The barrage of dismal news reports may be shaping a public perception that a financial crisis is looming for the $1.2 trillion student loan debt market. News of high default and delinquency rates weaken the economy's recovery and leave some to doubt whether a college education is even worth the cost.

The barrage of dismal news reports may be shaping a public perception that a financial crisis is looming for the $1.2 trillion student loan debt market. News of high default and delinquency rates weaken the economy's recovery and leave some to doubt whether a college education is even worth the cost.

This perception, however, may not reflect reality, according to credit unions and CUSOs that offer private student loans.

Among the 655 credit unions that offer private student loans nationwide according to Credit Union Student Choice, a Washington-based student loan CUSO, the delinquency and default rates are substantially lower than the total student loan industry, thanks to conservative underwriting requirements and other industry best practices.

The CUSO said it serves nearly 240 credit unions.

More importantly, credit unions are finding student loans may be another way to reach young adults and convert them into lifelong members. Student loans also Provide a needed service to members, generating new loan revenue and diversifying loan portfolios.

Still, some news surrounding student debt is alarming. The CFPB estimated total student loan debt was approaching $1.2 trillion in 2013, slightly more than the $1.1 trillion in total assets of all of the nation's federally insured credit unions.

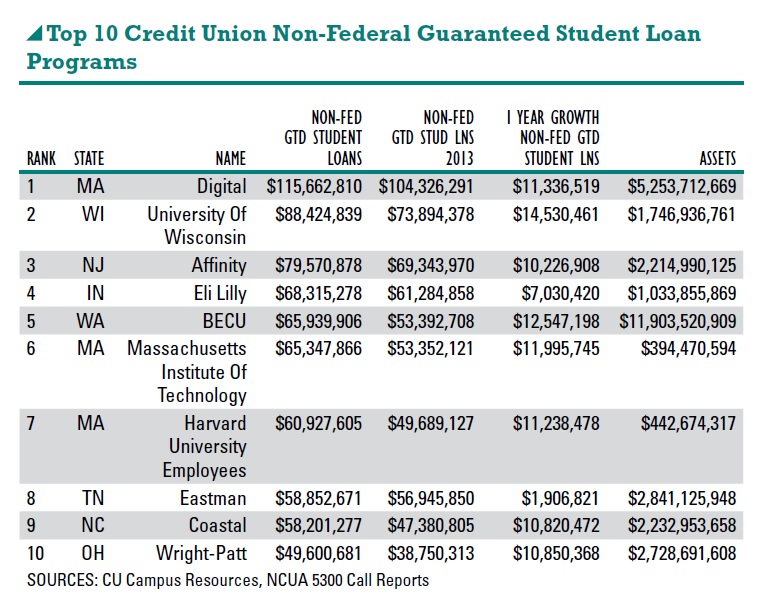

Of the $1.2 trillion, federal government loans accounted for about $1.035 trillion and private student loans totaled $165 billion, according to CFPB estimates. The credit union industry is a small player in the market holding only $2.8 billion of private student loans.

Some bad news that rained on the credit union industry's parade included a formal CFPB complaint filed earlier this year against ITT Educational Services Inc. The complaint also named Student CU Connect, a CUSO managed by San Diego-based First Associates Loan Servicing LLC.

The CFPB alleged ITT had a direct hand in developing the CUSO. Its founding members included the $2.6 billion Bellco Credit Union in Greenwood Village, Colo.; the $1.9 billion Community America Credit Union in Kansas City, Mo.; the $565 million Credit Union of America in Wichita, Kan.; the $595 million Directions Credit Union in Sylvania, Ohio; the $1.1 billion Eli Lilly Federal Credit Union in Indianapolis; the $2.4 billion Veridian Credit Union in Waterloo, Iowa; and, the $1 billion Workers' Credit Union in Fitchburg, Mass.

The CFPB charged the Carmel, Ind.-based for-profit ITT targeted largely low-income students and then entrapped them in a series of high-interest rate temporary and private student loans most students had little hope of repaying.

Most Student CU Connect member credit unions declined to comment about their roles in the ITT program when contacted by CU Times for this article.

However, Community America said it hasn't been involved with any kind of student lending for years, and Directions said it has not participated in any new loan activity with the CUSO but declined further comment.

The ITT story, nevertheless, hit home with Scott Patterson, president/CEO of Credit Union Student Choice. It was not involved with the ITT program, he said.

“When we first started doing student lending, it was kind of a warm, friendly, apple pie sort of thing, helping families with their education access needs,” Patterson said. “Student loans since then, however, have gotten a very bad reputation, especially in the media.”

Patterson and other CUSOs complained the private student loan market is being unfairly characterized as high risk, which may be holding back some credit unions from entering the market and forcing them to lose out on new opportunities.

After launching its private student loan program in February 2011, the $5.1 billion CEFCU in Peoria, Ill., set a goal to reach $24 million in student loans in five or six years. That goal was reached in year three, said Doug Higgins, CEFCU credit manager.

“We've found our student members use more products and services (debit cards, ATM cards, checking accounts, direct deposit, web banking) than our average members,” Higgins said. “These loans seem to be a very sticky product. Our intended goal is once they graduate from school to get their car loans, their credit cards, their mortgages that build lifelong relationships.”

Andrea Mosher, vice president of lending for the $561 million University of Michigan Credit Union in Ann Arbor, is less optimistic that student loans are an auspicious way to capture young members.

“You can liken student loans very much to indirect lending,” Mosher said. “It would be hard for a community credit union to glue a student as a full-service member who is going to a school that the credit union is not directly tied to in any way.”

Even if credit unions are not affiliated with colleges, it would benefit them to work with financial aid offices to educate students before they graduate on the importance of repaying their student loan to build their credit history.

“We do a lot of financial literacy classes on campus on credit, budget and finances and we always make sure we talk about where student loans fit into all of it,” Mosher explained. “If more credit unions could find opportunities to do financial literacy at the university level, I will tell you that I think we get more stickiness from our students when we interact with them and they know who we are rather than just a financial institution giving them a loan.”

Over the last few years, the mainstream media has posted many stories focusing on college graduates drowning in thousands of dollars in debt who were unable either to find a job, settled for a minimum wage position or moved back in with their parents.

In reality, however, only 4% of student loan balances are more than $100,000, according to a Brookings Institute research report released in June. The study analyzed more than two decades of data, concluding that borrowers struggling with high debt loads may not be a new and growing trend. Additionally, the percentage of borrowers with high payment-to-income ratios has not increased over the last 20 years; if anything, it has declined, according to the report.

“On average, students graduate with less than $25,000 in student loan debt and that's a car payment,” said Mike Long, president/CEO of the CU Campus ResourcesCUSO in Madison, Wis. “In my opinion, graduating with $25,000 in education debt is a much better investment than buying a new Toyota Camry because you are going to earn significantly more income with a college degree over the long run.”

Aside from the debate of the effects of student debt, the credit union's total private student loan portfolio appears to be performing at much higher level than the overall student loan market.

Patterson and Long give due to strong metrics because of their CUSOs' conservative underwriting such as requiring a loan co-signer, approving loans only for not-for-profit public and private schools, and disbursing the loan funds directly to the university.

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.