The $3.8 billion Phoenix cooperative knew it was time to shake some things up, Cathy Graham, vice president of marketing said. One of those strategies included targeting auto refinance qualifications to members.

"We started to see it pick up about six years ago. The efforts were really successful based on the markets in our marketplace," she recalled. "We were seeing some nice volume but we were just going to our members."

Recommended For You

Since Desert Schools is a community-chartered credit union that encompasses all of Phoenix, Graham said there was much more room to do broader marketing for auto loan refinances. At the time, however, everyone was promoting rates along the lines of "if you have a higher rate than X, we can lower that rate as low as Y and you can lower your payments," she explained.

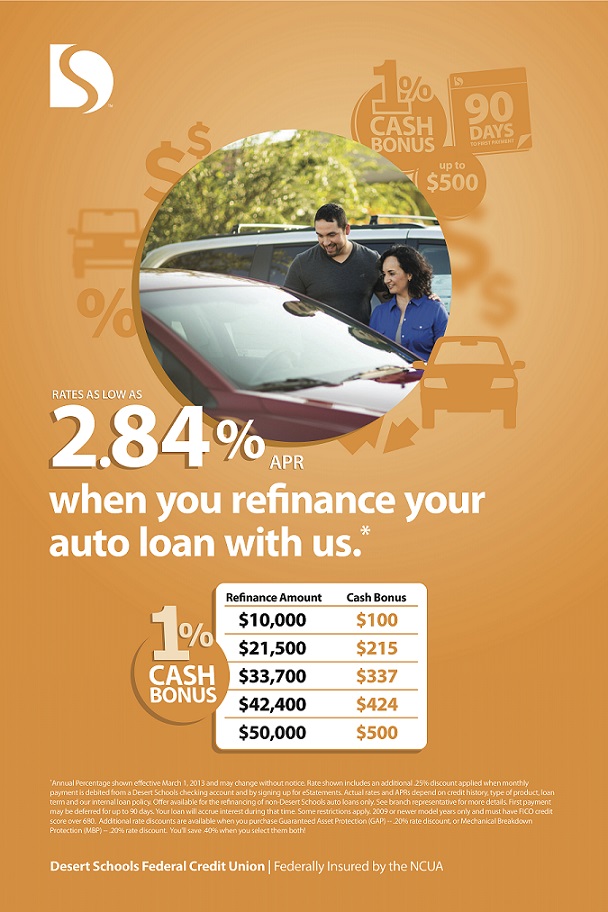

Not wanting to get lost in the rate shuffle, Desert Schools staffers started brainstorming on how to stand out from the competition. They turned to the credit union's members for feedback on 10 different offers, Graham said. Among them were gift cards and auto care packages. But it was a 1% cash-back incentive that won over the majority of the members in that focus group.

"What we heard back was they expected a good rate but they wanted something tied to cash. The 1% cash-back tested the highest," Graham said, adding the credit union's current auto loan rate is pretty low at 2.84%.

The incentive went live on a Monday back in June 2012 and by the next day, Desert Schools' auto refis experienced a significant spike, Graham said.

"I've been in marketing for over 20 years and I've never seen such an overwhelming response to a (marketing campaign)," she mused.

Over the course of the remainder of 2012, Desert Schools continued the cash-back incentive intermittently and then the offer went dark for a while, Graham said. In March 2013, the credit union resurrected the offer and loan volume has soared since then.

More than $237 million in auto refis have been generated and members have received $2.37 million, according to Lisa Saye, assistant vice president of consumer lending.

Those who refinance their non-Desert Schools auto loans with the credit union can get up to $500 cash back. The amount paid is based on 1% of the total loan amount, which carries a $10,000 minimum, and does not include any additional loan dollars toward ancillary products such as guaranteed asset protection and mechanical breakdown protection.

Graham said Desert Schools did some analysis on what the credit union was getting in consumer direct loans before the cash-back incentive promotion. The figures were impressive: $7 million per month with no promotion compared to $14 million with the promotion. Graham noted that in July, the credit union did $16 million in auto refis.

The one problem that came with the cash-back incentive was not being repared for the surge, Graham acknowledged.

"We did get a little behind," Saye added, noting it helped that the loans were refis rather than new originations. "We realized we didn't have the staffing to keep up but we made some tweaks in centralized processing and got all of the kinks ironed out. During our highest volume months, we were able to process without strapping staff."

According to Chicago-based Cars.com, an online vehicle shopping website, cash-back offers are abundant in the automotive market. National customer incentives tend to be in the $500 to $2,000 range. The company ranked the 10 best customer incentives in the marketplace based on percentage off base manufactured suggested retail prices. Topping the list were two 2013 Jaguar models, with the 2014 Dodge Challenger, 2014 Cadillac XTS and 2014 Dodge Charger rounding out the five best offers.

Meanwhile, Desert Schools' cash-back incentive is holding its own so well that the credit union is offering a similar promotion with its home equity product, Graham said. While the financial institution can't offer the deal on first mortgages, another focus group was tapped to get a feel for if, hypothetically, it could work, too.

Indeed, that feedback from focus groups has helped Desert Schools with its introduction and tweaking of products and services. Graham said online groups are even better because they are a lot less expensive and people can participate anytime during a 24-hour period. Typically, between 60 and 75 people respond. While the responses are more qualitative than quantitative, the credit union has some control over what's real and who's trolling.

"I can go in and see what people are saying," Graham said. "I can ask the facilitator to ask, 'Hey, find out if that person wants to clarify,' or 'I notice this person is going down a wrong path, can we cut off access?'"

The cash-back incentive also helped to justify Desert Schools' media advertising in the Phoenix market to the higher-ups, Graham said.

"We can say, 'If we spend this amount to promote our product, we can get this.' The COO and CFO are saying, 'Hey we need more money for marketing.' When we look at ROI with a direct mail campaign, you're spending hundreds of thousands of dollars. Between consumer lending, marketing and financing, we want to make sure that we're getting ROI."

Every bit of exposure helps in its competitive arena. Graham said with 3% to 4% of auto market share, Desert Schools is ranked fourth behind Wells Fargo, Bank of America and Chase Bank.

However, 10% of all consumers in Phoenix have some type of relationship with the credit union, Graham added. Another advantage is Desert Schools spends all of its marketing dollars in the Phoenix area so it has sustainability. For every $1 the credit union spends on auto refis, it generates $58 in balances, Graham noted.

"For our auto pre-qualification direct marketing, we're getting a response rate of about 16% for people applying for an auto refi loan and a close rate of 7% for funded loans." she said.

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.