Big data this. Big data that. While the term used to mean a lot of things, to Russell Palmer, targeted offers are where it's at.

Big data this. Big data that. While the term used to mean a lot of things, to Russell Palmer, targeted offers are where it's at.

Palmer is card services manager at the $1.9 billion Spokane Teachers Credit Union in Spokane, Wash., and has been using the ability to sift through large stores of data from different sources to focus on things like behavioral segmentation, balance transfer offers and rewards programs for the cooperative's 57,000 credit card accounts and about twice that many debit card holders, he said.

Those sources currently are transactional and other data from First Data and STCU's own core system, a Phoenix EFE platform from Davis + Henderson.

Recommended For You

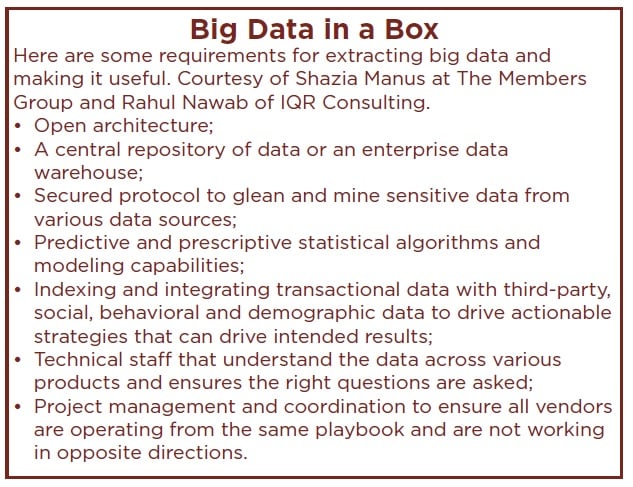

Along with Palmer, the team involved a STCU data warehouse analyst, staffers from The Members Group, the 235-client Iowa processor that runs on First Data rails, and analytics specialists from IQR Consulting in Santa Rosa, Calif.

Like the cloud, the term "big data" gets tossed around a lot and can mean a lot of things.

"Data has been around for ages. But until recently, data has been used in an isolated, linear fashion to drive one product or activity," said Shazia Manus, TMG president/CEO. "It has not been used in aggregation with the multitude of data points that are available today to provide a broader context. What has shifted is the volume and magnitude of data, as well as increased availability and access to that data."

To IQR Consulting President Rahul Nawab, big data for credit unions refers to the creation and organization of disparate and different data sources accessible across the organization.

"Data analytics is all about mining existing sources of information to arrive at the best possible decision, whatever the question may be. Today, those questions happen to be most centered on payments," he explained.

Palmer said big data really means leveraging information so STCU can know its members better and position its products and promotions to be more relevant to them and their needs.

He used an example of how the data warehouse gets mined and refined at his credit union.

"Say you have a home loan with us. Well, we can look for households where children have recently turned 16 and know from there that you might also be looking for an auto loan, so it makes sense for us to try to target you for that kind of offer."

Nawab, whose IQR client list includes 19 credit unions, takes it a step further.

"An evolving example is how small business loans are approved," he said. "Take for example a small business with less than 10 employees and less than three years of profitability or balance sheet history. Yet, this small business has a heavy social and payment history with Amazon."

Big data analytics can create an online or social index to learn what this potential borrower is saying and how they are behaving to better evaluate risk, Nawab said. "With this intelligence, loan managers can make an immediate decision versus waiting for three years of balance sheets to materialize."

A lot of this, of course, sounds like customer relationship management, but it's not exactly the same thing, Manus noted.

"When the topic of big data analytics arises among credit union leaders, they often talk about the work they're doing with their CRM solutions," she said. "But often, that CRM usage is confined to one area, most often marketing. It's not typically being used in an integrated fashion to make decisions across the institution."

Instead, CRM is one of many data sources in the broader context of Big Data analytics, Manus added.

"In this era of big data, credit unions should be mining information from online and mobile banking, call centers, payment transactions and products such as loans and deposits, in totality to drive the credit union's growth strategy," Manus said.

That can be easier said than done.

"Currently, data and data sources are extremely fragmented. To figure out a single view of the member requires a lot of effort, specifically in pulling data from various sources, including vendors and processors," Nawab said. "This naturally requires a lot of effort to coordinate, organize and eventually analyze."

Palmer acknowledged that the work has just begun at STCU and that work is underway now to develop card rewards projects that will provide both a good fit for most of his members as well as recurring income for the credit union.

"We really feel like we're in the early stages of leveraging big data at STCU," he said.

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.