits, deploying the proceeds as loans, ensuring that loans get repaid, and providing related services, according to the report.

“Aite Group is concerned that a greater majority of banks do not seek stellar capabilities for a skill that is a key bank competency and crucial to the maintenance of profitability levels,” the report read.

Second, underwriting can be a competitive differentiator, O'Connell noted. When lenders and analysts underwrite loans, they strike a balance between the desire to win a piece of business and the need to book a loan that will not deteriorate in credit quality, something that is not easily done.

The credit mandate requires as much protection in the form of covenants, collateral and guarantees as possible; a spread over cost of funds that compensates for the riskiness of a loan is also required, the report read. But in order to win business, underwriters also have to avoid structuring a deal so conservatively that a rival bank offers more favorable terms and wins the business away.

O'Connell said the more support underwriters receive and the more these capabilities are accompanied by stellar goals, the better a bank will be at winning new business without structuring weak loans.

“Underwriting speed is also critical to competitive outcomes; the faster a bank can underwrite a loan in a way that accommodates its risk appetite, the more often it will win business in competitive situations,” he said.

Third, underwriting impacts regulatory outcomes. O'Connell said during audits, bank examiners have always focused heavily on banks' underwriting capabilities, including how their credit policy is designed, how those rules are enforced, how well staff underwrites loans, and how well underwriting is documented.

As a result of the global financial crisis of 2008, various bank regulators in the United States now use stress testing to evaluate the banks they regulate, O'Connell said. Within these demanding and broadly scoped tests are evaluations of a bank's ability to manage risk with appropriate underwriting.

“Banks shouldn't take their eye off the ball to focus on competitive threats,” O'Connell said. “Competitiveness should not come at the expense of banks' core competencies.”

Banks' core business is in gathering deposits, deploying the resulting liquidity as loans, and managing the resulting risks in their loan portfolios, he added.

“If banks don't adequately invest in their credit risk management and underwriting, the resulting losses will become a far bigger problem than any threat of disintermediation,” O'Connell said.

Meanwhile, credit unions are in a keen position to make the most of their conservative lending standards practiced during the height of the Great Recession, another business lending veteran said.

Member business loans increased by 44% since 2008 while commercial loans at smaller community banks have declined by more than $120 billion or 25%, said Larry Middleman, president/CEO of CU Business Group LLC, a business lending and services CUSO that serves more than 460 credit unions in 45 states.

Middleman also noted the strong commercial real estate activity in eight of the 12 Federal Reserve Districts, and that four of 10 small businesses are looking for loans this year.

With this demand, there are a variety of innovative businesses lending options available to credit unions today, he offered.

“From government-guaranteed lending to equipment leasing to online working capital loans, credit unions can choose from a menu of lending options to offer their members,” Middleman said. “And all of these allow the credit union to keep the core business relationship while supplementing with additional products and generating fee income for the credit union.”

Overall, commercial loan dollars at banks dropped 10% between 2008 and 2011, and have now recovered to 2008 figures, he said. Additionally, credit union charge-offs have stayed well below those of banks.

“Credit unions stayed below the magical 1% charge-off rate for business loans, meaning less than 1% of total business loan balances,” Middleman said. “On the other hand, commercial bank charge-off rates went as high as 2.45% in 2009. Given the difficulties of the recession, this performance by credit unions is quite admirable.”

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.