LAS VEGAS — NCUA Chairman Debbie Matz announced Wednesday that the agency plans to propose a rule that would eliminate the 5% cap on fixed assets at the upcoming board meeting.

“The proposal would cut the red tape and streamline the process for federal credit unions to occupy land or buildings. Our intent is to allow federal credit unions to manage their own fixed-asset purchases without having to seek permission or waivers from NCUA,” Matz said in her prepared remarks for NAFCU's Annual Conference.

“When you want to update your facilities, upgrade technology, or make other purchases that have no impact on safety and soundness, NCUA should not micro-manage your individual business decisions,” she also said.

Matz reminded credit unions that NCUA examiners are checking to see how credit unions are executing risk-mitigation controls to better protect, monitor, and recover from cyberattacks.

“This is part of a nationwide effort to safeguard our systems and protect against attacks by cyber-terrorists, as well as hackers who are after cash in your members' accounts,” she said. “I encourage all of you to get educated and share best practices with each other.”

Next to cybersecurity, the NCUA's top supervisory priority is interest rate risk.

“Credit unions cannot afford to ignore this increasingly serious risk, because ignoring rising rates is like pitching a tent on a beach at low tide,” Matz said.

“You don't want to pitch your portfolio's tent in a low-rate environment when rates are rising above historic lows, and market experts are warning that as rates rise, they may rise quickly,” she added.

Matz expressed concern over some credit union officials suggesting that interest rate risk is no longer an issue.

“A few even suggested that short-term rates will continue to hold at record lows, because they haven't risen yet,” she said.

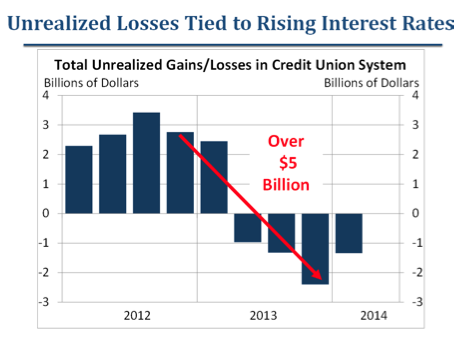

Matz showed a graph that said $2.7 billion swung to unrealized losses of $2.4 billion in one year.

“The number of credit unions with unrealized losses on assets available-for-sale has quadrupled. So, I think you can understand our concern,” she said.

Matz also told credit unions the agency is in the process of revising the risk-based capital proposal.

“We're not saying credit unions can't take on assets that promise greater returns in exchange for greater risk. We're just saying that if you do, you need to hold appropriate capital,” she said.

“We have already identified five candidates for revised risk weights. They include investments, mortgages, member business loans, credit union service organizations and corporates.”

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.